LQTY +206.19% in 24 Hours Amid Volatile Price Movements

- LQTY surged 206.19% in 24 hours to $0.86 on Aug 30, 2025, but remains in a long-term downtrend with 5,612.19% annual decline. - Analysts attribute the rebound to speculative trading or market corrections, but long-term trends remain bearish with no sustained recovery. - Technical indicators suggest the rally may signal bear phase exhaustion, yet key resistance levels remain unbroken for confirmation. - Structured backtesting is recommended to evaluate similar market reactions through defined parameters a

On AUG 30 2025, LQTY rose by 206.19% within 24 hours to reach $0.86. Despite this daily rebound, the broader time frames reveal a highly volatile profile, with the token recording a 222.22% decline over seven days, a 1818.18% drop over one month, and a staggering 5612.19% decline over a 12-month horizon. The sharp 24-hour gain contrasts starkly with the longer-term bearish trend, highlighting the unpredictable nature of LQTY’s market dynamics.

The token’s 24-hour rise suggests a potential short-term reversal in sentiment, though it remains within the context of a broader downtrend. Analysts project that such sharp intraday gains often reflect speculative trading activity or market correction phases following overbears. However, these gains have yet to translate into a sustained recovery, as the longer-term indicators remain bearish. The lack of follow-through on the rally raises questions about the sustainability of recent buying pressure.

Technical analysts have focused on the 24-hour reversal as a potential indicator of exhaustion in the short-term bear phase. The move may be interpreted as a rejection of recent support levels, though without confirmation of a breakout above key resistance, it remains premature to label it as a trend reversal. The broader context of continued weekly and monthly declines suggests that any bullish momentum is likely to be short-lived without a significant shift in fundamental or macroeconomic conditions.

To test the potential of similar market reactions, a structured backtesting approach is essential. This involves specifying key parameters such as the asset under test, trigger conditions, and exit strategies. Establishing these variables allows for a rigorous evaluation of how a strategy might perform under historical conditions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With the expectation of Polymarket issuing tokens, which ecosystem projects are worth speculating on?

After the meme craze fades, perhaps it's time to refocus on the prediction market.

BTC Weekly Watch: Has the Market Code Emerged? Dynamic Take-Profit Strategy Suggestions Included

Monad airdrop query goes live, almost all testnet users “get rekt”?

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

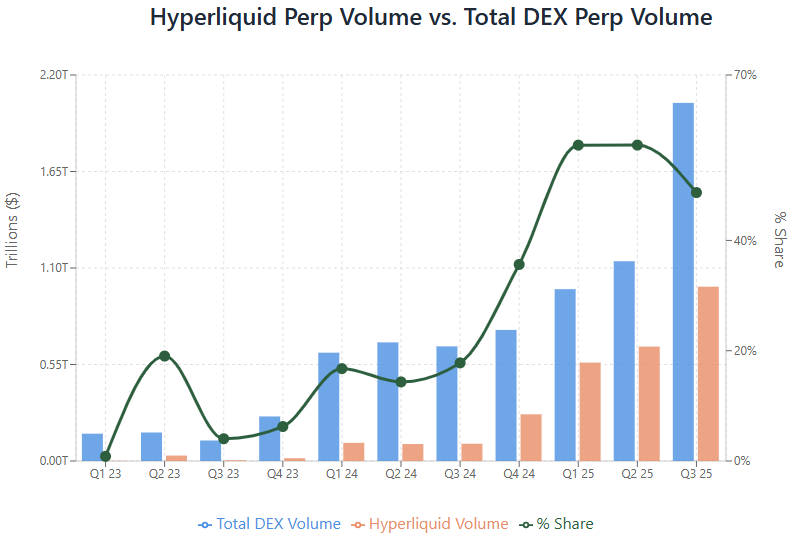

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.