Crypto treasury companies are firms that hold digital assets as corporate reserves and can add management, cybersecurity and liquidity risks to bearer assets like Bitcoin; overleveraged treasuries may trigger forced selling and deepen market downturns.

-

Bearer assets converted to corporate treasuries introduce manager, cybersecurity and cash‑flow risks.

-

Overleveraged treasury firms can amplify sell‑offs via forced liquidations, creating market contagion.

-

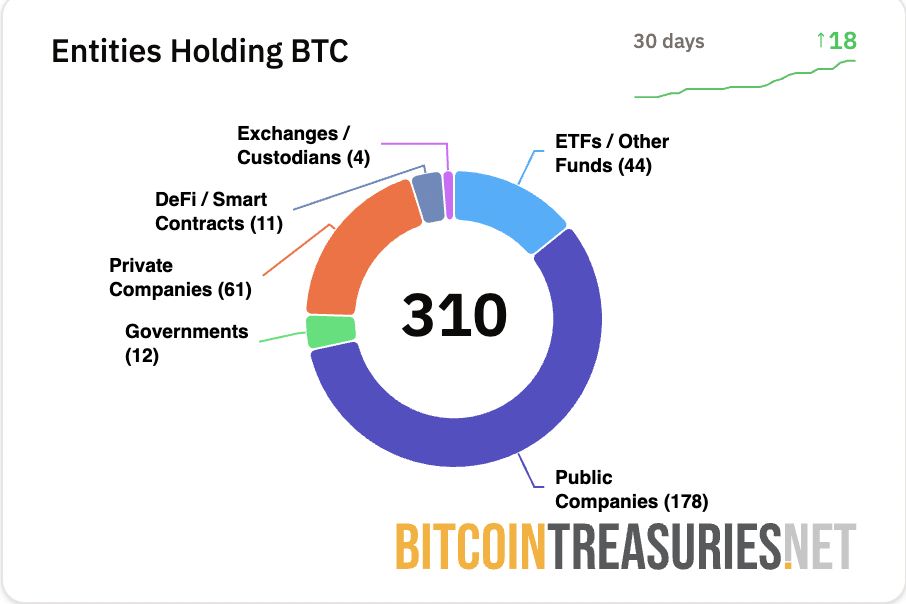

178 public companies hold BTC on balance sheets (BitcoinTreasuries), and some firms now diversify into altcoin treasuries.

Crypto treasury companies risk: management, cybersecurity and forced selling can amplify market downturns — learn mitigation steps and what investors should watch.

Crypto treasury firms introduce several layers of risk to an asset class that inherently features reduced or no counterparty risk.

What are the main risks posed by crypto treasury companies?

Crypto treasury companies convert bearer digital assets into corporate reserves and therefore add management, cybersecurity and liquidity risks to assets that otherwise carry low counterparty risk. Overleveraged firms can trigger forced selling and deepen market downturns.

Josip Rupena, CEO of lending platform Milo and former Goldman Sachs analyst, told Cointelegraph that crypto treasury companies mirror the securitization risks of past financial products such as collateralized debt obligations.

There are 178 public companies with BTC on their balance sheets. Source: BitcoinTreasuries

How do treasury engineering and corporate decisions change investor exposure?

When companies engineer bearer assets into corporate products, investors face new exposures: the competence of management, the chosen custody and cybersecurity practices, and the firm’s ability to generate cash flow to meet obligations.

Rupena explained that a sound underlying asset can be transformed by corporate structures into an opaque exposure, leaving investors uncertain of counterparty and operational risks.

Why could overleveraged treasuries exacerbate a market downturn?

Overleveraged treasury firms may be forced to liquidate digital assets to satisfy creditors or margin calls. Rapid, concentrated selling can depress prices and produce contagion across assets and firms that hold similar reserve strategies.

Market analysts have warned that a chain of forced sales could amplify volatility. Plain‑text sources referenced in reporting include BitcoinTreasuries and industry commentary published in Cointelegraph.

When are altcoin treasuries becoming common and what effect do they have?

Throughout July and August 2025, several firms announced allocations to Toncoin, XRP, Dogecoin and Solana as part of treasury diversification. Moving away from a Bitcoin‑only reserve strategy can increase portfolio volatility and raise questions about liquidity and market depth for certain tokens.

Examples show mixed market reactions: some companies saw share prices fall sharply after announcing memecoin reserves, while others experienced limited impact as markets priced in strategy and governance clarity.

How should investors and boards respond to crypto treasury strategies?

- Demand transparency: require periodic disclosure of holdings, custody, leverage and stress‑testing results.

- Assess governance: ensure board expertise and independent risk oversight for crypto exposures.

- Limit leverage: set clear borrowing limits and avoid pledging core reserves as collateral.

- Plan liquidity: maintain fiat buffers to avoid forced asset sales during market stress.

Frequently Asked Questions

Are crypto treasury companies the cause of the next bear market?

There is no definitive evidence that crypto treasury firms alone will cause the next bear market. However, overleveraged treasuries could exacerbate downturns through forced selling, increasing downside risk for the broader market.

What signals indicate a treasury firm is overleveraged?

Key signals include large off‑balance borrowing, frequent margin calls, opaque custody arrangements, sudden asset sales and rapid increases in corporate debt relative to reserves.

Key Takeaways

- Structural risk: Converting bearer assets into corporate treasuries introduces management and operational exposures.

- Market impact: Overleveraged firms can amplify sell‑offs and create contagion through forced liquidations.

- Mitigation: Strong governance, transparency, liquidity buffers and limits on leverage reduce systemic risk.

Conclusion

Crypto treasury companies present both strategic opportunities and material risks. Investors and boards must prioritize governance, disclosure and prudent leverage limits to prevent treasury strategies from amplifying market downturns. Ongoing monitoring and public disclosure will be central to reducing systemic risk and preserving investor confidence.