The 2025 Meme and Political Token Paradox: Balancing Speculative Frenzy with Institutional Caution

- 2025 crypto market faces tension between meme/political token speculation and institutional risk controls. - Trump Coin and BullZilla drive $74.5B meme market, but volatility demands 50-70% portfolio allocation to Bitcoin/Ethereum. - Institutions use AI rebalancing, stop-loss thresholds, and MiCA regulation to manage meme token risks. - 68% of retail investors prioritize community engagement over utility, creating speculation-stability paradox.

The 2025 crypto market has become a battleground for two opposing forces: the unrelenting speculative fervor of meme and political tokens and the cautious recalibration of institutional risk management. While projects like Trump Coin (TRUMP) and BullZilla have surged into the $74.5 billion meme coin market [6], their volatility and event-driven narratives demand a strategic approach to portfolio diversification. This article dissects the dual dynamics of speculative momentum and risk-rebalance, offering a roadmap for investors navigating this high-stakes terrain.

The Speculative Engine: Meme and Political Tokens in 2025

Meme and political tokens thrive on social media virality and ideological narratives. The Trump-linked token, currently at $0.03980, has drawn institutional attention with a proposed ETF by Canary Capital, yet its price has plummeted 11.98% in a month [1]. Similarly, BullZilla’s “Roar Burn Mechanism” creates artificial scarcity, while Fartcoin ($0.8914) leverages humor to build community-driven value [5]. These tokens are not merely speculative—they are cultural artifacts, their prices dictated by sentiment, political events, and meme cycles.

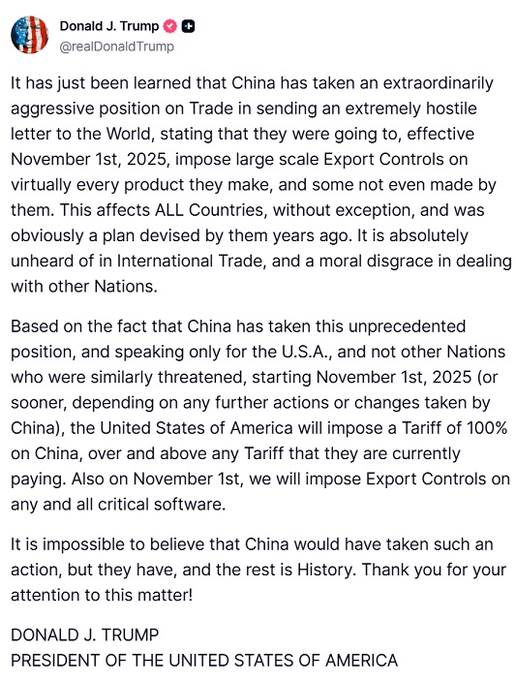

However, this momentum is inherently fragile. A study using the BEKK-MGARCH model revealed that political signals (e.g., Trump’s memecoin launch) amplify volatility across crypto assets, creating spillover effects that destabilize even unrelated tokens [2]. For instance, the dissolved Constitution-buying experiment ($0.01835) and libertarian-themed tokens ($0.01432) reflect ideological experiments with uncertain longevity [2].

Risk Rebalance: Institutional Frameworks and Diversification Strategies

Institutional investors are now treating meme and political tokens as niche assets requiring strict risk controls. The recommended strategy allocates 50–70% of crypto portfolios to established coins like Bitcoin and Ethereum , with the remainder split among emerging projects, stablecoins, and meme tokens [3]. For example, Arctic Pablo Coin (APC) employs deflationary mechanics and structured ROI projections, positioning it as a “safer” speculative bet compared to TRUMP’s reliance on political hype [1].

Key risk mitigation tactics include:

1. Stop-loss thresholds: TRUMP’s 70% value drop since January 2025 underscores the need for hard limits to prevent catastrophic losses [2].

2. AI-driven rebalancing: Tools leveraging real-time market data optimize asset allocation, adjusting exposure to meme tokens based on sentiment analysis and volatility trends [5].

3. Regulatory alignment: The EU’s MiCA regulation and the Trump administration’s pro-crypto executive order are reshaping custody standards and compliance expectations, offering a framework for institutional-grade governance [4].

The Paradox of Utility and Speculation

While meme coins like BullZilla and APC introduce utility (e.g., NFT governance, metaverse integration), their long-term viability remains unproven [6]. Institutional frameworks emphasize blockchain-based utility as a differentiator—projects like Bitcoin Hyper (HYPE), a Layer-2 solution on Solana , blend innovation with Bitcoin’s security, offering a hybrid model for risk-averse investors [6].

Yet, the allure of meme tokens persists. A 2025 survey found that 68% of retail investors prioritize community engagement over utility, drawn to tokens with viral narratives [6]. This creates a paradox: while utility-driven projects may offer stability, meme tokens dominate headlines and liquidity.

Conclusion: Navigating the 2025 Meme-Industrial Complex

The 2025 meme and political token market is a double-edged sword. It offers explosive growth potential but demands disciplined risk management. Investors must balance speculative bets on tokens like TRUMP and Fartcoin with structured allocations to utility-driven projects and stablecoins. As regulatory clarity emerges and AI tools refine portfolio strategies, the key to success lies in adaptability—leveraging meme coin momentum while anchoring portfolios in institutional-grade frameworks.

Source:

[1] Political Crypto Assets: Navigating Risk, Reward and the ...

[2] Memecoins' spillover effects in cryptocurrency markets

[3] 5 Ways to Diversify Your Crypto Portfolio in 2025

[4] Navigating the New Crypto Terrain: Trump's Week 1 ...

[5] Crypto Portfolio Diversification Tips to Consider in 2025

[6] The 2025 Meme Coin Boom: How Speculative Frenzy and ...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who is the culprit behind the liquidation of 1.6 million people?

It's not USDe depegging, nor Binance disconnecting, but rather market makers collectively acting maliciously?

Trump's Trade War Resumes: Analysis of the Macroeconomic Factors Behind the Simultaneous Decline in Crypto and Stocks

Tariffs = stock market/cryptocurrency plunge, but today is far more than that.

From APENFT to AINFT: Reshaping the Digital Ecosystem with AI and Moving Towards a New Era of Intelligence

AINFT is committed to deeply integrating the intelligent creativity of AI with the trust mechanism of blockchain, evolving from a digital asset platform into a self-driven and continuously evolving intelligent digital ecosystem.