GHST +87.91% in 24 Hours Amid Protocol Updates and Airdrop Activity

- GHST surged 87.91% in 24 hours on August 27, 2025, amid Ghost's infrastructure upgrades and airdrop plans despite a 745.97% weekly decline. - The airdrop targets early adopters via on-chain activity metrics, aiming to decentralize token distribution and boost community engagement. - Protocol enhancements include a decentralized governance module and cross-chain integration, supporting GHST's utility as a governance token. - Analysts link short-term volatility to airdrop speculation, though long-term succ

A surge in investor interest has propelled GHST by 87.91% in a 24-hour period as of August 27, 2025, despite a significant 745.97% decline in the past week. The rapid price fluctuation follows a series of developments tied to the broader Ghost ecosystem, including infrastructure upgrades and airdrop mechanisms aimed at expanding user participation.

Protocol Enhancements and Airdrop Mechanics

The Ghost platform recently announced a major update to its infrastructure, including the launch of a decentralized governance module and the integration of a new token distribution model. These changes are designed to increase token utility and incentivize community engagement. A key component of the update includes an airdrop program targeting early adopters and active users, which has generated renewed attention for GHST.

The airdrop is based on on-chain activity metrics such as staking, voting, and participation in governance proposals. Eligible participants are being identified through automated smart contracts, with token allocations expected to be distributed in the coming weeks. The initiative is part of a broader strategy to decentralize control and ensure a more equitable distribution of tokens.

Investor Sentiment and Token Performance

The 24-hour price rally has been attributed to heightened speculation around the airdrop and the long-term viability of the Ghost protocol. While the one-month performance shows a 222.72% increase, the asset remains down by 5560.93% compared to the same period a year ago, reflecting the volatile nature of the market.

Analysts project that the success of the airdrop and the upcoming upgrades may influence future price dynamics, though the impact will depend on market adoption and continued development progress. Early signs of increased liquidity and on-chain activity suggest that the ecosystem is attracting new participants, which could support further price appreciation if the momentum is sustained.

Ongoing Development and Governance Plans

Ghost’s development team has outlined a roadmap that includes the introduction of new tools for developers and content creators, as well as expanded integration with cross-chain bridges. The governance module, now live, allows token holders to propose and vote on key protocol decisions, reinforcing the decentralized ethos of the project.

The platform has also confirmed plans to host a series of community events in the next quarter, including workshops and hackathons, to foster further innovation and engagement. These activities are expected to bolster the ecosystem’s growth and strengthen the role of GHST as a utility and governance token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

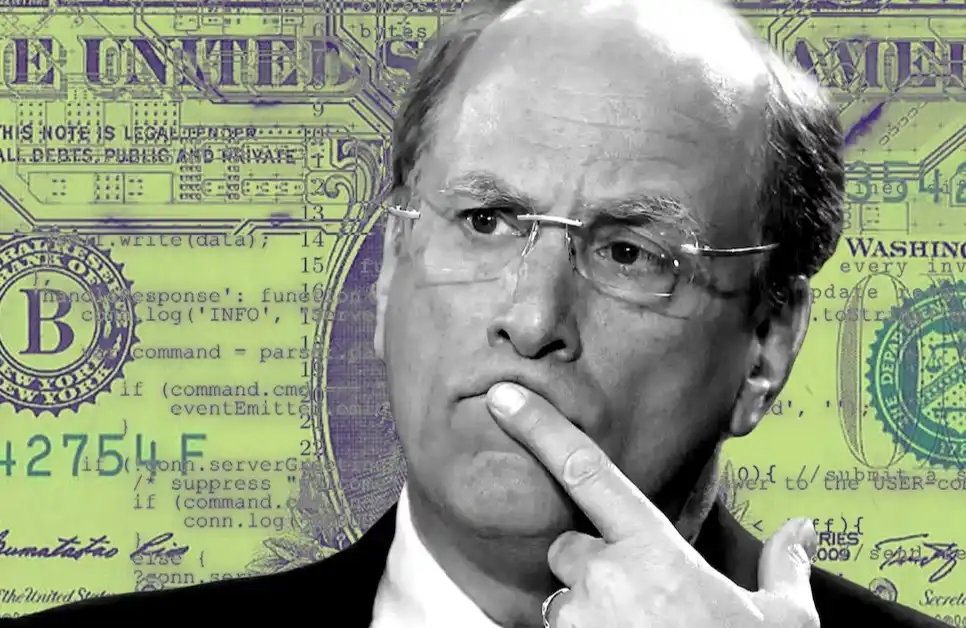

BlackRock CEO: Crypto Wallets Surpass $4 Trillion, "Asset Tokenization" Is the Next "Financial Revolution"

BlackRock has revealed its goal to bring traditional investment products such as stocks and bonds into digital wallets, targeting an ecosystem worth over $4 trillions.

Chainlink chooses MegaETH to implement the only native real-time oracle, driving the emergence of next-generation high-frequency DeFi applications

Setting a high-performance standard: Chainlink oracle network brings ultra-low latency market data to the first real-time blockchain, ushering in a new narrative for on-chain finance.

Bitcoin retail interest is in ‘bear market’ as crypto sentiment flips to fear

‘Dino coin’ season: Why are Zcash and Dash seeing biggest rebounds?