Bitcoin is for payments; store of value is ‘just a neat byproduct’: BitVM creator

The debate about Bitcoin as a method of payment versus a store of value is ongoing. With prices consistently above $100k, the relentless push from ETF issuers and Bitcoin treasury companies, and the inevitable institutionalization of the space, using Bitcoin for small payments seems more alien than ever.

But is Jack Dorsey right in saying that Bitcoin fails if it’s only a store of value and not used for payments?

Bitcoin as a method of payment

Bitcoin was fundamentally created as a means of payment, a real form of electronic cash for private, peer-to-peer transactions, while its store of value status appeared later as an added benefit. As BitVM creator Robin Linus states:

“Bitcoin’s purpose is payments—store of value is just a neat byproduct.”

Over time, the dominant narrative around Bitcoin has shifted heavily toward “digital gold” and institutional investment, and many influential voices, like Dorsey and Linus, argue this misses the project’s original spirit and shortchanges its long-term relevance. Linus reinforced the historical perspective, declaring:

“The cypherpunk vision was clearly electronic cash for private, peer-to-peer payments. The ‘digital asset’ narrative came later from others. Strange that this is even controversial”.

Dorsey doubled down on his statement, saying:

“I think it has to be payments for it to be relevant on the everyday, otherwise, it’s just something you kind of buy and forget and only use in emergency situations or when you want to get liquid again. So I think if it doesn’t transition to payments and find that everyday use case, it just gets increasingly irrelevant. And that’s failure to me.”

Satoshi’s words leave no doubt

Satoshi Nakamoto’s very first communications, emails, and the infamous Bitcoin whitepaper make it clear that Bitcoin is about e-cash, currency, money, and payments. His intentions for Bitcoin as a method of payment are unambiguous.

In early emails with Adam Back in 2008, Satoshi described Bitcoin as a breakthrough method for building peer-to-peer electronic currency, referencing previous digital cash projects and focusing on payments.

He wrote about proof-of-work as a way to enable currency on a distributed timestamp server, making the intent for payments crystal clear.

Changing narratives: from currency to asset

Over the years, the narrative has shifted. Institutionalization arrived in the form of ETFs, “Number Go Up” (NGU)-focused marketing, and conversations about Bitcoin as a portfolio hedge.

While bringing liquidity and broader acceptance, these changes have arguably moved the ecosystem away from solutions that benefit everyday people and real-world payment use cases; a divergence from Satoshi’s vision.

While Bitcoin’s rise as a store of value has been notorious, it has overshadowed its true foundation in private, peer-to-peer, digital payments.

Some of the project’s strongest voices, Dorsey, Linus, Swan, and even Satoshi himself, remind the community that genuine, universal utility depends on embracing Bitcoin as money in action, not just money in storage.

Bitcoin Audible host Guy Swann called for a serious public debate, tagging the likes of Dorsey and Linus, and other influential Bitcoin community members like Michael Saylor, Saifedean Ammous, and Adam Back:

“I want the best here who will bring real arguments. Not just taglines, moral posturing, and quotes from the whitepaper.”

Relegating Bitcoin to a mere store of value risks losing the original vision and utility that once set it apart. The future of Bitcoin as a method of payment depends on a community willing to challenge prevailing narratives and restore focus on payments and real-world adoption.

The post Bitcoin is for payments; store of value is ‘just a neat byproduct’: BitVM creator appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

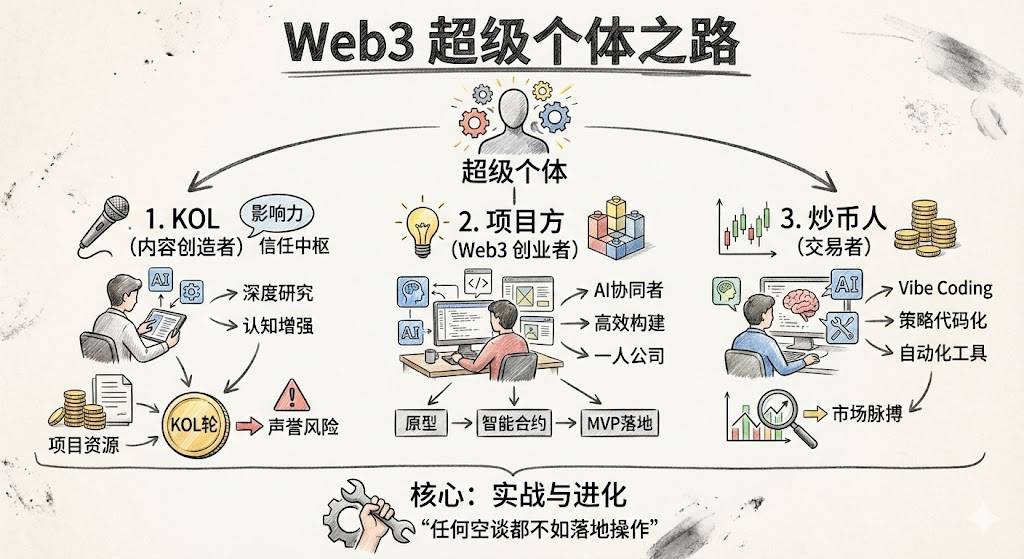

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.