XRP's Triple-Bullish Catalysts: Why This Is the Moment to Act Before the Summer Breakout

- XRP faces a pivotal breakout threshold driven by technical momentum, institutional adoption, and real-world utility growth. - SEC's commodity reclassification unlocked $7.1B in capital, with Gumi investing $17M in XRP as a strategic reserve asset. - Ripple's ODL processed $1.3T in Q2 2025, while XRP's 5-second settlements challenge SWIFT in 110+ countries. - Technical indicators show mixed signals: MACD bullish but RSI overbought, with $3.08 as key resistance for potential $4 retest.

The XRP market is at a pivotal inflection point , driven by a convergence of technical momentum, institutional adoption, and real-world utility growth. These three catalysts—each independently compelling—now align to create a rare opportunity for investors to position ahead of a potential summer breakout.

Catalyst 1: Technical Momentum and Price Action

XRP’s price has been consolidating in a descending channel since early August 2025, with critical support levels at $2.79 and $2.58, and resistance near $3.08–$3.09 [1]. While the RSI (74.738 as of August 22) suggests overbought conditions, the MACD’s bullish crossover above the signal line indicates strengthening upward momentum [3]. Historical backtesting of this strategy—buying XRP upon a MACD Golden Cross and holding for 30 trading days—reveals an average return of 5.5% with a total return of 48.9% from 2022 to 2025, despite a significant max drawdown of 74.6%. However, the mixed signals—such as a "sell" technical rating from oscillators and a -8.73% weekly price decline—highlight the need for caution [1]. A breakout above $3.08 could trigger a retest of $3.66 and eventually $4, while a breakdown below $2.87 risks a pullback to $2.60 [1]. Whale activity, including large transactions on platforms like Upbit, further signals strategic accumulation [1].

Catalyst 2: Institutional Adoption and Regulatory Clarity

The U.S. SEC’s August 2025 ruling reclassifying XRP as a commodity in secondary markets has unlocked $7.1 billion in institutional capital and driven $25 million in ETF inflows [1]. This regulatory clarity has catalyzed major institutional moves, including Gumi Inc.’s $17 million investment in XRP as a strategic reserve asset, leveraging its $0.0004 per-transaction fee and 5-second settlement speed [2]. Ripple’s On-Demand Liquidity (ODL) service, which processed $1.3 trillion in Q2 2025, further validates XRP’s scalability in cross-border payments [3]. The synchronized ETF filings from Grayscale, Bitwise, and others could inject $5–$8 billion in capital, mirroring Bitcoin’s 2024 liquidity surge [3].

Catalyst 3: Real-World Utility and Infrastructure Growth

XRP’s utility as a functional asset is expanding rapidly. Ripple’s ODL service now operates in 110+ countries, with 300+ financial partners leveraging its cost efficiency (0.0002% fees) and speed (5-second settlements) to replace SWIFT in high-cost corridors [4]. Strategic partnerships with Santander and Standard Chartered have streamlined cross-border remittances, while Ripple’s RLUSD stablecoin processed $408 million in DeFi volume in July 2025 [3]. Analysts project XRP could capture 14% of SWIFT’s $14 trillion cross-border market by 2030, driven by its infrastructure advantages [4].

The Convergence of Forces

The interplay of these three catalysts creates a compelling case for XRP. Technically, the asset is primed for a breakout if institutional inflows and real-world adoption continue to accelerate. The SEC’s ruling has removed a critical legal overhang, enabling ETFs and futures to attract macroeconomic tailwinds. Meanwhile, XRP’s utility in cross-border payments and DeFi positions it to benefit from the broader shift toward tokenized infrastructure. Historically, a MACD Golden Cross strategy has shown an average return of 5.5% over 30 trading days, suggesting that technical momentum can translate into tangible gains when aligned with fundamental catalysts.

For investors, the key is timing. With XRP trading near $2.81–$2.83 and facing a critical decision point in its price pattern, the window to act before a summer breakout is narrowing. The combination of technical indicators, institutional capital flows, and real-world adoption metrics suggests that XRP is not just a speculative play but a foundational asset in the evolving digital financial ecosystem. Historical data from a MACD Golden Cross strategy—showing an average return of 5.5% over 30 trading days—further underscores the potential for technical momentum to drive meaningful gains when aligned with strong fundamentals.

**Source:[1] XRP at a Pivotal Breakout Threshold: Is $4 Within Reach? [3] XRP's Strategic Edge in the 2025 Scaling Wars: Why Layer 1 Matters for Institutional Adoption [https://www.bitget.com/news/detail/12560604939339]

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How to achieve ultra-high win rates on Polymarket through insiders?

The more insiders there are, the more accurate the price is, and the more reliable the information provided by the market becomes.

Singapore Implicated in Cambodia Pig-Butchering Scam, "Tax Haven" Status Questioned Again

The charges have once again drawn attention to Singapore's role in criminal activities in the Southeast Asian region.

[Long Thread] Crypto "Three Kingdoms"

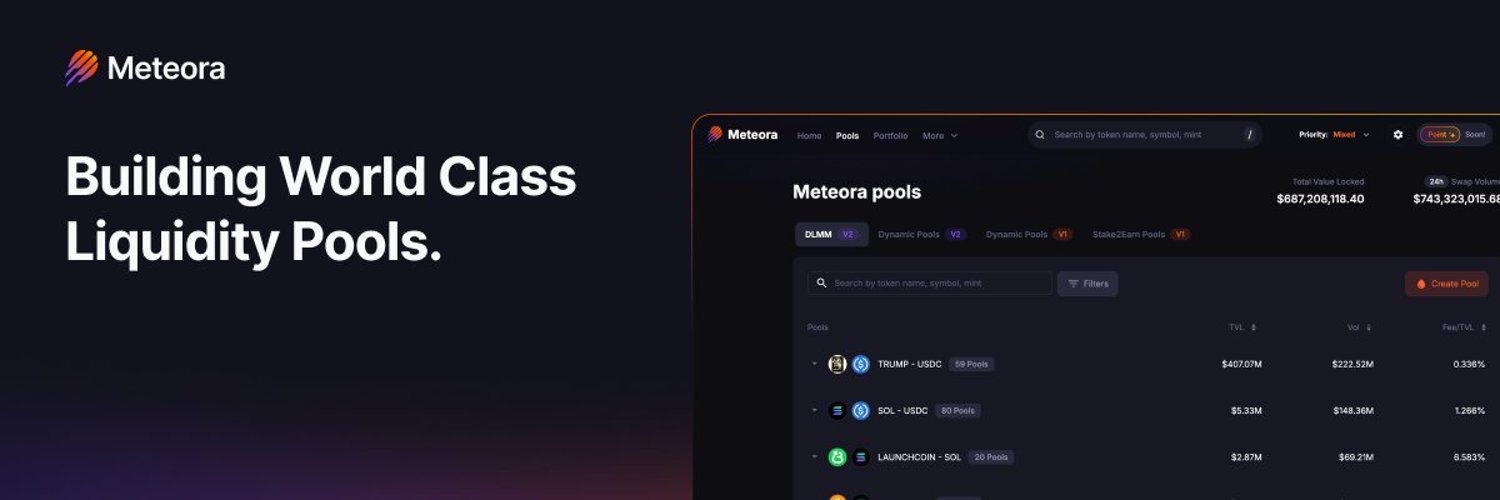

Research Report|In-Depth Analysis and Market Cap of Meteora(MET)