Claiming airdrops requires "buying tokens" first? Camp Network sparks criticism across the entire network

The total number of wallets participating in the testnet interactions reached as high as 6 million, but only 40,000 addresses qualified for the airdrop, meaning almost everyone was excluded.

Original Title: "A New Height of 'Being Milked Back': Why Did the Camp Network Airdrop Draw So Much Criticism Across the Web?"

Original Author: Asher, Odaily

Camp Network is arguably the most criticized project among recent "airdrop farming" projects for "milking back" users.

Last night, Camp Network, an L1 project that raised up to 30 millions USD and focuses on solving AI copyright chaos, officially launched its mainnet, while also opening token trading and airdrop claiming.

Originally, many "airdrop farmers" participated in various ecosystem projects on the testnet with the mindset of "after months of hard work, at least I can get a pork knuckle meal," diligently accumulating "matches." However, the outcome was a plot twist—almost everyone got milked back.

Below, Odaily will walk you through why, from the moment the airdrop eligibility check began, Camp Network became the target of criticism within the "airdrop farming" community.

Most Users Ineligible for Airdrop, Eligible Users Required to Pay $10 for Registration

Complaint 1: Large Number of Early Users Ineligible for Airdrop

On August 22, Camp Network announced the launch of airdrop eligibility checking. According to community feedback, unless users had previously minted NFTs or invited enough friends, the vast majority of early users who worked hard to interact with Camp Network's testnet tasks were not eligible for the airdrop.

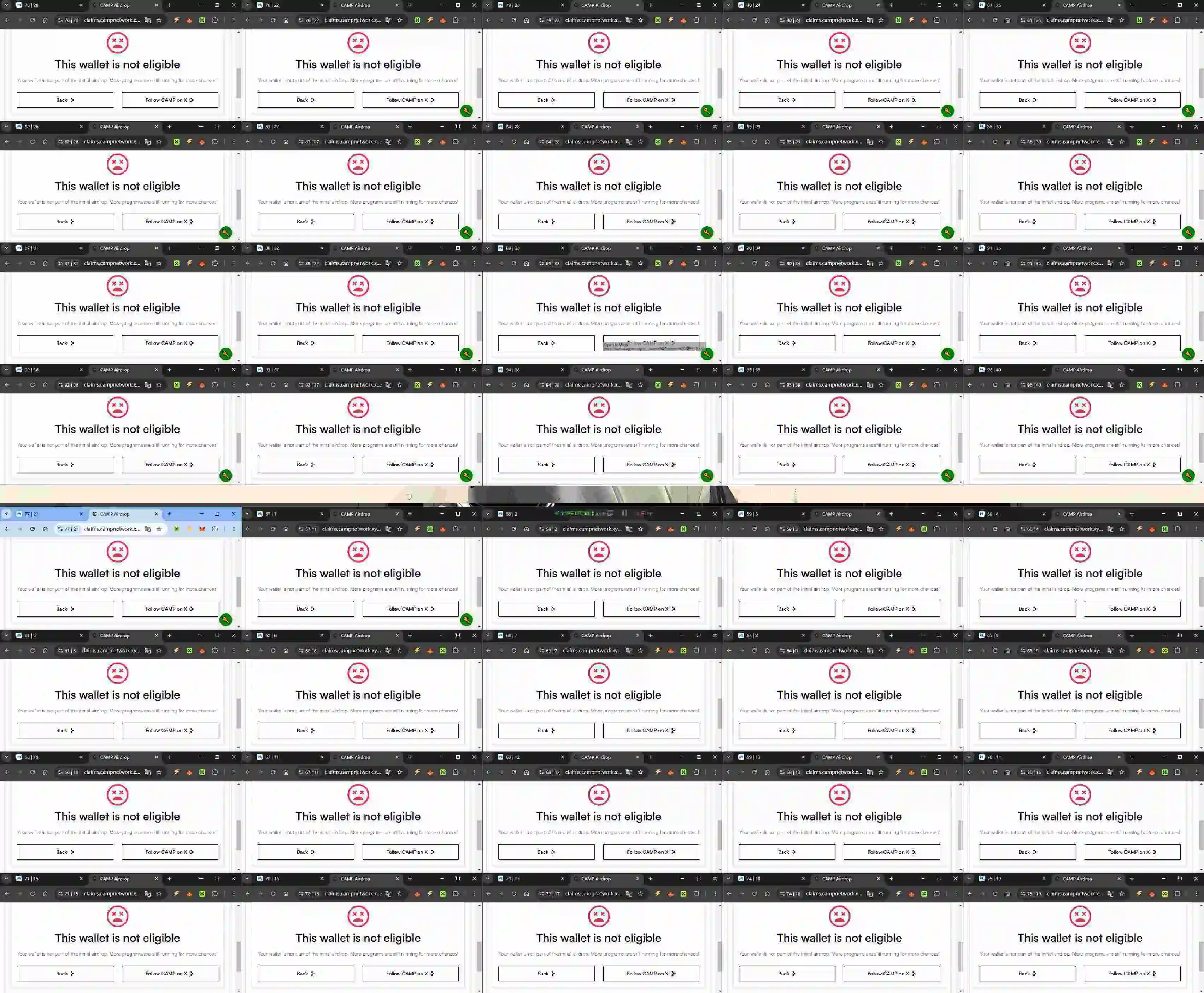

A "farming" user finds none of their Camp Network testnet accounts eligible for the airdrop

According to community statistics, the total number of wallets interacting with the Camp Network testnet reached 6 million, with about 280,000 active wallets in the Summit Series, but only 40,000 addresses qualified for the airdrop.

Community statistics on Camp Network testnet addresses

Complaint 2: Eligible Users Must Pay $10 to Register for the Airdrop

A large number of "airdrop farmers" were already disgruntled after being "milked back," causing widespread discontent in the community. Unexpectedly, even the few users who qualified for the airdrop were required by the project team to pay an extra fee—specifically, 0.0025 ETH (about $10) as a registration fee to confirm their claim. This made Camp Network the first mainstream L1 airdrop project to require users to pay to participate.

However, as negative sentiment quickly spread in the community, Camp Network urgently announced later that afternoon that it would cancel the airdrop registration fee and promised a full refund of the 0.0025 ETH to users who had already paid.

Under community pressure, the official team canceled the airdrop registration fee

Complaint 3: Strict KYC Requirements

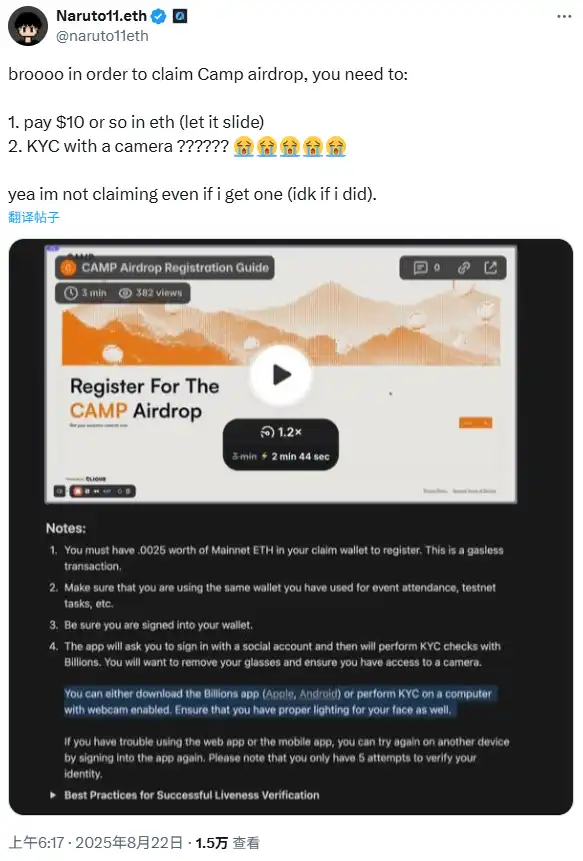

Even if you were lucky enough to qualify for the airdrop, you might not be able to claim it due to strict KYC requirements. According to feedback from eligible users, the strict KYC identity verification was even more frustrating than the $10 registration fee. The process required camera verification, and the KYC provider blocked VPNs and certain countries, excluding a large number of international users.

Community members complain about the strict KYC requirements

Only 20% Unlocked at TGE, Claiming Requires Buying Tokens on Exchanges to Pay Gas Fees

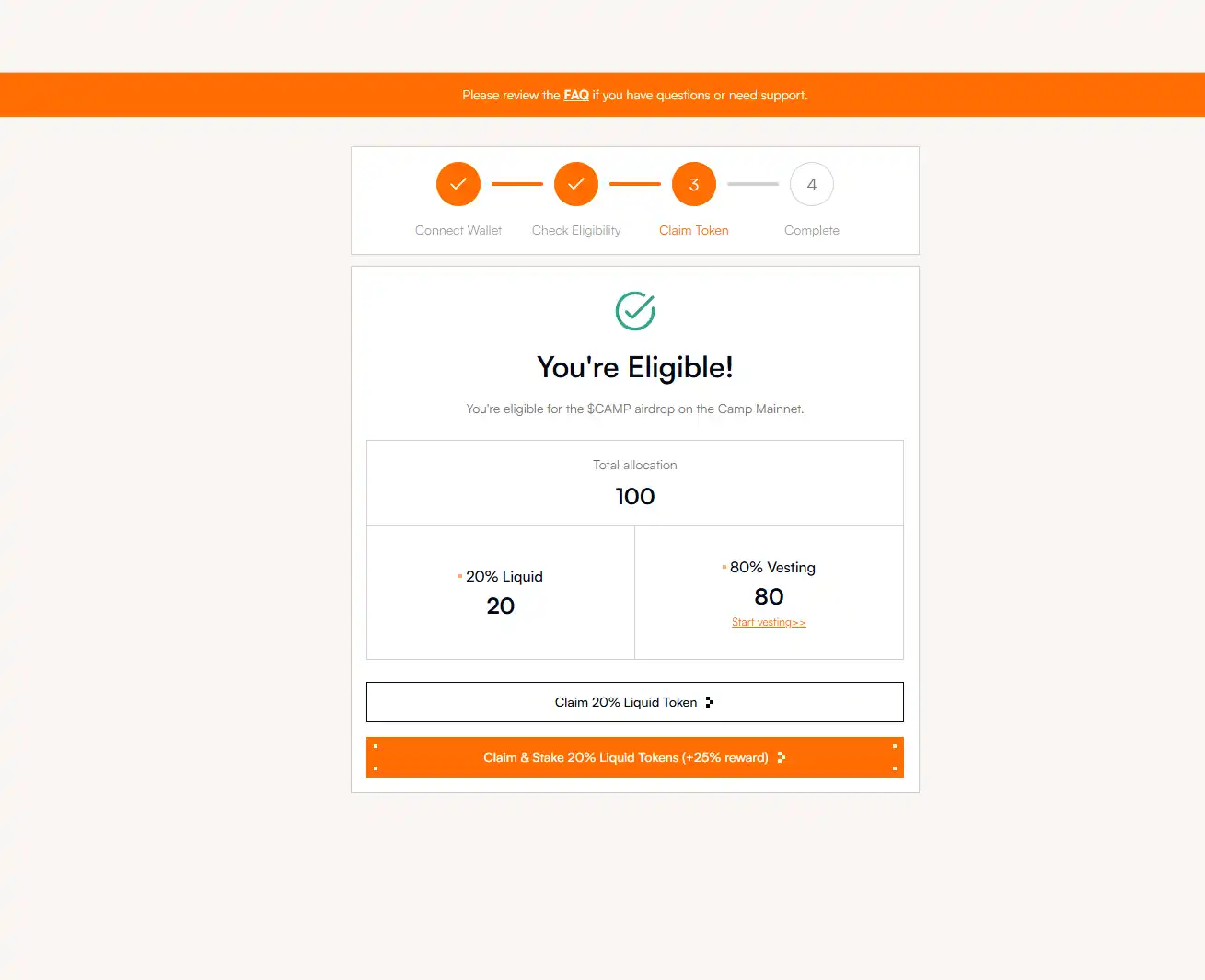

Even more frustrating than the exclusion of many early users was the requirement to buy tokens on an exchange to pay gas fees for claiming the airdrop during TGE. As shown below, this early user received 100 CAMP tokens, but only 20% (i.e., 20 CAMP) could be unlocked at launch, currently priced at $0.09 each, worth less than $2.

CAMP token airdrop claiming interface

To Claim Tokens, Users Must First Buy Tokens on Exchanges to Pay Airdrop Gas Fees, but Withdrawals Are Not Yet Available

Even more absurd, to claim the airdrop, users needed to buy CAMP tokens on an exchange to pay Camp Network mainnet gas fees, but some exchanges listing CAMP still do not allow withdrawals (as shown below for Bitget exchange).

CAMP withdrawals are still unavailable on Bitget trading platform

It is clear that the Camp Network team has set up multiple barriers in the airdrop design, making it difficult for most early users to claim their tokens smoothly. Such a highly controlled token mechanism inherently carries great uncertainty and risk. Whether you choose to go long or short, everyone should think twice and avoid acting impulsively due to emotions or short-term market movements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bearish Bets Rise as Bitcoin Put Options Surge

Bitcoin put options hit 28% of total volume, showing rising bearish sentiment amid a $1.15B spike in activity.Skew Turns Negative, Echoing October Crash ConcernsWhat This Means for Bitcoin Investors

Bitcoin OBV Shows Breakdown on Higher Timeframes

Bitcoin's OBV is signaling weakness on the weekly and 3D charts, while the daily chart holds steady for now.Weekly and 3D Charts Signal a BreakdownDaily Chart Still Holds — A Bullish Setup Ahead?What’s Next for Bitcoin?

Thumzup Eyes Dogecoin Integration for Instant Payouts

Thumzup may soon offer Dogecoin payouts, reducing friction and enabling instant cross-border payments.Why Dogecoin? Speed, Simplicity, and ReachTrump Jr. Support Could Drive Adoption

[Long Thread] Cysic Research Report: The Path of ZK Hardware Acceleration in ComputeFi