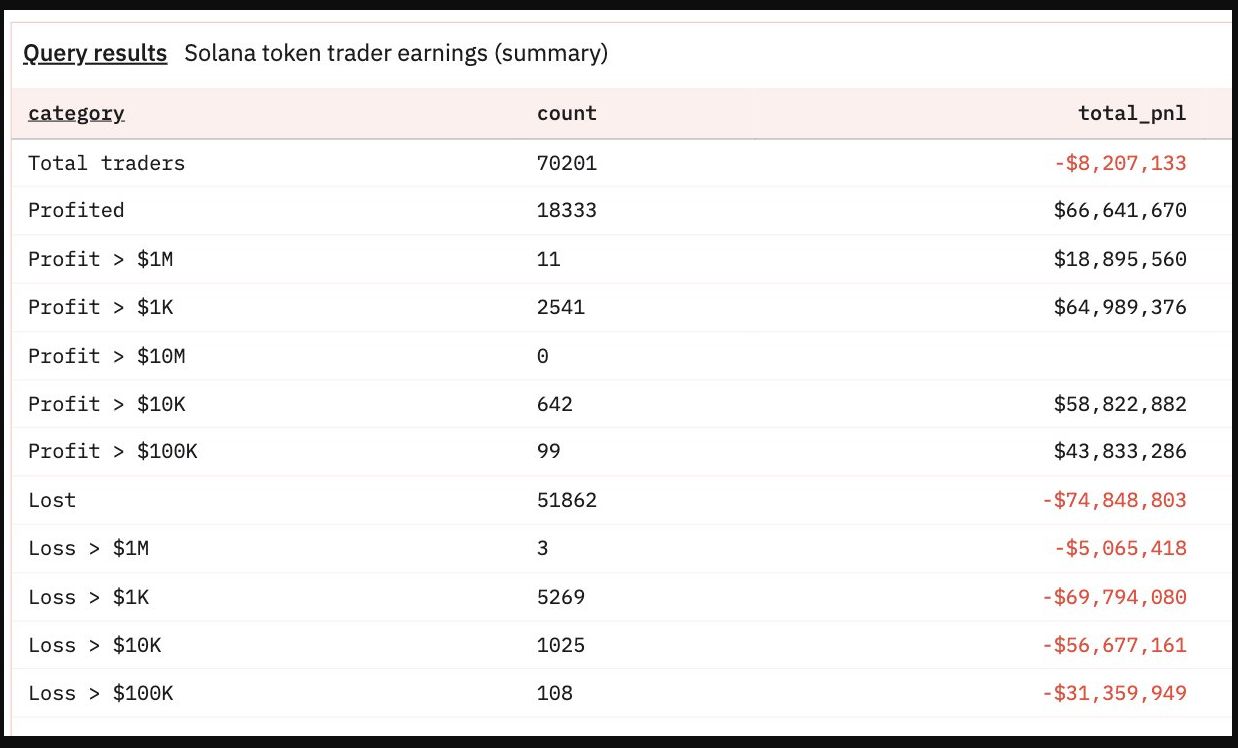

The YZY token crashed after a rapid pump, leaving over 51,000 of 70,200 traders with realized losses; only 11 wallets profited more than $1M, underscoring the high risk of celebrity-endorsed memecoins like the YZY token on Solana.

-

Only 11 wallets made $1M+ from YZY token trades.

-

More than 51,000 of 70,200 traders realized losses after an 1,400% intraday spike.

-

YZY price is down over 80% from its high; 19,531 wallets now hold the token (Nansen).

YZY token losses front-loaded: Over 51,800 traders lost money on Kanye’s YZY token—read the breakdown and risk steps to protect your capital.

What caused the YZY token crash?

The YZY token crashed after an initial 1,400% rally on launch followed by aggressive profit-taking and rapid sell pressure, leaving the token more than 80% below its high. Data from blockchain analytics platforms Bubblemaps and Nansen show heavy concentration of gains among few wallets and widespread retail losses.

How many traders lost money on the YZY token?

Of the roughly 70,200 traders who interacted with the YZY token, more than 51,800 realized losses, while just 11 wallets earned over $1 million and 99 wallets earned more than $100,000, according to Bubblemaps. Nansen reports 19,531 wallets currently hold the token as price sits down over 80% from the all-time high.

Only 11 wallets managed to profit over $1 million, from the 70,200 total traders who gained exposure to the YZY coin.

More than 51,000 traders incurred losses on Kanye West’s recently launched memecoin, highlighting the potential risks of trading celebrity-endorsed tokens with no intrinsic technological utility.

The Kanye West-linked YZY (YZY) token was launched on the Solana blockchain on Aug. 21. It rallied 1,400% within the first hour before losing over 80% of its value.

Of the 70,200 traders who invested in the celebrity-endorsed token, more than 51,800 realized losses, with three traders losing over $1 million, according to blockchain data platform Bubblemaps. Bubblemaps reported on X that “Meanwhile, 11 wallets made $1M+.”

Amid large-scale losses from the majority of the token’s traders, only 11 out of 70,000 wallets generated over $1 million in profit, while 99 generated over $100,000, highlighting the financial risks of celebrity-endorsed meme tokens with a lack of blockchain utility.

Source: Bubblemaps

Source: Bubblemaps

Meanwhile, the YZY token’s price is down over 80% from its all-time high, trading at $0.5515 with just 19,531 traders holding the token, data from blockchain intelligence platform Nansen shows.

YZY/USD, all-time chart. Source: Nansen

YZY/USD, all-time chart. Source: Nansen

Who else was affected by YZY price moves?

High-profile traders and leveraged accounts were among those hit. Former kickboxing champion Andrew Tate opened a 3x leveraged short on the YZY token that resulted in a reported $700,000 loss on the associated Hyperliquid account, as reported by mainstream crypto news outlets in plain text.

How did insiders and snipers profit from the launch?

Blockchain investigators pointed to active snipers and potential insiders who capitalized on launch sequencing. Bubblemaps named Hayden Davies as a likely beneficiary, claiming he “sniped the YZY launch and made $12M.” The platform also named a network of repeat snipers tied to prior high-return launches.

The original complaint filed against several token operators. Source: PACER

The original complaint filed against several token operators. Source: PACER

Despite large retail interest spikes, most celebrity-endorsed tokens fail to gain sustainable traction. Data shows more than 30 celebrity-endorsed tokens launched on Solana in June 2024 and have fallen by at least 73.23% since launch. Public figures linked to endorsements include 50 Cent, Caitlyn Jenner, Iggy Azalea and Ronaldinho Gaúcho.

Tate endorsed multiple Solana memecoins in June 2024; most of those tokens dropped roughly 99% shortly after endorsement, further illustrating the volatility and event-driven nature of celebrity memecoin markets.

How should traders assess memecoin risk?

Traders should prioritize liquidity, token distribution, on-chain ownership concentration, and verified smart-contract audits before entering memecoin trades. Short-term pumps often concentrate gains to early wallets and automated sniping bots, which increases downside risk for retail buyers.

How to protect capital when trading memecoins

- Check liquidity depth and slippage estimates on the target pool.

- Examine token distribution and on-chain holders for concentration risk.

- Set strict position-sizing and stop-loss rules to limit downside.

- Prefer projects with verifiable utility, audits, and transparent teams.

Frequently Asked Questions

How many wallets profited over $1 million from YZY token?

Blockchain data shows only 11 wallets made more than $1 million from YZY token trades, while 99 wallets made over $100,000, indicating heavy profit concentration among early or insider participants.

Why are celebrity-endorsed memecoins so risky?

Celebrity-endorsed memecoins often lack on-chain utility, have concentrated token allocations, and are driven by short-lived hype. These factors increase volatility and the likelihood of large retail losses on retracements.

Key Takeaways

- Majority lost: Over 51,800 of ~70,200 traders realized losses on the YZY token.

- Profit concentration: Only 11 wallets captured $1M+ gains, showing uneven distribution of returns.

- Risk management: Check liquidity, holder concentration, audits, and avoid leverage to limit downside.

Conclusion

The YZY token episode underscores the heightened risk profile of celebrity-endorsed memecoins: rapid pumps can create large winners among a few wallets while leaving most retail traders with losses. Traders should apply disciplined risk checks and prioritize projects with clear utility and transparent tokenomics. For ongoing coverage and on-chain analysis, COINOTAG will monitor developments and on-chain data updates.