The US government is publishing economic data onchain to increase transparency: Chainlink and Pyth will publish BEA GDP, PCE and other macroeconomic feeds on public blockchains. Onchain government data enables automated trading, real-time prediction markets and improved DeFi risk models.

-

US government publishes BEA data onchain via Chainlink and Pyth.

-

Expect automated trading, prediction markets and DeFi risk tools to use live macro inputs.

-

Pyth token rose ~70% on the announcement; Chainlink (LINK) rallied roughly 61% during August.

Onchain government data: US taps Chainlink and Pyth to publish BEA GDP and PCE onchain — learn implications for DeFi and markets.

The US government announced on Tuesday that it is publishing economic data onchain to boost transparency for government spending.

What does it mean that the US government is publishing economic data onchain?

Onchain government data means official macroeconomic figures from agencies like the Bureau of Economic Analysis (BEA) will be published directly to public blockchains by oracle providers. This creates a verifiable, tamper-resistant record for GDP, PCE and other indicators that markets and DeFi protocols can consume in real time.

How will Chainlink and Pyth publish BEA GDP and PCE data onchain?

Chainlink was selected to provide BEA data feeds including real gross domestic product (GDP), the PCE price index, and real final sales to private domestic purchasers. Pyth was named a publisher of GDP data by the Department of Commerce. Both providers will post signed data transactions that smart contracts and onchain applications can read.

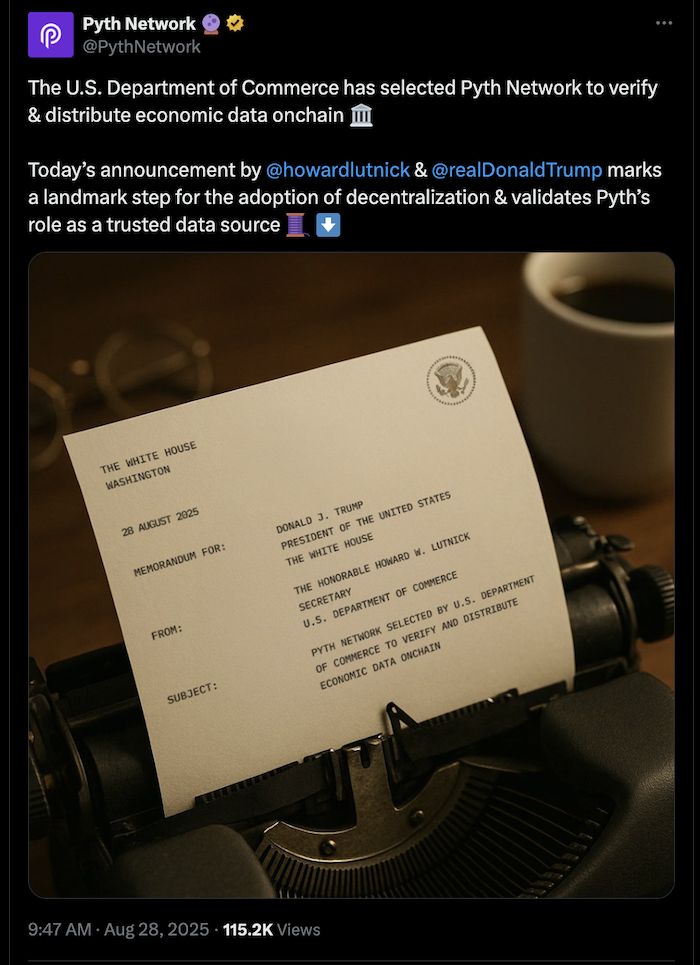

The selection follows an administrative push to increase government spending transparency and to support financial innovation. A Chainlink spokesperson said the company will add additional feeds in response to public demand or government direction. A Pyth announcement confirmed its role publishing GDP figures onchain.

Source: Pyth Network

Source: Pyth Network

Publishing official economic data onchain enables several concrete use cases. Smart contracts can trigger actions when a reported indicator crosses thresholds. Prediction markets can settle automatically based on authoritative onchain figures. DeFi protocols can use real-time macro inputs for collateral and risk adjustments.

How might traders and markets react to onchain government economic data?

Market participants reacted immediately. The price of Pyth (PYTH) surged by nearly 70% on the announcement. LINK posted modest intraday gains of over 3% before retracing to about $25.

LINK has rallied approximately 61% since early August, rising from roughly $15.43 to current levels. These moves show how oracle-related tokens can experience heightened volatility when selected for high-profile government projects.

Chainlink rallies by about 61% during August. Source: TradingView

Chainlink rallies by about 61% during August. Source: TradingView

How will DeFi and tokenized finance use onchain BEA data?

Onchain BEA and PCE feeds will support:

-

Automated trading strategies that react to official macro releases.

-

Real-time prediction markets for GDP and inflation outcomes.

-

Risk management for stablecoins, tokenized government bonds, perpetual futures, and RWAs that rely on macro inputs.

How to access onchain government economic data

-

Identify the oracle feed provider (Chainlink or Pyth) and the published feed name onchain.

-

Subscribe to the feed via your smart contract or oracle client to receive signed updates.

-

Validate signatures and timestamps on each data point before using values in automated logic.

-

Integrate the feed into trading algorithms or DeFi risk models for live adjustments.

Frequently Asked Questions

Which BEA indicators will be available onchain?

The initial feeds include real GDP, the PCE price index, and real final sales to private domestic purchasers. Additional BEA series may be added based on demand or government guidance.

Will the data be authoritative and auditable?

Yes. Onchain publication uses signed oracle messages traceable to the provider. The BEA remains the authoritative source; the onchain copy provides an auditable, timestamped record for smart contracts.

Key Takeaways

- Onchain government data: Provides verifiable BEA GDP and PCE feeds for blockchains.

- Oracle roles: Chainlink and Pyth selected to publish different macro feeds and enable smart-contract consumption.

- Market impact: Oracle tokens and related markets can see rapid price moves; expect new DeFi products to incorporate macro inputs.

Conclusion

Publishing official economic data onchain marks a practical step toward greater transparency and programmable macro inputs. With Chainlink and Pyth delivering BEA feeds, developers and traders gain reliable, onchain signals for automation and risk management. Watch for protocol integrations and product innovation as adoption progresses.

| Chainlink | BEA data feeds, expandable on demand | Real GDP, PCE, real final sales | LINK rallied ~61% in August |

| Pyth | Published GDP data for Department of Commerce | GDP | PYTH surged nearly 70% on announcement |

Publication date: 2025-08-28. Source mentions: Bureau of Economic Analysis (BEA), Chainlink statements, Pyth Network announcement, TradingView market data and Cointelegraph reporting referenced as plain text sources.