Fluent's Strategic Pivot to Data Intelligence: A Catalyst for Long-Term Growth in a Post-Cookie Era

- Fluent partners with Databricks and appoints Virginia Marsh to lead data monetization, adapting to the post-cookie era with privacy-first solutions. - The U.S. advertising market is projected to grow at 8.5% CAGR, with retail media expanding 15–20% YoY, driven by first-party data. - Fluent's commerce media segment saw a 121% YoY revenue increase in Q2 2025, contributing 36% of total revenue and showing a path to profitability. - Fluent's integrated data clean room and cross-platform collaboration differe

The digital advertising landscape is undergoing a seismic shift. As third-party cookies fade into obsolescence, the industry is racing to redefine data intelligence in a privacy-first world. In this evolving arena, Fluent Inc. (NASDAQ: FLNT) has emerged as a strategic innovator, leveraging partnerships, leadership, and technology to position itself at the forefront of commerce media. By aligning with Databricks and appointing Virginia Marsh to lead its data monetization efforts, Fluent is not merely adapting to the post-cookie era—it is redefining it.

The Market Imperative: Privacy-First Data Intelligence

The phasing out of third-party cookies has accelerated demand for first-party data and secure collaboration frameworks. According to PwC's 2025–2029 Global Entertainment & Media Outlook, the U.S. advertising market is projected to grow at an 8.5% CAGR, reaching $389.1 billion by 2029. Within this, retail media—a sector Fluent has deeply embedded itself in—is expanding at a staggering 15–20% YoY. By 2028, the U.S. retail media market alone is expected to surpass $98 billion, driven by brands and retailers leveraging first-party shopper data for hyper-targeted, privacy-compliant campaigns.

Fluent's Commerce Media Solutions business exemplifies this trend. In Q2 2025, it generated $16.1 million in revenue—a 121% year-over-year increase—and contributed 36% of the company's consolidated revenue. This segment's gross profit surged 43% YoY to $2.9 million, signaling a path to profitability.

Strategic Alliances and Leadership: The Databricks Partnership

Fluent's collaboration with Databricks is a cornerstone of its transformation. By integrating Databricks' Data Intelligence Platform and Delta Sharing protocol, Fluent enables brands to exchange high-intent audience signals securely while maintaining full data control. This partnership addresses two critical pain points: privacy compliance and scalable data activation. Delta Sharing's open, privacy-first architecture allows for real-time audience modeling and AI-powered insights, empowering brands to innovate without compromising regulatory standards.

The strategic value of this partnership is twofold. First, it future-proofs Fluent's offerings against evolving privacy regulations, such as GDPR and CCPA. Second, it positions Fluent as a leader in data monetization, a sector projected to grow as brands seek to extract value from their first-party data.

Virginia Marsh's appointment as Head of Data & Agencies further strengthens this strategy. With a decade of cross-industry experience, Marsh is tasked with building privacy-safe data products and deepening partnerships with agencies and platforms. Her focus on identity-resolved, real-time data aligns with Fluent's goal to transcend traditional performance marketing and become a data intelligence provider. This leadership shift underscores Fluent's commitment to long-term value creation through scalable, outcome-driven solutions.

Competitive Differentiation: Beyond Clean Rooms and Traditional Platforms

Fluent's competitive edge lies in its ability to integrate data clean room capabilities directly into its workflows. Unlike competitors retrofitting legacy systems, Fluent's platform is designed for secure, cross-platform collaboration from the ground up. This approach enables seamless measurement and activation across the “aisle, shelf, and screen,” a critical differentiator in a fragmented advertising ecosystem.

Moreover, Fluent's partnerships with platforms like VideoAmp and its modular clean room architecture allow brands to unify data across multiple channels without creating new silos. This interoperability is a key advantage in 2025, where 66% of retail media teams are already using clean rooms but struggle with integration. Fluent's solutions address these challenges by embedding clean room insights into planning and activation workflows, enabling data-driven decisions that directly inform campaign optimization.

Traditional analytics platforms, such as CDPs and dashboards, lack the infrastructure for secure cross-organization data sharing. Fluent, by contrast, is built for a privacy-first world, offering AI/ML-driven insights and cross-screen measurement that align with evolving regulatory and consumer expectations.

Financial Resilience and Long-Term Value

Despite a 23.86% revenue decline in Q2 2025 compared to the prior year, Fluent's strategic pivot is already yielding results. Its commerce media annual revenue run rate has exceeded $80 million, and the company anticipates adjusted EBITDA profitability in Q4 2025 and full-year profitability in 2026. These metrics suggest a path to sustainable value creation, supported by higher-margin, recurring revenue from data solutions.

The market is beginning to recognize Fluent's transformation. With a forward-looking P/E ratio that reflects its software-like margins and data-driven growth, the stock is positioned to benefit from increased investor confidence in its long-term vision.

Investment Thesis: A Privacy-First Leader in a $200B+ Market

Fluent's strategic pivot to data intelligence is a masterstroke in a post-cookie world. By combining Databricks' enterprise-grade infrastructure, Marsh's leadership, and a focus on privacy-compliant monetization, the company is well-positioned to capture a significant share of the $200+ billion commerce media market. Its ability to unify fragmented data, deliver actionable insights, and comply with evolving regulations creates a durable competitive moat.

For investors, Fluent represents a compelling long-term opportunity. The company's focus on first-party data, AI-driven activation, and secure collaboration aligns with macro trends in digital advertising. While short-term volatility may persist, the fundamentals of Fluent's transformation—robust revenue growth in its commerce media segment, a clear path to profitability, and a leadership team attuned to the privacy-first paradigm—make it a standout in the post-cookie era.

In a world where data is the new currency, Fluent is not just adapting—it is leading the charge. For those seeking exposure to the next phase of digital advertising, Fluent's strategic pivot offers a compelling case for investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

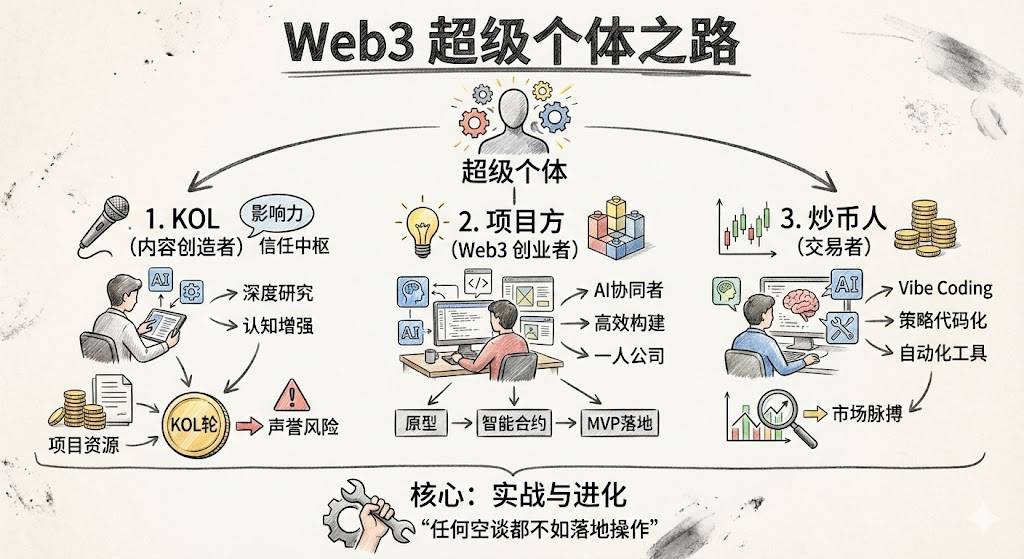

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.