Key Notes

- The proposal introduces "late block" penalties to prevent miners from withholding blocks during selfish mining strategies.

- Reward Splitting would ensure orphaned blocks from honest miners still receive proportional compensation for their work.

- XMR price dropped 20% since attacks began, trading below $260 while Google searches for privacy coins hit record highs.

Monero has been suffering from what is called a selfish mining strategy, or attack, perpetrated by the Qubic Pool—led by Sergey Ivancheglo, also known as Come-from-Beyond (CFB)— as Coinspeaker has been covering . In this context, core contributors, in particular developers from the Monero Research Lab, are discussing ideas to mitigate Qubic’s strategy or prevent such attacks from happening in the future.

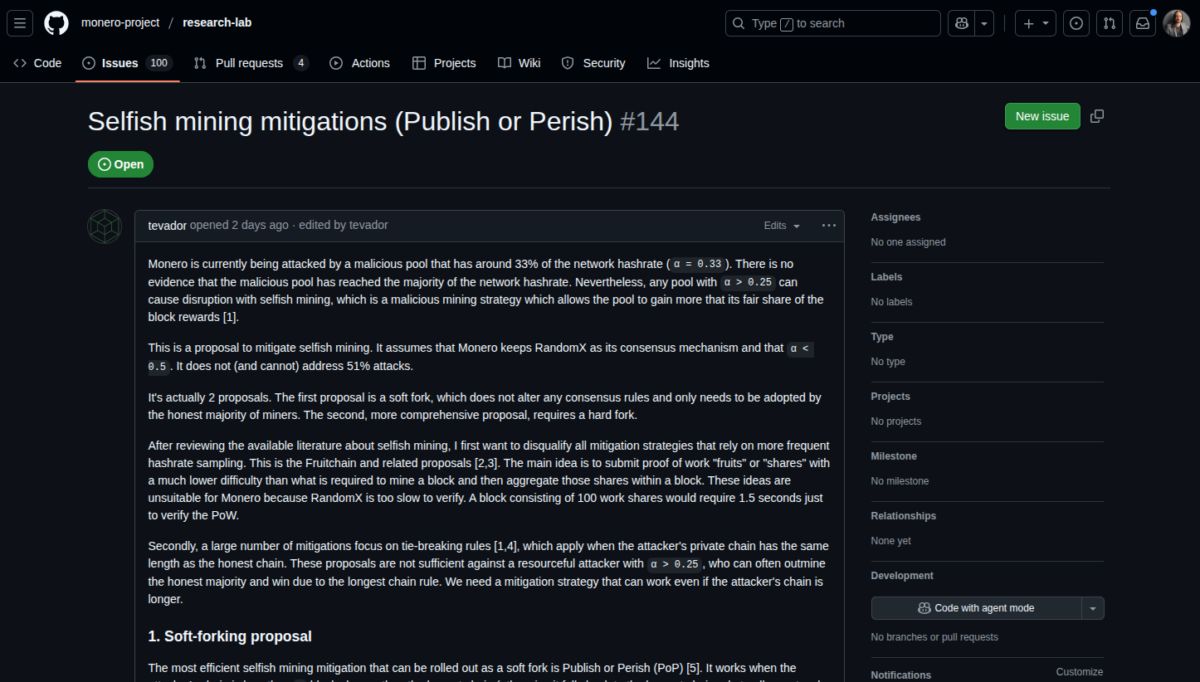

Among different ideas proposed and discussed in the past few weeks, the “Publish or Perish” proposal by tevador from August 27 is gaining popularity in different circles of Monero supporters. The proposal goes as issue #144 in the research-lab repository of the monero-project organization on GitHub, yet to be formalized as a pull request. It is based on the “Publish or Perish: A Backward-Compatible Defense Against Selfish Mining in Bitcoin” paper by Ren Zhang, published in February 2017 .

Selfish mining mitigations (Publish or Perish), issue #144 | Source: GitHub, moneroproject/research-lab

Overall, this proposal could make selfish mining unprofitable and less disruptive for attackers with less than 51% hashrate, promoting network stability. Dan Dadybayo, Research & Strategy Lead at Unstoppable Wallet, commented exclusively to Coinspeaker on the matter:

“Monero’s resilience relies not just on privacy, but on a secure and fair mining process. With a single pool now controlling around 33% of the hashrate, selfish mining becomes a real threat. Honest miners earn less, and network trust can waver,” Dan Dadybayo explained. “The new proposals, like Publish or Perish and Reward Splitting, are important steps. They make selfish mining far less profitable while protecting honest miners’ revenue. Whether through a soft fork, hard fork, or coordinated detective mining, these measures are about preserving Monero’s reliability and keeping the network robust against attacks.”

What is the Publish or Perish Proposal by Monero Research Lab

In summary, tevador’s proposal involves two separate sub-proposals, as he explains in the posted issue: (1) a soft fork, requiring a simple backward-compatible upgrade approved by “the honest majority of miners,” and (2) a hard fork, requiring higher coordination for a more complex upgrade, non-backward-compatible, that could divide the blockchain.

The soft-forking proposal, which is effectively the Publish or Perish (PoP) proposal, introduces the “late block” concept, punishing miners who take too long to broadcast a mined block. This directly addresses an important part of the selfish mining strategy, which involves mining multiple blocks in stealth mode, waiting to broadcast all of them at the same time, reorganizing (reorg) the chain, and invalidating previously mined and broadcasted blocks by competitor miners.

Here's an ELI5 on selfish mining,

the attack Qubic is currently using against Monero.👇Mom has three kids: Alice, Bob, and Carol.

Mom promises to give a candy to the kid who finishes the homework first. 🍬Alice is super fast in doing her homework.

However, she doesn't tell… pic.twitter.com/PYCC72wj5E— Vini Barbosa (@vinibarbosabr) August 26, 2025

According to tevador, this would mitigate smaller attempts from a malicious entity with less than 51% of the network’s hashrate, requiring at least three-block-deep reorgs. However, it would still be possible, although less profitable, for Qubic to selfishly mine, as the pool has already deployed six- and nine-block-deep reorgs throughout August 2025.

The hard-forking proposal would extend the PoP proposal by adding Reward Splitting (RS) to eliminate economic incentives for selfish mining attacks unless a malicious miner can outpace the honest network by at least 20 blocks. Reward Splitting introduces several consensus changes to Monero and fundamentally alters reward distribution, affecting all miners, to promote fairness and network stability. Honest miners benefit directly, as their valid but orphaned blocks still earn a proportional share of the reward that would have been distributed only to the selfish miner at Monero’s current state.

Monero Research Lab developers discussed the proposal in an open meeting held on August 29, with transcripts now available to the public. Besides tevador’s ideas, the participants also mentioned the controversial suggestion of making Monero a hybrid chain, adding a finality layer based on proof-of-stake. One of the developers known as ACK-J expressed concerns about this approach, mentioning XMR’s early distribution “as it favored the few early adopters too greatly,” in his words.

“There’s nothing we can do about that now, but switching to PoS knowing this seems insane to me. I currently support tevador’s proposals to stay with PoW, increase fees and research creative solutions to selfish mining.”

Monero (XMR) Price Analysis

Monero XMR $257.0 24h volatility: 1.1% Market cap: $4.74 B Vol. 24h: $69.57 M was changing hands slightly below $260 per coin at the time of this writing, trading in a solid range between this level and $285 per XMR. The leading privacy coin has dropped by around 20% from its trading range in July 2025, before the selfish mining attacks started being executed—although they were already being publicly discussed, with Sergey Ivancheglo openly sharing his intentions in the name of Qubic.

The daily chart suggests a short-term downtrend for XMR against the US dollar, failing to break above the 50-day exponential moving average (1D50EMA), an important technical indicator for cryptocurrencies in general.

XMR/USD 1D price chart as of August 29, 2025 | Source: TradingView

This proposal marks an important moment for Monero as a mitigation for Qubic’s selfish mining attacks now appears closer to becoming a reality, addressing the growing uncertainty around the project. Positive signals could provide the needed strength for the XMR price to recover, while further disruptions could cause the opposite.

The momentum could be favorable for Monero as Google searches for “privacy coins” have reached an all-time high in recent days, as Coinspeaker reported earlier.