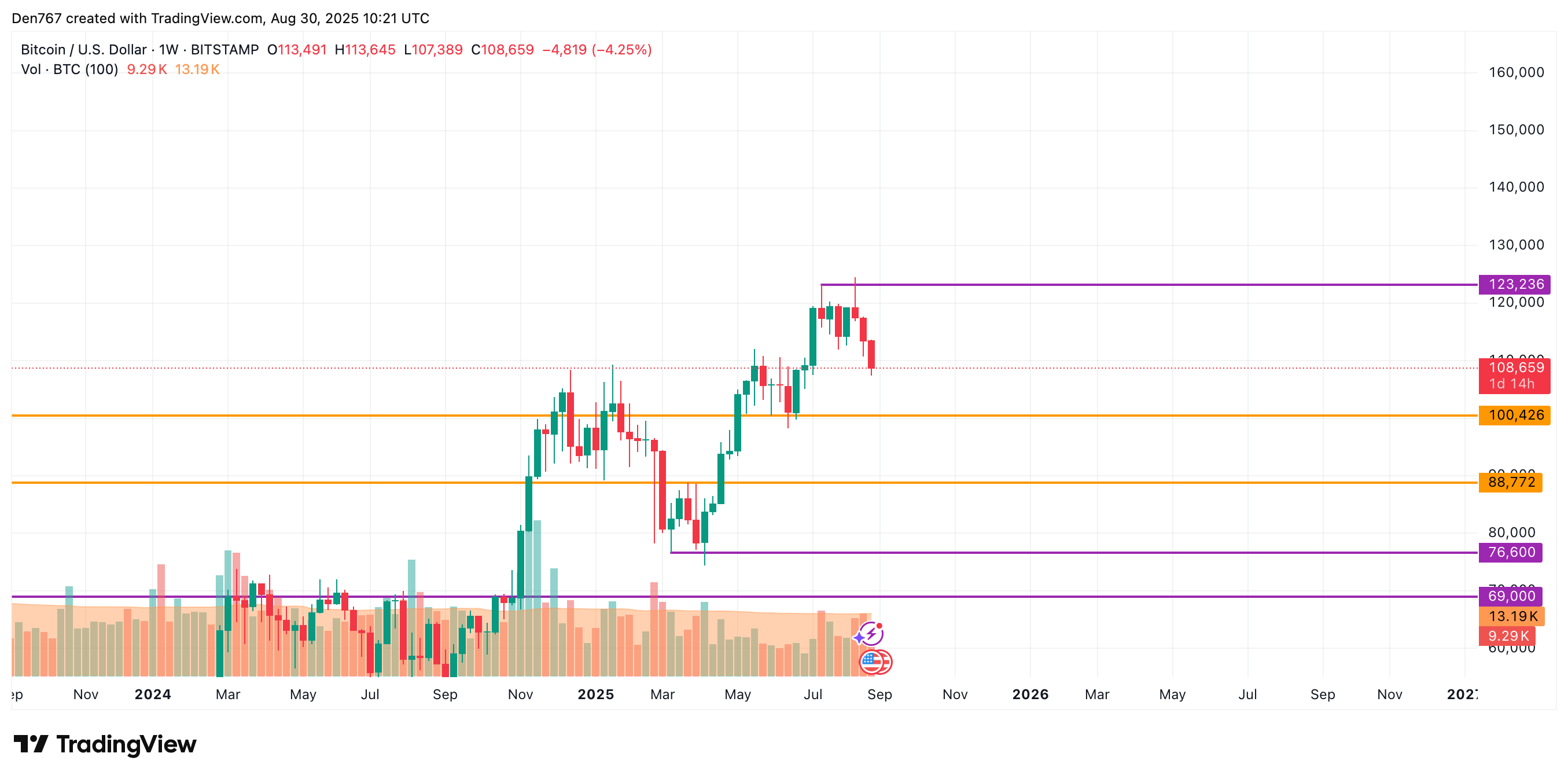

Bitcoin price analysis: Bitcoin (BTC) is trading near $108,659 and showing short-term weakness with possible sideways action between $108,000–$111,000; a decisive hourly close above $108,663 would suggest continuation toward $110,000.

-

BTC short-term range: $108,000–$111,000

-

Hourly resistance to watch: $108,663; daily structure shows false breakout risk.

-

Current price data sourced from CoinStats; chart references from TradingView.

Bitcoin price analysis: BTC trading near $108,659 with key resistance at $108,663—see levels, risks, and next targets. Read the full technical outlook.

What is the Bitcoin price analysis today?

Bitcoin price analysis indicates BTC is trading at $108,659 with short-term downward pressure but likely sideways action. A clear hourly close above $108,663 would support a push toward $110,000, while failure to hold support could bring a test of lower levels. Data: CoinStats, TradingView.

The rates of some coins are rising today while others are in the red zone, according to CoinStats.

Top coins by CoinStats

How is BTC/USD performing on hourly and daily charts?

On the hourly chart, BTC is approaching a local resistance at $108,663. If the hourly bar closes above that mark, momentum could push prices toward the $110,000 zone. TradingView chart signals show a near-term breakout scenario contingent on that hourly close.

Image by TradingView

On the daily timeframe, Bitcoin experienced a false breakout of yesterday’s bar low. That setup suggests buyers may need additional accumulation time before a sustained move higher. Risk management remains critical as daily price action lacks clear reversal confirmation.

Image by TradingView

From a midterm perspective, BTC’s rate has softened following the previous bullish daily bar. No reliable reversal signals are present, so traders should anticipate a potential test of nearby support levels.

In this case, sideways trading in the range of $108,000–$111,000 is the more likely scenario.

Image by TradingView

Bitcoin is trading at $108,659 at press time.

Why is the hourly resistance at $108,663 important?

The $108,663 level is the immediate technical barrier on the hourly chart. A successful hourly close above it would invalidate the short-term resistance and likely trigger continuation toward the next psychological zone at $110,000. Failure to close above keeps BTC range-bound and increases probability of support retests.

How should traders manage risk in the current setup?

Use tight position sizing and defined stop levels near recent swing lows. Monitor hourly closes for confirmation: 1) close above $108,663 suggests bullish continuation; 2) rejection at resistance increases odds of sideways or lower moves. Reference data from CoinStats and TradingView for live snapshots.

Frequently Asked Questions

Is Bitcoin likely to break above $110,000 soon?

Bitcoin could reach $110,000 if the hourly candle closes above $108,663. Without that confirmation, momentum is insufficient for a reliable breakout. Watch hourly and daily closes for validation.

How should long-term holders react to today’s price action?

Long-term holders should view current moves as noise unless daily structure shifts. Maintain core positions, reassess if daily closes break key support levels, and consult official exchange or charting platforms for live data.

Key Takeaways

- Range-bound bias: BTC likely trading between $108,000 and $111,000 in the short term.

- Key confirmation level: Hourly close above $108,663 signals potential move to $110,000.

- Risk management: Use defined stops and reference CoinStats/TradingView data for live conditions.

Conclusion

This Bitcoin price analysis shows a short-term neutral-to-cautious bias with a pivotal hourly resistance at $108,663. Traders should await clear hourly or daily confirmations before assuming trend direction. For continuous market snapshots, consult CoinStats and TradingView; COINOTAG will follow developments and update coverage as conditions change.