Larry Fink's prophecy is coming true: How can RWA surpass stablecoins?

This article explores the current status and mechanisms of the tokenization of U.S. government bonds, highlighting how blockchain technology simplifies traditional financial processes, though it remains subject to securities regulations. The analytical framework covers an overview of tokens, regulatory structures, and on-chain applications, revealing rapid growth but also challenges such as fragmented regulation and limited on-chain utility. Institutions and DeFi platforms are actively engaging in the development of RWA (real-world asset) tokenization, but a unified regulatory framework and cross-chain solutions still need to be improved. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

You might wonder whether such tokenization involves complex legal mechanisms. In fact, it does not. Its implementation relies on the transfer agent responsible for managing the official shareholder registry, which operates by replacing the traditional internal database with blockchain technology.

To provide a clearer analysis of major U.S. government bond tokens, this article constructs three analytical frameworks: a token overview covering protocol introduction and issuance volume, the regulatory framework and issuance structure, and on-chain application scenarios. Notably, since U.S. government bond tokens are classified as digital securities and must comply with securities laws and related regulations, this characteristic significantly impacts their issuance volume, number of holders, and on-chain application scenarios. These seemingly unrelated factors are actually dynamically interrelated. At the same time, contrary to popular belief, U.S. government bond tokens also have many limitations. Next, let us delve into the development and future of this field.

Tokenization of Everything

"Every stock, every bond, every fund, every asset can be tokenized." — Larry Fink, CEO of BlackRock

Since the passage of the U.S. GENIUS Act, global attention to stablecoins has surged, and South Korea is no exception. But are stablecoins really the endgame for blockchain finance?

As the name suggests, stablecoins are tokens on public blockchains pegged to fiat currencies. In essence, they are still currencies and must find application scenarios. As discussed in the Hashed Open Research x 4Pillars Stablecoin Report, stablecoins can be used in remittances, payments, settlements, and other fields. However, the area currently touted as the "ultimate release point for stablecoin potential" is Real-World Assets (RWA).

RWA (Real-World Assets) refers to tangible assets circulating on the blockchain in digital token form. In the blockchain industry, RWA typically refers to traditional financial assets such as commodities, stocks, bonds, and real estate.

Why has RWA become the focus after stablecoins? Because blockchain can not only change the form of money, but also has the potential to reshape the underlying structure of traditional financial markets.

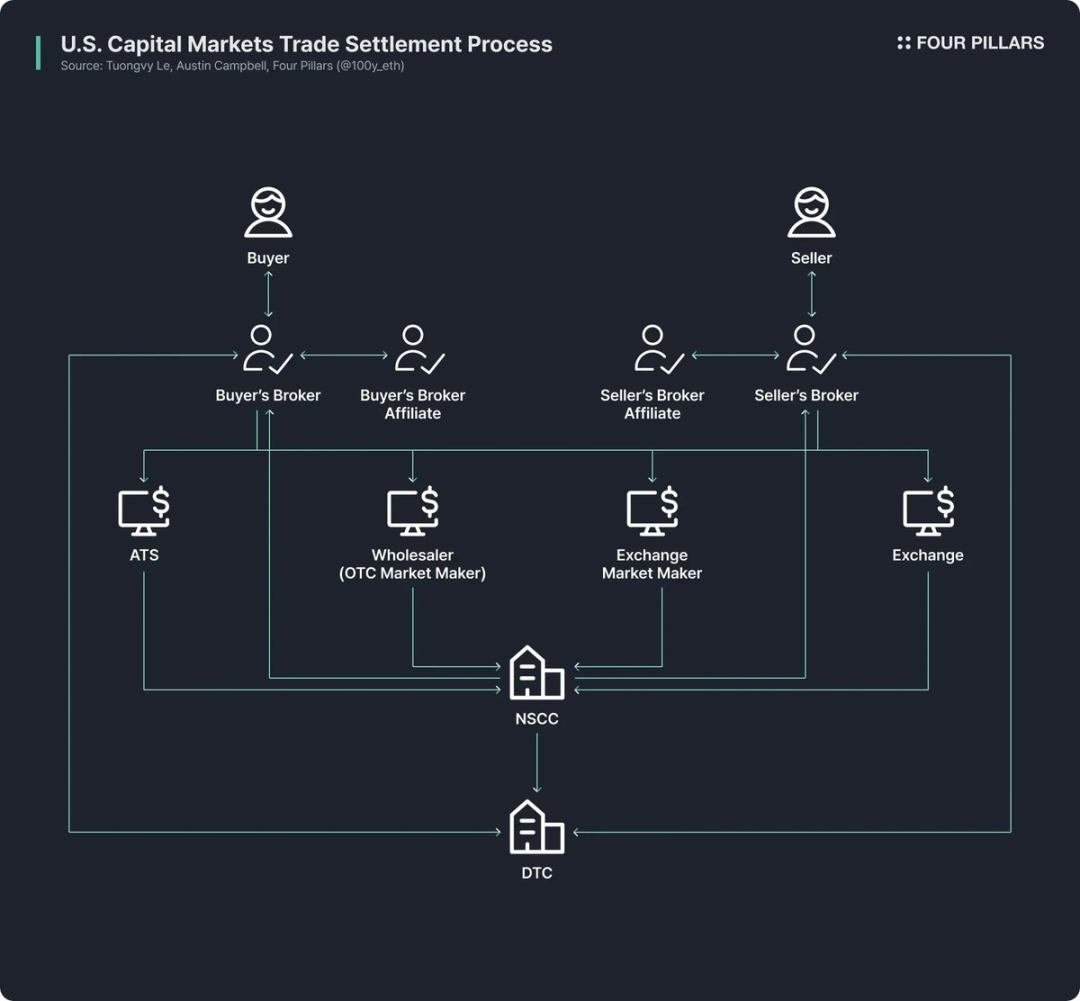

Today's traditional financial markets still rely on extremely outdated infrastructure. Although fintech companies have optimized the front-end experience for retail users by improving the accessibility of financial products, the back-end operation mode of transactions remains stuck in the practices of half a century ago.

Take the U.S. stock and bond trading markets as an example. Their current structure originated from reforms in the 1970s following the "paperwork crisis" of the late 1960s: the Securities Investor Protection Act and amendments to the Securities Act were introduced, and institutions such as the Depository Trust Company (DTC) and National Securities Clearing Corporation (NSCC) were established. This complex system has been in operation for over 50 years and has always suffered from redundant intermediaries, settlement delays, lack of transparency, and high regulatory costs.

Blockchain has the potential to fundamentally revolutionize this situation and build a more efficient and transparent market system: by upgrading the back end of financial markets with blockchain, instant settlement, programmable finance driven by smart contracts, direct ownership without intermediaries, higher transparency, lower costs, and fractionalized investment can be achieved.

For this reason, many public institutions, financial institutions, and enterprises are actively promoting the tokenization of financial assets. For example:

- Robinhood plans to support stock trading through its own blockchain network and has submitted a proposal to the U.S. SEC, calling for the establishment of a federal regulatory framework for RWA tokenization;

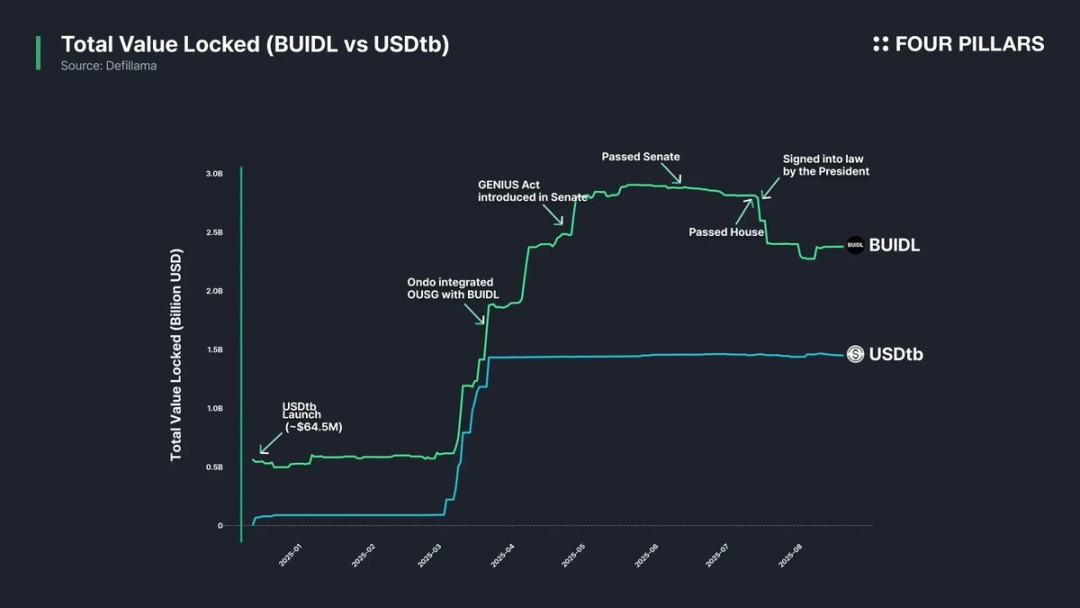

- BlackRock, in cooperation with Securitize, issued the BUIDL tokenized money market fund with a scale of 2.4 billions USD;

- SEC Chairman Paul Atkins has publicly supported stock tokens, and the SEC's internal cryptocurrency working group has formalized regular meetings and roundtable discussions related to RWA.

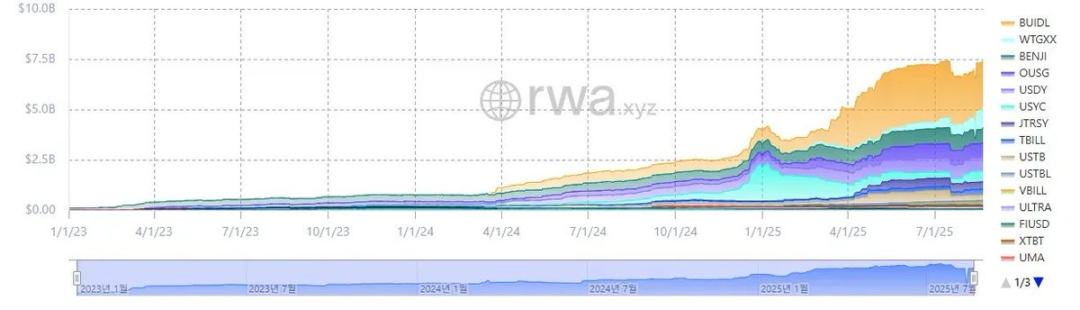

(Source: rwa.xyz)

Setting aside the hype, the RWA market is actually growing rapidly. As of August 23, 2025, the total issued RWA reached 26.5 billions USD, up 112% from a year ago, 253% from two years ago, and 783% from three years ago. The types of tokenized financial assets are diverse, among which U.S. government bonds and private credit are growing the fastest, followed by commodities, institutional funds, and stocks.

U.S. Government Bonds

(Source: rwa.xyz)

Among the RWA market, the tokenization of U.S. government bonds is the most active. As of August 23, 2025, the U.S. bond RWA market size was about 7.4 billions USD, a 370% increase from last year, showing explosive growth.

It is worth noting that both global traditional financial institutions and decentralized finance (DeFi) platforms are actively deploying in this field. For example, BlackRock's BUIDL fund leads with 2.4 billions USD in assets; DeFi protocols such as Ondo have launched funds like OUSG based on RWA tokens backed by BUIDL, WTGXX, and other bonds, with a scale maintained at about 700 millions USD.

Why have U.S. government bonds become the most active and largest field in the RWA market? The reasons are as follows:

- Liquidity and Stability: U.S. Treasuries have the deepest liquidity in the world and are regarded as "safe assets" with no default risk and extremely high credibility;

- Increased Global Accessibility: Tokenization lowers the investment threshold, allowing overseas investors to participate in U.S. Treasury investments more conveniently;

- Expanded Institutional Participation: Leading institutions such as BlackRock, Franklin Templeton, and WisdomTree are leading the market by issuing tokenized money market funds and Treasury products, providing a trust endorsement for investors;

- Stable and Considerable Returns: U.S. Treasuries offer stable and relatively high yields, averaging about 4%;

- Low Tokenization Difficulty: Although there is no dedicated regulatory framework for RWA yet, the basic tokenization operations for U.S. Treasuries are already feasible within the scope of existing regulations.

Tokenization Process of U.S. Government Bonds

How exactly are U.S. Treasuries tokenized on-chain? Although it may seem to involve complex legal and regulatory mechanisms, the operation is actually very simple under the premise of complying with existing securities laws (the issuance structure of different tokens may vary; only representative methods are introduced here).

One point must be clarified: The currently issued "RWA tokens based on U.S. Treasuries" do not directly tokenize the bonds themselves, but rather tokenize funds or money market funds based on U.S. Treasuries.

In the traditional model, public asset management funds such as U.S. Treasury funds must designate a "transfer agent" registered with the SEC—these financial institutions or service companies are entrusted by the securities issuer to manage investors' fund ownership records. Legally, the transfer agent is the core of securities record and ownership management and is responsible for maintaining the official shares of fund investors.

The tokenization process for U.S. Treasury funds is very straightforward: tokens representing fund shares are issued on-chain, and the transfer agent uses the blockchain system for internal operations to manage the official shareholder registry. In short, it is simply migrating the database that maintains shareholder records from a private system to the blockchain.

Of course, since the U.S. has not yet introduced a clear regulatory framework for RWA, holding tokens currently cannot guarantee 100% legally protected fund share ownership. However, in practice, the transfer agent manages fund shares based on on-chain token ownership records, so in the absence of hacking or unexpected events, token ownership usually indirectly guarantees fund share rights.

Main Protocols and RWA Analytical Framework

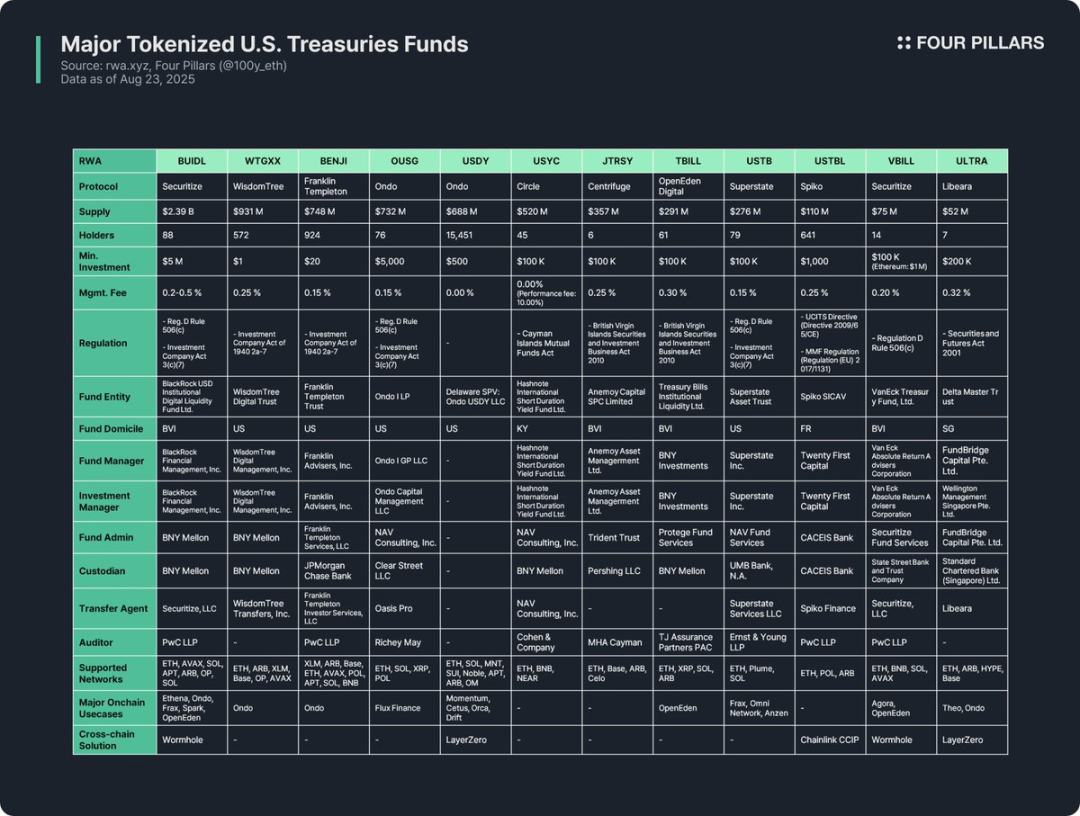

Tokenization of U.S. Treasury funds is the most active field in the RWA industry, so many protocols have issued related RWA tokens. This article analyzes 12 major tokens from three dimensions:

(1) Token Overview

Including protocol introduction, issuance volume, number of holders, minimum investment amount, and management fees. Since fund structures, tokenization methods, and on-chain utility vary by protocol, analyzing the issuing protocol can quickly grasp the core characteristics of the token.

- Issuance volume: reflects the fund size and market acceptance;

- Number of holders: suggests the fund's legal structure and on-chain application scenarios. If the number of holders is small, it may be because securities laws require investors to be high-net-worth qualified investors or qualified purchasers. Such tokens are usually limited to whitelist wallets for holding, transferring, or trading, making it difficult to be widely used in DeFi protocols.

(2) Regulatory Framework and Issuance Structure

Clarifies the national regulatory rules followed by the fund and sorts out the various entities involved in fund management.

After analyzing 12 RWA tokens based on U.S. Treasury funds, their regulatory frameworks can be divided into the following categories according to the fund's place of registration and fundraising scope:

- Regulation D Rule 506(c) + Investment Company Act Section 3(c)(7)

The most widely used framework. Regulation D Rule 506(c) allows public fundraising to an unlimited number of investors, but requires all investors to be "accredited investors," and issuers must strictly verify identity through tax records, asset proof, etc.; Investment Company Act Section 3(c)(7) exempts private funds from SEC registration requirements, but all investors must be "qualified purchasers" and the fund must maintain a private structure. The combination of the two can expand the investor base while avoiding the regulatory burdens of registration and disclosure, suitable for eligible U.S. and foreign funds. Representatives include BUIDL, OUSG, USTB, VBILL, etc.

- Investment Company Act of 1940 Section 2a-7

A framework for SEC-registered money market funds, requiring funds to maintain stable value, invest only in short-term high-credit instruments, and ensure high liquidity. Unlike the above framework, it allows public issuance to ordinary investors, so the minimum investment amount for such tokens is low and accessible. Representatives include WTGXX, BENJI.

- Cayman Islands Mutual Funds Law

Applicable to open-ended mutual funds registered in the Cayman Islands (flexible issuance and redemption), requiring a minimum initial investment of no less than 100,000 USD. Representative: USYC.

- BVI Securities and Investment Business Act 2010 (Professional Funds)

The core law regulating investment funds registered in the British Virgin Islands, "professional funds" are aimed at professional investors (not the public), with a minimum initial investment of 100,000 USD. Note: If fundraising from U.S. investors, Regulation D Rule 506(c) must also be followed. Representatives include JTRSY, TBILL.

- Others

Local rules apply depending on the fund's place of registration. For example: USTBL issued by France's Spiko follows the EU UCITS Directive and Money Market Fund Regulation; ULTRA issued by Singapore's Libeara follows the Securities and Futures Act 2001.

The fund issuance structure involves seven core participants:

- Fund entity: the legal entity pooling investor funds, often using U.S. trusts, BVI, or Cayman Islands offshore structures;

- Fund manager: the entity that establishes the fund and is responsible for overall operations;

- Investment manager: the entity that actually makes investment decisions and manages the portfolio, which may be the same as or independent from the fund manager;

- Fund administrator: responsible for accounting, NAV calculation, investor report preparation, and other back-office operations;

- Custodian: securely holds the fund's assets such as bonds and cash;

- Transfer agent: manages the shareholder registry, legally records and maintains fund or share ownership;

- Auditor: an independent accounting firm responsible for external audit of the fund's accounts and financial statements, which is key to investor protection.

(3) On-Chain Application Scenarios

One of the greatest values of bond fund tokenization is its potential application in the on-chain ecosystem. Although regulatory compliance and whitelist restrictions make it difficult for bond fund tokens to be used directly in DeFi, some protocols have explored indirect applications: for example, DeFi protocols such as Ethena and Ondo use BUIDL as collateral to issue stablecoins or include it in investment portfolios, providing retail users with indirect participation channels. In fact, BUIDL has rapidly expanded its issuance volume by integrating with mainstream DeFi protocols, becoming the largest bond-type token.

Cross-chain solutions are also crucial for improving on-chain utility. Most bond fund tokens are issued not only on a single network but also across multiple chains to increase investor choice—although their liquidity does not need to reach stablecoin levels, cross-chain functionality can enhance user experience and enable seamless token transfers across multiple networks.

Insights

After studying 12 major U.S. Treasury fund RWA tokens, I found the following insights and limitations:

- Limited On-Chain Utility: RWA tokens are not freely usable just because they are tokenized; their essence remains digital securities and they must comply with real-world regulatory frameworks. All bond fund tokens can only be held, transferred, or traded between whitelist wallets that have completed KYC, making it difficult for them to be directly used in permissionless DeFi fields.

- Few Holders: Due to regulatory thresholds, the number of holders of bond fund tokens is generally low. Money market funds such as WTGXX and BENJI, which are open to retail investors, have relatively more holders, but most funds require investors to be accredited investors, qualified purchasers, or professional investors, resulting in a limited eligible group and making it difficult for the number of holders to even reach double digits.

- Mainly B2B On-Chain Applications: For the above reasons, bond fund tokens currently have no direct DeFi applications for retail users and are more often adopted by large DeFi protocols. For example, Omni Network uses Superstate's USTB for treasury management, and Ethena uses BUIDL as collateral to issue USDtb stablecoins, allowing retail users to benefit indirectly.

- Fragmented and Non-Standardized Regulation: The issuers of bond fund tokens are registered in different countries and follow different regulatory frameworks. For example, although BUIDL, BENJI, TBILL, and USTBL are all bond fund tokens, they belong to different regulatory systems, resulting in significant differences in investor qualifications, minimum investment amounts, and application scenarios. This fragmentation increases the difficulty for investors to understand, and the lack of unified standards makes it difficult for DeFi protocols to integrate universally, limiting on-chain utility.

- Lack of Dedicated RWA Regulatory Framework: There are currently no clear rules specifically for RWA. Although transfer agents already record shareholder registries on the blockchain, on-chain token ownership has not yet been legally recognized as equivalent to real-world securities ownership. Dedicated regulations are needed to connect on-chain ownership with real-world legal ownership.

- Insufficient Application of Cross-Chain Solutions: Although almost all bond fund tokens support multi-chain issuance, actual cross-chain solutions are rare. Further promotion of cross-chain technology is needed to avoid liquidity fragmentation and improve user experience.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After the Curve team’s new venture, will Yield Basis become the next phenomenal DeFi application?

This article analyzes the DeFi hit product YieldBasis, which aims to redefine liquidity providers' profit models by converting volatility into yield in Curve pools, while completely eliminating impermanent loss. The project was founded by the core Curve team and demonstrated strong momentum from its inception.

Grayscale and TAOX take action on two fronts, Bittensor ushers in its institutional moment

This article analyzes how the Bittensor ($TAO) token is accelerating towards compliance and institutionalization, driven by the dual positive factors of Grayscale submitting the Form 10 registration statement and the US-listed company TAO Synergies Inc. ($TAOX) completing a private placement. It is also regarded as a core asset connecting traditional finance with decentralized AI networks.

Morgan Stanley opens crypto investments to a broader client base