Key Notes

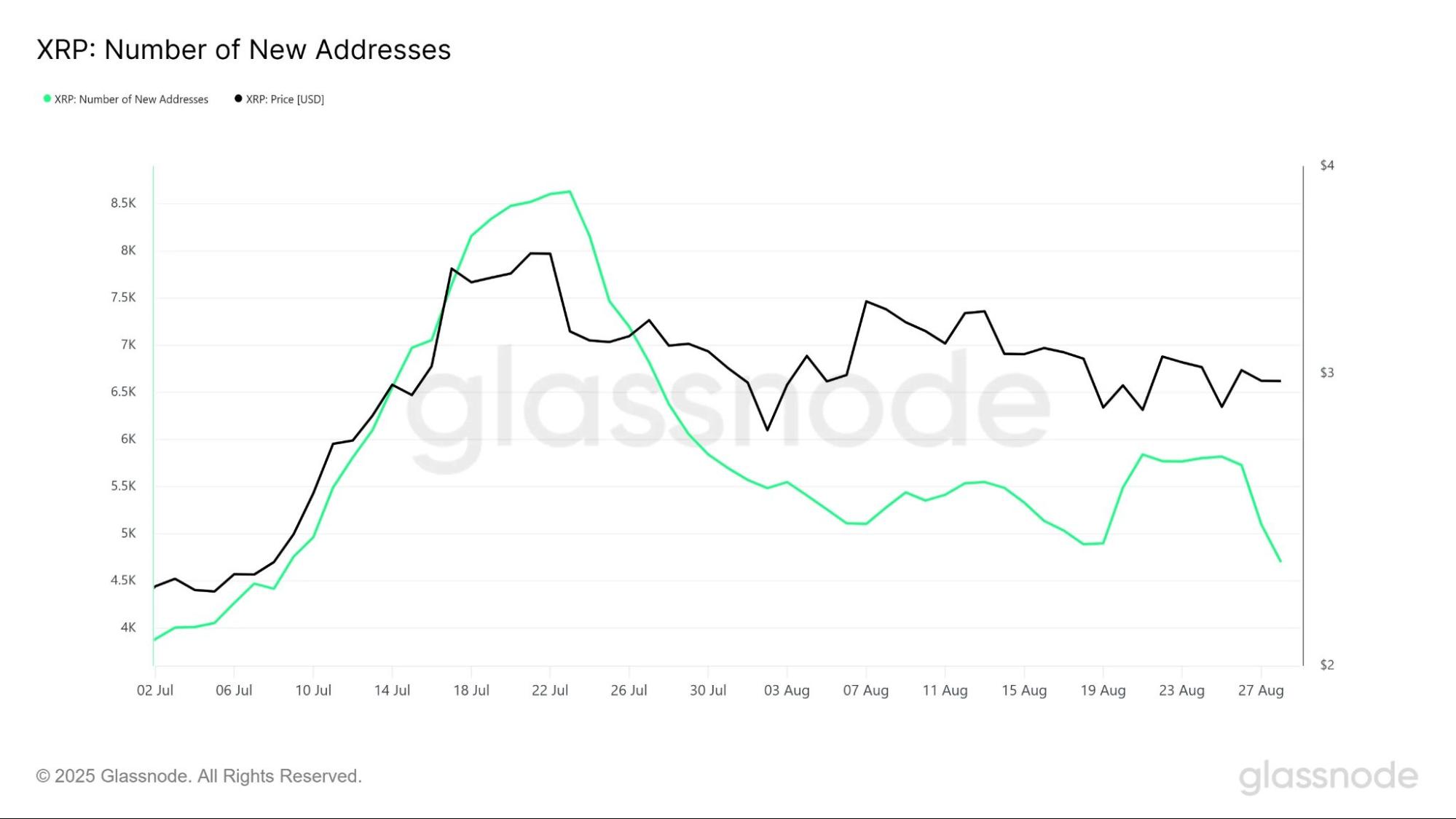

- XRP network data shows first-time transactions near a two-month low, signaling reduced inflows from fresh investors.

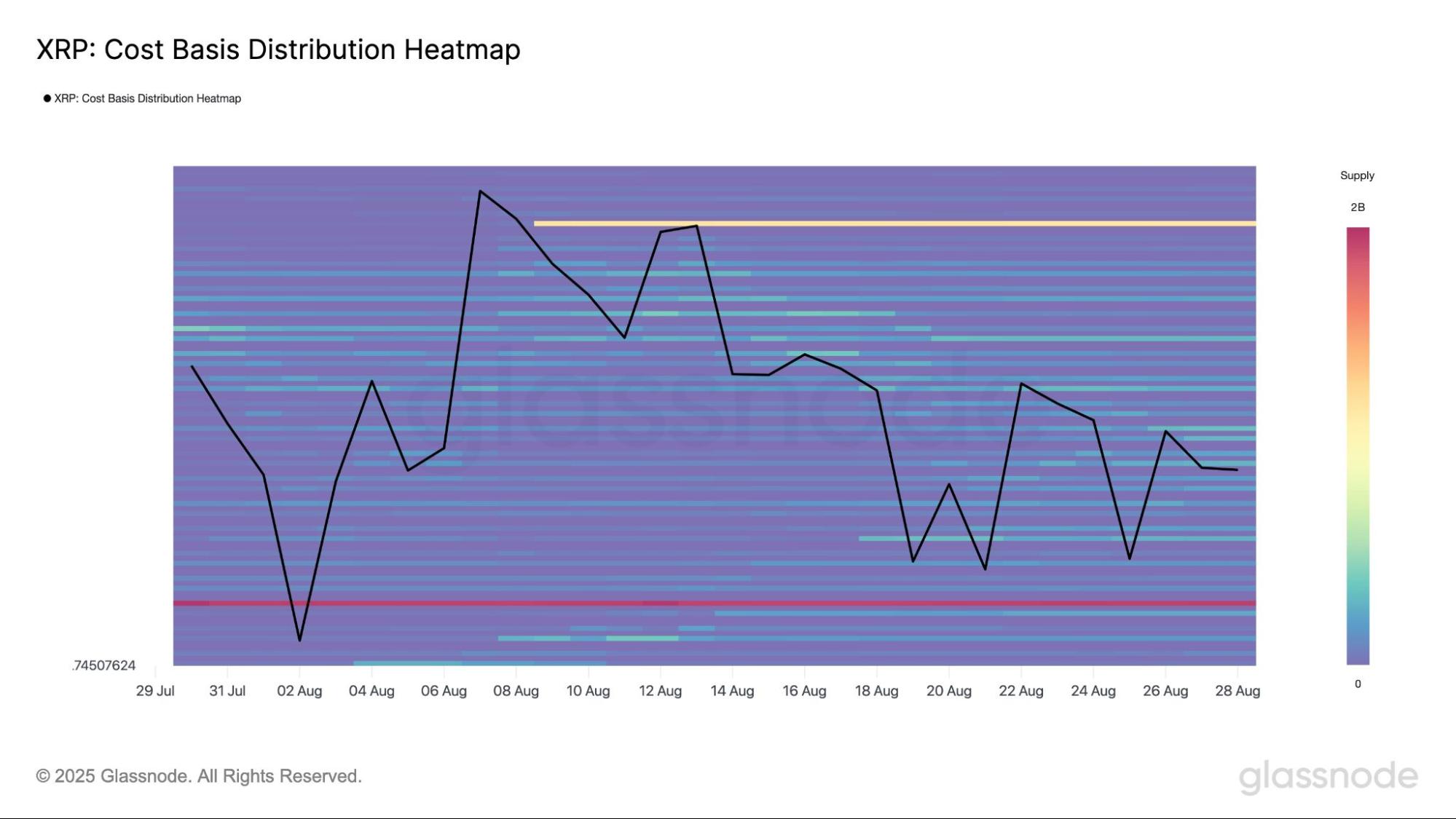

- XRP faces a critical test near $2.80, with the largest supply cluster between $2.81–$2.82.

- All eyes will be on the Fed rate cuts and macro push during September.

XRP XRP $2.82 24h volatility: 5.2% Market cap: $168.00 B Vol. 24h: $6.73 B once again faces strong selling pressure and has corrected more than 4.38% today, after losing the crucial support at $3.0. As we approach September, one of the least performing months for the crypto market, the investor sentiment is waning further. XRP price is set to close August with negative returns on the monthly chart.

XRP Price Action Ahead and On-Chain Activity

At the time of writing, XRP is trading at $2.86, after repeatedly failing to close above the $3.00 mark over the past two weeks, indicating weak bullish momentum. If selling pressure persists, XRP could decline further, with $2.74 acting as a likely support level for consolidation, amid ongoing whale selloff .

XRP Price Under Selling Pressure | Source: TradingView

However, if investor sentiment improves, XRP price could stage a recovery. Regaining $2.95 as support would provide the momentum to challenge higher levels, while a breakout above $3.07, followed by $3.12, would negate the current bearish outlook.

Network data indicates waning interest from new participants, as first-time transactions have fallen close to a two-month low. This decline suggests reduced activity from fresh investors, limiting new capital inflows into XRP and contributing to the asset’s continued stagnation.

XRP Active Addresses Are Declining | Source: Glassnode

What Happens in September?

XRP price is approaching a key test around $2.80 in September, according to Glassnode’s cost basis heatmap. The largest supply cluster lies between $2.81 and $2.82, where nearly 1.71 billion XRP were purchased. As of Friday, XRP was trading at approximately $2.88, slightly above this supply zone.

XRP Heatmap With Cost Basis Distribution | Source: Glassnode

Furthermore, looking at the macro front, there are expectations of a Fed rate cut coming next month in September. According to the CME Fed Watch Tool , the current expectations of the rate cut stand at 87.12%.

On the other hand, Ripple has continued to move further with its infrastructure development for XRPL, along with pushing the RLUSD stablecoin into the mainstream. These developments might provide additional support and prevent further dragging of XRP price lower.

WEPE Meme Coin on Solana Draws Limelight

Amid the growing activity in the crypto market, Wall Street Pepe (WEPE) is also making its move. This high-frequency meme coin is now live on Solana as it targets a rapidly expanding community of traders, navigating a market dominated by influential crypto whales.

Initially, WEPE was available only on Ethereum. However, its shift to Solana is a strategic power move. Over the past year, Solana has emerged as the go-to platform for trading meme coins, particularly with the recent surge of the crypto supercycle.

Solana-based WEPE allocation was accompanied by token burns on Ethereum, so that supply across chains could remain tightly balanced.

Users can buy WEPE on Solana with ETH, SOL, USDT, USDC, or a credit card. Alternatively, it is also possible to swap ETH-based WEPE for Solana WEPE on a 1:1 basis.

next