Key Notes

- Tron's fee reduction from 210 to 100 sun represents the largest cost cut in the network's history, effective August 29.

- Trading data reveals $64 million in short positions versus $15.9 million in longs, indicating widespread bearish expectations.

- Technical analysis shows death cross formation and RSI decline, suggesting prolonged consolidation between $0.33-$0.36 levels.

Tron Network Founder Justin Sun issued a post on August 29 supporting Tron Improvement Proposal #789 , which reduces network fees by 60%. The proposal, submitted on Wednesday, is set to lower the energy unit price from 210 sun to 100 sun, citing TRX TRX $0.34 24h volatility: 2.0% Market cap: $31.91 B Vol. 24h: $1.11 B price doubling in value since 2024, effectively raising on-chain activity costs in real dollar terms.

On August 26, 2025, the Tron Super Representative community proposed to reduce Tron network fees by 60%. This is the largest fee reduction since the founding of the Tron network. The proposal has already passed and will take effect at 20:00 (GMT+8) this Friday!

Here’s my view on…

— H.E. Justin Sun 👨🚀 (Astronaut Version) (@justinsuntron) August 29, 2025

The proposal passed the majority voting requirement and now takes effect on Friday, August 29 at 20:00 (GMT+8), marking the largest fee reduction in Tron’s history. While acknowledging short-term profitability risks to TRON investors, Sun highlighted that increased adoption and activity would outweigh revenue losses in the long run.

He confirmed that the Tron Super Representative community will conduct quarterly reviews of network fees, taking into account TRX price swings, transaction volumes, and growth metrics to remain competitive.

How will Tron Price React to the Proposed 60% Fee Cut?

In terms of immediate market reaction to the 60% Tron network fee cut, traders appear to be anticipating short-term downward swings in TRX price, as hinted by Justin Sun in his post.

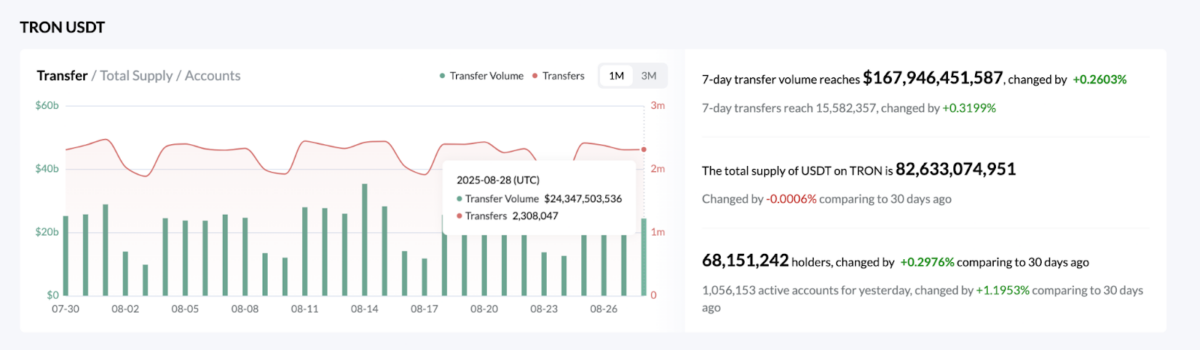

At press time, the Tron network boasts $82 billion of total USDT supply, while $24 billion in USDT transactions executed on Tron account for 20% of USDT’s total 24-hour trading volume of $136 billion.

Tron Network USDT Stablecoin transfer metrics as of August 29, 2025 | Source: Tronscan.org

Fee cuts are great for attracting new users to the network and are expected to boost Tron’s dominance in stablecoin transactions .

However, the cut essentially reduces income accruing to token holders. With fewer incentives to hold the token, TRX is likely to face considerable unstaking and a massive short-term supply surge if stakers opt out to deploy resources toward more rewarding chains.

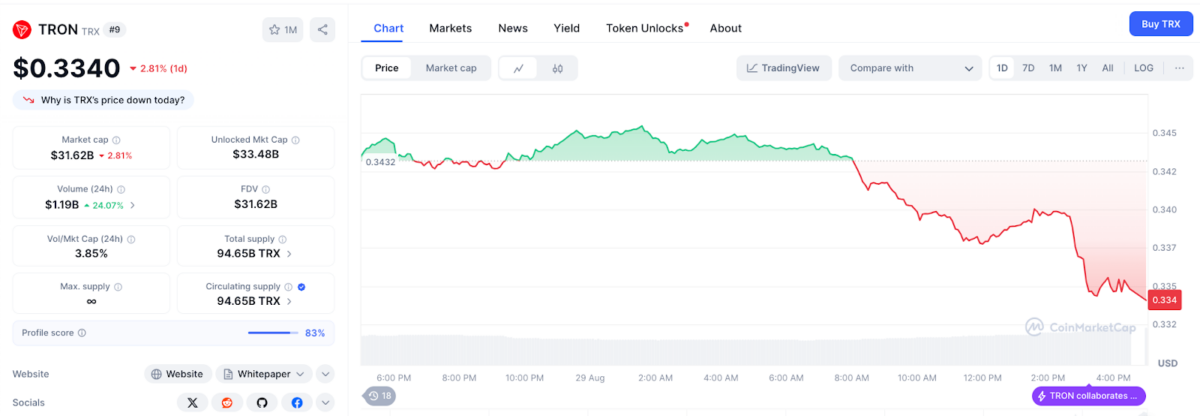

Tron Price Action as of Aug 29, 2025 | Source: Coinmarketcap

CoinMarketCap data shows TRX price dipping 4% intraday alongside a 29.5% increase in trading activity, with trading volume approaching $1.2 billion.

When price dips are accompanied by a larger uptick in trading volume, it signals heavy sell-side pressure as traders adjust their positions in response to the latest announcement.

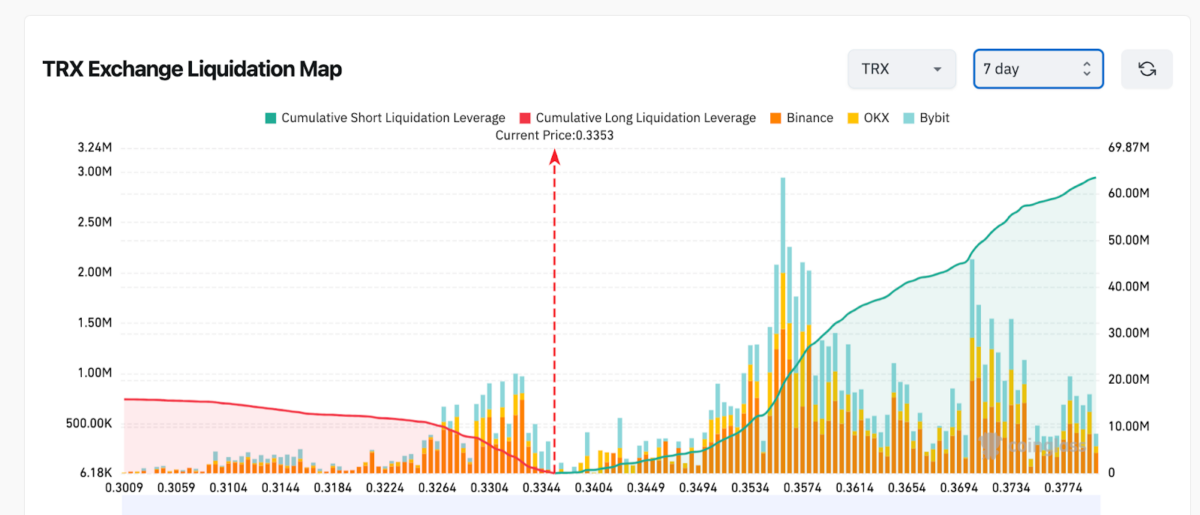

CoinGlass’ liquidation map data , which tracks the value of active futures contracts listed for an asset around key price levels, further emphasizes these short-term bearish expectations dominant among TRX holders.

Tron (TRX) 7-day Liquidation Map Data as of August 29, 2025 | Source: Coinglass

Hours after Justin Sun’s post supporting the TRX fee cut, SHORT positions deployed against TRX over the last seven days crossed $64 million, according to CoinGlass. Meanwhile, bullish traders have trimmed down exposure to $15.9 million in active long TRX positions. With short positions exceeding longs by 302%, this hints that the majority of traders anticipate a TRX price drop in the coming trading sessions.

TRX Price Forecast: Prolonged Consolidation Expected Between $0.33 and $0.36

Tron price has dipped 4% intraday to hit $0.33 at press time as traders position for short-term volatility with respect to the fee cut. A closer look at the TRX liquidation map shows that $19 million of the short positions are deployed at the $0.36 price level. TRX price is likely to remain at risk of persistent downswings until the bulls stage a decisive breakout above it.

Conversely, the largest bull support lies at the $0.33 zone where bulls have deployed $3.4 million long positions.

Tron (TRX) Technical Analysis | TRXUSD 24-Hour Price Chart

Technical indicators on the TRXUSDT 24-hour chart further emphasize this stance. As seen below August 27, TRX formed a death cross as the 5-day simple moving average dropped below both the 8-day and 13-day averages, within 24 hours of the fee proposal.

This crossover signals weakening short-term momentum and raises caution for bullish traders. The Relative Strength Index (RSI) has also retreated from overbought territory towards 58.95%, signaling declining buying pressure with ample room for more downside until seller fatigue sets in.

Based on the current technical insights and derivatives market insights, TRX price is now likely headed for a prolonged consolidation within the $0.33 support and the $0.35 level where the 8-day and 13-day moving averages currently intersect.