Layer Brett: Can This Ethereum Layer 2 Meme Coin Replicate PEPE's 100x Gains in 2025?

- Layer Brett ($LBRETT), an Ethereum Layer 2 meme coin, claims to merge viral appeal with blockchain scalability, offering 10,000 TPS and $0.0001 gas fees. - Unlike PEPE's infinite supply and zero utility, $LBRETT features fixed supply, 25% staking rewards (55,000% APY), and 10% transaction burns for deflationary value. - Institutional partnerships with Plan Mining/Kakao Chat and DAO governance aim to expand real-world use cases, contrasting PEPE's informal structure and social media-driven volatility. - A

In the summer of 2025, the cryptocurrency market is witnessing a seismic shift in how meme coins are evaluated. While PEPE, the frog-themed token that surged 100x in 2024, remains a cultural phenomenon, its lack of technical infrastructure and utility has left it vulnerable to volatility. Enter Layer Brett ($LBRETT), an Ethereum Layer 2 project that claims to merge the viral appeal of meme coins with the scalability and financial incentives of blockchain innovation. But can it truly replicate PEPE's gains—or even surpass them?

The PEPE Paradox: Hype vs. Long-Term Viability

PEPE's meteoric rise was fueled by internet virality, celebrity endorsements, and a zero-utility tokenomics model. Its supply is infinite, and its value is entirely dependent on social media sentiment. While this created a speculative frenzy, it also exposed the coin's fragility. By mid-2025, PEPE's price had stabilized at a fraction of its peak, as investors rotated into projects with clearer use cases.

The key issue with PEPE—and most pure meme coins—is their inability to scale or integrate into broader blockchain ecosystems. They lack staking mechanisms, deflationary models, or real-world applications. In contrast, Layer Brett is built on Ethereum's Layer 2 infrastructure, offering 10,000 transactions per second (TPS) and gas fees as low as $0.0001. This positions it as a viable platform for microtransactions, DeFi, and NFTs—use cases that PEPE cannot support.

Layer Brett's Technical Edge: Scalability and Staking Rewards

Layer Brett's native token, $LBRETT, is designed to address the limitations of legacy meme coins. With a fixed supply of 10 billion tokens, it introduces scarcity—a stark contrast to PEPE's infinite supply. The tokenomics are further bolstered by a 25% allocation to staking rewards. This logarithmic decay model creates urgency for early adopters, as staking rewards will diminish as more tokens are locked.

The project also incorporates a 10% transaction burn mechanism, reducing circulating supply and increasing token scarcity. This deflationary approach is absent in PEPE's model, where supply inflation erodes value over time. Additionally, Layer Brett's Ethereum Layer 2 architecture ensures compatibility with existing DeFi protocols, enabling seamless integration with platforms like Uniswap and Aave .

Institutional Partnerships and DAO Governance

Layer Brett's roadmap includes partnerships with Plan Mining and Kakao Chat, expanding its utility beyond speculative trading. These collaborations aim to integrate $LBRETT into real-world applications, such as microtransactions for messaging services and staking rewards for content creators. Meanwhile, the project's plans for a Decentralized Autonomous Organization (DAO) empower holders to govern the ecosystem, fostering community-driven development.

In contrast, PEPE's governance is entirely informal, with no structured mechanism for community input. This lack of institutional credibility limits its long-term appeal to investors seeking sustainable growth.

Risk Considerations: The High-Yield Trap

While Layer Brett's high APY is enticing, it's important to contextualize the risks. The project has not undergone a third-party audit, and its reliance on Ethereum's Layer 2 infrastructure means it's subject to the same smart contract vulnerabilities as other L2s. Additionally, the token's value is still unproven in a live market.

However, Layer Brett's Ethereum-based security and community-driven model mitigate some of these risks. The project's transparency in tokenomics and roadmap also sets it apart from opaque meme coin projects. For investors, the key is to balance the high-yield potential with a long-term view of utility and adoption.

The 2025 Bull Run: A Case for $LBRETT

Analysts project that $LBRETT could see strong returns by late 2025, driven by its deflationary model, institutional partnerships, and Ethereum L2 adoption.

For PEPE, the outlook is less optimistic. Its value is tied to social media trends, which are inherently unpredictable. While it may experience short-term spikes, its lack of technical infrastructure and utility makes it a high-risk, low-utility play.

Final Verdict: A Meme Coin with a Plan

Layer Brett represents a new breed of meme coin—one that leverages blockchain innovation to create a sustainable, scalable ecosystem. While PEPE's gains were driven by hype, $LBRETT's potential lies in its technical foundations and financial incentives. For investors seeking the next opportunity, the question isn't whether Layer Brett can replicate PEPE's gains—it's whether they can act before the bull run peaks.

In a market where hype often outpaces fundamentals, Layer Brett offers a compelling case for combining meme-driven virality with blockchain utility. Whether it becomes the next PEPE remains to be seen—but for now, the numbers speak for themselves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is sandwich attack illegal too? MIT prodigy brothers who profited $25 million to stand trial

The victim is an MEV bot.

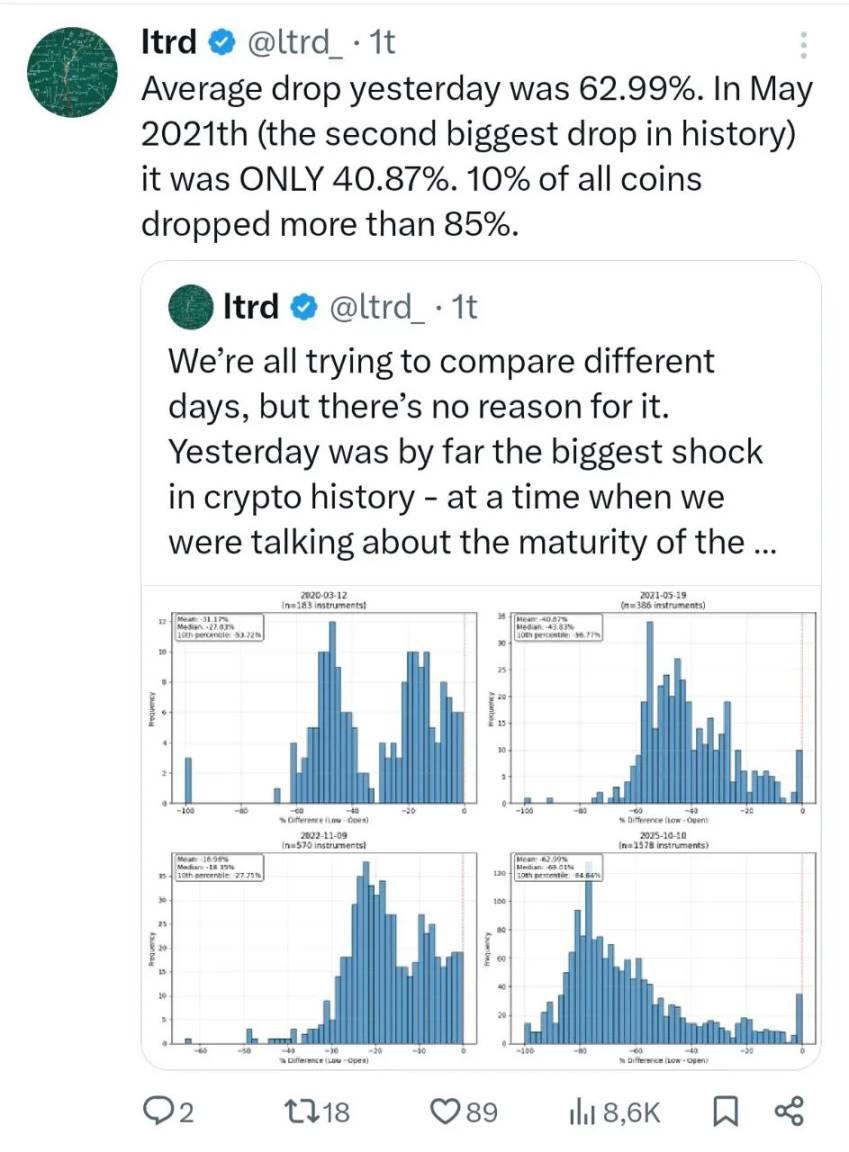

"10.11" Review and Survival Guide for the Survivors

In the post-crash era, where should cryptocurrency investment go from here?

From JPEG to AI Infrastructure, How Does AINFT Achieve a New Ecological Reconstruction?

AINFT aims to build a decentralized AI application aggregation ecosystem, allowing users to freely explore and utilize various AI Agent digital assistants just like using an "App Store."