INJ +217.72% in 24Hr Amid Volatile Short-Term Price Fluctuations

- INJ surged 217.72% in 24 hours to $13.62 on Aug 28, 2025, followed by a 747.79% seven-day drop. - Analysts attribute volatility to on-chain activity, tokenomics changes, and shifting market sentiment. - Despite a 310.61% monthly gain, INJ fell 3063.2% annually, highlighting speculative momentum over intrinsic value. - Technical indicators confirm high volatility, with sharp spikes and reversals typical of leveraged crypto assets.

On AUG 28 2025, INJ surged by 217.72% within 24 hours to reach $13.62, marking one of the most dramatic short-term price movements in its recent history. However, over the past seven days, the asset experienced a sharp correction, dropping 747.79%. The 310.61% increase over the last month contrasts starkly with the -3063.2% decline recorded over the preceding year, illustrating INJ’s high volatility and the unpredictable nature of its market performance.

The price movement highlights INJ’s tendency to experience rapid, large swings in both directions. Analysts project that these fluctuations could be attributed to a mix of on-chain activity, tokenomics adjustments, and broader market sentiment shifts. The 24-hour rise to $13.62 may reflect a sudden increase in demand or positive news catalysts, though no specific trigger was disclosed in the available data. The subsequent seven-day drop suggests either profit-taking or a shift in risk appetite among traders.

Technical indicators suggest INJ is operating in a high-volatility regime, with sharp price spikes followed by swift reversals. Over the past year, the asset has struggled to maintain gains, with the 3063.2% annual loss indicating a fundamental disconnect between short-term price swings and long-term value accrual. This pattern is typical for high-leverage crypto assets that rely on speculative momentum rather than intrinsic value drivers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

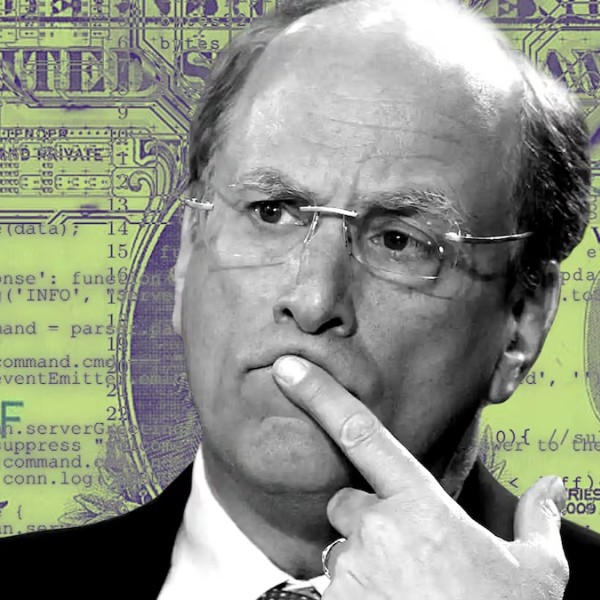

The CEO of the world's largest asset management firm: The scale of "crypto wallets" has exceeded $4 trillion, and "asset tokenization" is the next "financial revolution"

BlackRock has revealed its goal to bring traditional investment products such as stocks and bonds into digital wallets, targeting this ecosystem worth over $4 trillion.

Brevis releases Pico Prism, enabling real-time Ethereum proofs on consumer-grade hardware

Pico Prism (zkVM) has improved its performance efficiency by 3.4 times on the RTX 5090 GPU.

Is sandwich attack illegal too? MIT prodigy brothers who profited $25 million to stand trial

The victim is an MEV bot.