Federal Reserve's Dovish Pivot: How Stephen Miran's Nomination Could Reshape Markets and Inflation Dynamics

- Stephen Miran's Fed confirmation signals a dovish pivot with dollar weakening and rate cuts to reshape global markets. - DXY fell 10% in six months while gold surged, reflecting 90% odds of 25-basis-point September rate cut. - Growth stocks, long-duration Treasuries, and commodities gain as inflation hedges under Miran's devaluation strategy. - Investors advised to rebalance portfolios toward tech/exporters, gold, and non-U.S. equities while monitoring inflation risks.

The confirmation of Stephen Miran to the Federal Reserve Board of Governors marks a pivotal moment in U.S. monetary policy. As a key architect of President Trump's economic agenda, Miran's dovish stance—rooted in a deliberate weakening of the dollar and accommodative rate cuts—threatens to upend traditional market dynamics. Investors must now grapple with the implications of a Fed increasingly aligned with Trump's vision of a “reset” global economy, where inflationary risks and asset class performance are reshaped by strategic devaluation and structural reforms.

Miran's Dovish Blueprint: A Policy of Dollar Devaluation and Rate Cuts

Miran's economic philosophy is unambiguous: lower interest rates, weaker dollar policies, and a reorientation of the Fed to serve broader administration goals. His advocacy for the “Mar-a-Lago Accord”—a framework to devalue the dollar by restructuring global trade and debt—has already influenced Trump's aggressive tariff policies. Now, as a Fed governor, Miran is poised to institutionalize these ideas.

The market has already priced in his influence. The U.S. dollar index (DXY) has fallen over 10% in six months, while gold and other commodities have surged. Futures markets now assign a 90% probability to a 25-basis-point rate cut at the September FOMC meeting, reflecting expectations of a dovish pivot. Miran's replacement of outgoing Governor Adriana Kugler during this critical juncture ensures his policies will dominate the Fed's short-term trajectory.

Implications for Key Asset Classes

Equities: Growth Stocks and Exporters to Shine

A weaker dollar and lower rates create a tailwind for equities, particularly growth-oriented and export-driven sectors. The tech sector, for instance, benefits from cheaper U.S. debt and stronger global demand for American goods. Historical data underscores this: reveals a consistent outperformance during dovish cycles. Investors should overweight companies with high net export exposure, such as semiconductor manufacturers and aerospace firms, which align with Miran's industrial policy priorities.

Bonds: Long-Duration Treasuries Gain Allure

Miran's dovish stance will likely drive bond yields lower, boosting prices for long-duration Treasuries. The 10-year U.S. Treasury yield has already dipped below 3.5%, and further declines are probable as the Fed signals rate cuts. highlights a downward trend, suggesting that investors should consider extending their bond portfolios into longer maturities. However, caution is warranted: a weaker dollar could reignite inflation, potentially eroding real returns if the Fed's 2% target is breached.

Commodities: Gold and Industrial Metals as Inflation Hedges

The dollar's decline under Miran's stewardship positions commodities as a critical hedge against inflation and currency depreciation. Gold, in particular, has surged to multi-month highs, mirroring the 1985 Plaza Accord's impact. illustrates this inverse relationship. Industrial metals like copper and oil are also set to benefit from a weaker dollar, which makes commodities more affordable for foreign buyers. Investors should allocate to gold ETFs and energy stocks to capitalize on this trend.

Strategic Moves for Investors

- Rebalance Toward Dovish-Friendly Sectors: Increase exposure to growth equities, particularly in tech and manufacturing, while reducing holdings in rate-sensitive value stocks.

- Extend Bond Maturities: Shift bond portfolios toward long-duration Treasuries and inflation-protected securities (TIPS) to lock in higher yields before potential rate cuts.

- Hedge Against Dollar Weakness: Allocate 10–15% of portfolios to gold and commodities, and consider non-U.S. equities to diversify currency risk.

- Monitor Inflation Signals: Keep a close eye on the PCE index and core CPI. If inflation accelerates beyond 2%, pivot toward short-duration bonds and cash equivalents to mitigate losses.

Conclusion: Navigating a Dovish Era

Stephen Miran's confirmation signals a Fed that is no longer insulated from political influence. His dovish policies—lower rates, weaker dollar, and structural reforms—will reshape asset valuations and inflation dynamics. While this strategy could stimulate growth and boost exports, it also carries risks of inflationary overshooting and currency volatility. Investors who position themselves now to capitalize on these shifts—while hedging against potential missteps—will be best prepared for the next chapter in U.S. monetary history.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise Solana Spot Staking ETF Reaches $223 Million in Assets on First Day

x402 Protocol: A New Era of Internet Payments at the Intersection of AI and Web3

What the x402 protocol represents is far more than just an optimization of payment methods; it is a paradigm shift in the value exchange layer of the internet.

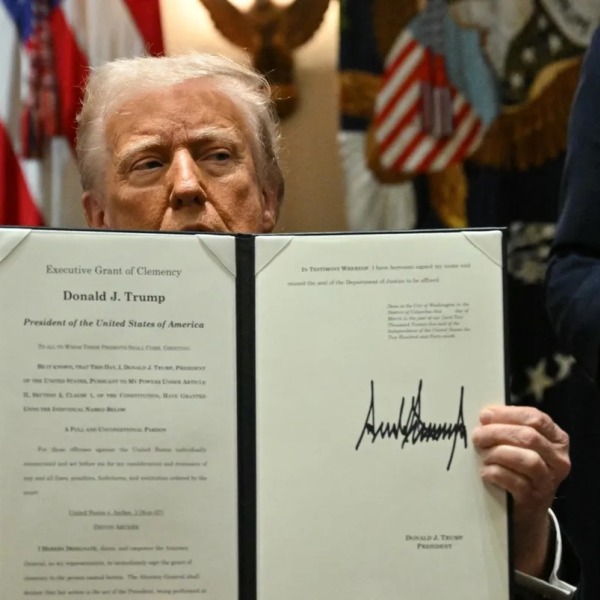

How powerful is the U.S. President’s pardon authority?

Through a workaround, the U.S. President could even pardon himself.

2025 Trading Guide: Three Essential Trading Categories and Strategies Every Trader Should Know

It is very important to clearly identify the type of trading you are involved in and make the appropriate adjustments.