Tangible Infrastructure vs. Speculative Momentum: 2025's Crypto Investment Playbook

- BlockDAG's $383M 2025 presale and 2,660% ROI highlight infrastructure-driven growth via 2.5M users, 19k ASIC miners, and 300+ dApps. - XRP relies on uncertain ETF approvals ($2.96 price) while HBAR ($0.19) gains from enterprise partnerships but faces governance centralization risks. - Analysts prioritize projects with audited scalability (BlockDAG's DAG-PoW) over speculative bets, emphasizing operational metrics over regulatory outcomes.

In 2025, the cryptocurrency market is at a crossroads. While speculative narratives around ETF approvals and institutional partnerships dominate headlines, a new breed of projects is redefining value creation through operational infrastructure, real-world utility, and audited scalability. This article examines three key players—BlockDAG, XRP , and HBAR—and argues why investors should prioritize projects with tangible momentum over those relying on speculative hype.

BlockDAG: The Infrastructure-Driven Powerhouse

With 29 sold batches and a token price surging from $0.001 to $0.0276, early investors have already seen 2,660% returns. But the real story lies in the project's operational metrics:

- 2.5 million active users on the X1 mobile mining app, democratizing access to blockchain participation.

- 19,350 ASIC miners generating $7.8 million in revenue, proving the viability of its hybrid DAG-PoW architecture.

- 300+ decentralized applications (dApps) built on its platform, spanning DeFi, gaming, and enterprise solutions.

BlockDAG's tokenomics are equally compelling. Of its 50 billion total supply, 33.3% is allocated to early distribution, 50% to miners, and 12.7% to ecosystem development. This structure ensures decentralized governance and long-term sustainability, contrasting sharply with centralized models like XRP.

The project's technical credibility is reinforced by audits from Halborn and CertiK, which resolved 100% of critical vulnerabilities. Its hybrid architecture—combining DAG scalability (15,000 TPS) with PoW security—positions it as a Layer 1 solution capable of outperforming Ethereum and Solana .

XRP: The ETF Speculation Play

Ripple's XRP has long been a speculative favorite, but 2025 brings both clarity and caution. The U.S. SEC's delayed decision on XRP ETFs (pushed to October 24, 2025) has kept the token's price stable at ~$2.96, with analysts estimating a 95% approval probability. However, this narrative hinges on regulatory outcomes, not operational progress.

While XRP's On-Demand Liquidity (ODL) service has real-world utility in cross-border payments, its value proposition remains tied to legal outcomes. The dismissal of the SEC's appeals in the Second Circuit Court has removed a major overhang, but the token's future depends on ETF approvals, which are inherently uncertain.

Investors should note that XRP's $125 million penalty for pre-2023 institutional sales and its controlled supply strategy (only 50 billion tokens exist) could drive long-term value. Yet, its reliance on regulatory tailwinds makes it a high-risk, high-reward bet compared to infrastructure-driven projects like BlockDAG.

HBAR: Institutional Adoption vs. Operational Momentum

Hedera Hashgraph (HBAR) has carved a niche with its 34-member enterprise council, including Google , IBM , and Boeing . Its hashgraph consensus mechanism offers 10,000 TPS and low fees, making it ideal for supply chain management and real-world asset (RWA) tokenization. As of August 2025, HBAR trades at $0.19, with a market cap of $10.77 billion and projections to hit $30 billion by year-end.

HBAR's institutional credibility is undeniable. Partnerships with Walmart and DHL for supply chain traceability, and its role in Google's Web3 initiatives, validate its utility. However, its governance model—controlled by a council rather than a decentralized community—raises questions about long-term adaptability.

While HBAR's real-world applications (e.g., micropayments, decentralized identity) are compelling, its growth is tied to enterprise adoption rather than user-driven momentum. This contrasts with BlockDAG's 2.5 million mobile miners and ASIC network, which create organic demand.

The 2025 Investment Thesis: Infrastructure Over Hype

As the crypto market matures, investors must distinguish between projects with operational traction and those relying on speculative narratives. BlockDAG exemplifies the former:

- User Growth: 2.5 million mobile miners and 19,350 ASICs creating a decentralized network.

- Technical Audits: Halborn and CertiK validations ensuring security and scalability.

In contrast, XRP's ETF speculation and HBAR's institutional partnerships lack the operational depth to sustain long-term value. While XRP's approval could drive short-term gains, its future remains regulatory-dependent. HBAR's enterprise focus is valuable but limited by its governance structure.

Investment Advice for 2025

- Prioritize Infrastructure: Projects like BlockDAG, with audited architectures and real-world user growth, offer sustainable value.

- Diversify Speculative Bets: XRP's ETF narrative and HBAR's institutional rally can complement a portfolio but should not dominate it.

- Monitor Operational Metrics: Track user adoption, dApp development, and network activity—these are better indicators of long-term success than regulatory news.

In a maturing market, the winners will be those who build tangible infrastructure and foster community-driven ecosystems. BlockDAG’s hybrid DAG-PoW model positions it as a 2025 standout—proving that the future of crypto lies in utility, not just speculation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who is the culprit behind the liquidation of 1.6 million people?

It's not USDe depegging, nor Binance disconnecting, but rather market makers collectively acting maliciously?

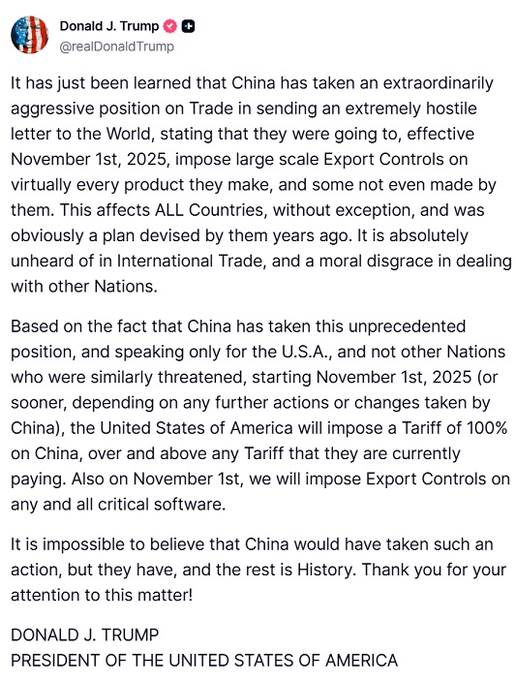

Trump's Trade War Resumes: Analysis of the Macroeconomic Factors Behind the Simultaneous Decline in Crypto and Stocks

Tariffs = stock market/cryptocurrency plunge, but today is far more than that.

From APENFT to AINFT: Reshaping the Digital Ecosystem with AI and Moving Towards a New Era of Intelligence

AINFT is committed to deeply integrating the intelligent creativity of AI with the trust mechanism of blockchain, evolving from a digital asset platform into a self-driven and continuously evolving intelligent digital ecosystem.