Metaplanet, Japan’s largest Bitcoin treasury firm, bought 1,009 BTC to bring its holdings to 20,000 BTC, funding the move in part by issuing new shares and using proceeds to redeem bonds — a strategic step that strengthens its crypto balance sheet while raising questions about share dilution and liquidity.

-

Metaplanet acquired 1,009 BTC, reaching 20,000 BTC in total holdings.

-

Purchase cost ~16.479 billion yen (~$112M); average price paid ~$102,607 per BTC.

-

Proceeds from recent share issuance used partly to redeem ~¥2.97 billion (~$20.4M) of bonds.

Metaplanet Bitcoin treasury: Metaplanet bought 1,009 BTC to reach 20,000 BTC while issuing new shares; read the financial implications and next steps for investors.

Metaplanet, Japan’s largest Bitcoin treasury firm, bought 1,009 BTC to reach 20,000 BTC in holdings while issuing millions of new shares.

Japan’s top Bitcoin treasury firm, Metaplanet, acquired 1,009 BTC, bringing its total holdings to 20,000 BTC while the company issued millions of new shares to shore up liquidity and refinance debt.

What did Metaplanet buy and at what cost?

Metaplanet acquired 1,009 BTC for a total of 16.479 billion yen (nearly $112 million). The firm’s reported average purchase price was approximately $102,607 per Bitcoin, representing about a 6.75% realized gain relative to Bitcoin’s market price at the time of the announcement.

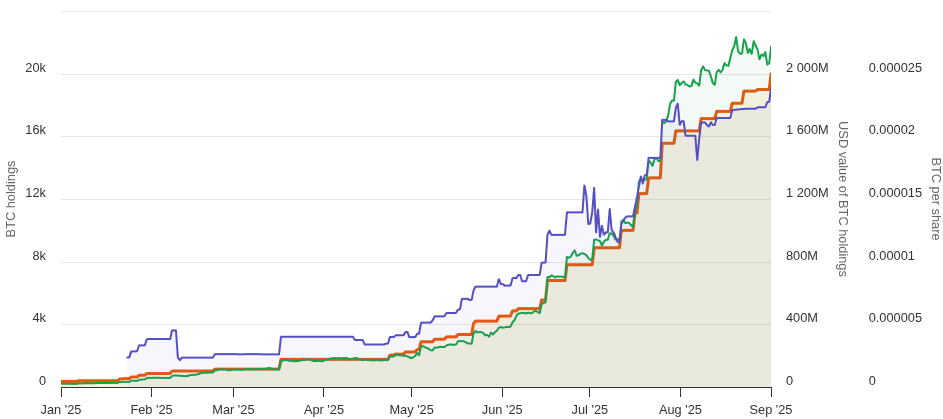

Metaplanet’s Bitcoin holdings chart. Source: Bitcointreasuries.net

How did Metaplanet finance the purchase?

Metaplanet financed part of its activities through equity issuance and warrant exercises. The company announced the issuance of 11.5 million new shares after warrants were exercised by an investor identified as Evo Fund.

Evo Fund purchased 10 million shares at ¥5.67 and 1.5 million at just under ¥6, totaling about ¥8.94 billion (~$65.73 million). Metaplanet used a portion of those proceeds to finance the early redemption of approximately ¥2.97 billion (~$20.4 million) of previously issued bonds.

Source: Metaplanet

What is Evo Fund’s remaining position?

Evo Fund retains rights to an additional 34.5 million shares under existing agreements. That residual exposure could supply further capital to Metaplanet if exercised, but it also implies potential future dilution for current shareholders.

Why is Metaplanet facing market pressure?

Metaplanet’s share price has plunged roughly 54% since mid-June, compressing the firm’s equity-based fundraising capacity. Falling share prices reduce the attractiveness of warrant exercises and limit access to capital, making it harder to fund additional Bitcoin acquisitions without incurring dilution.

Analysts note that this dynamic can create a feedback loop: lower stock prices can constrain funding, which can slow or halt treasury accumulation, in turn affecting investor sentiment.

Are Bitcoin treasuries a safe long-term strategy?

Bitcoin treasuries are a high-conviction corporate strategy that can preserve upside exposure to BTC, but they are not without risk. Companies using equity and debt to buy BTC face margin and liquidity pressure if stock prices fall or if Bitcoin volatility triggers loan covenants.

History shows several treasury-centric firms faced severe stress when funding channels dried up. Firms can become forced sellers under margin calls or loan term triggers, which can crystallize losses for shareholders.

Which data sources inform this analysis?

Reported metrics in this article are drawn from Metaplanet’s corporate announcement and aggregated custody/treasury data compiled by BitcoinTreasuries.net. These sources are mentioned here as plain text for verification and transparency.

When did these events occur?

Metaplanet announced the 1,009 BTC purchase and the issuance of new shares in a corporate release dated Monday of the current reporting period. The firm also disclosed plans to raise capital via public offerings in overseas markets and to seek shareholder approval for additional preferred share issuance.

Summary table: Metaplanet key transaction metrics

| Total BTC after purchase | 20,000 BTC |

| BTC purchased | 1,009 BTC |

| Purchase cost | ¥16.479 billion (~$112M) |

| Average price per BTC | $102,607 |

| Share issuance (recent) | 11.5 million new shares |

| Evo Fund cash in | ~¥8.94 billion (~$65.73M) |

| Bonds redeemed | ~¥2.97 billion (~$20.4M) |

Frequently Asked Questions

How many Bitcoins does Metaplanet now hold?

Metaplanet holds 20,000 BTC after the latest purchase of 1,009 BTC, according to the company announcement and aggregated treasury data.

Will the share issuance dilute existing shareholders?

Yes. Issuing new shares and potential exercises of warrants increase share count and can dilute existing equity, although the capital raised was used to reduce bond liabilities and support treasury operations.

Could Metaplanet be forced to sell Bitcoin?

If funding channels narrow or lenders demand collateral under margin or covenant provisions, Metaplanet could face circumstances that pressure asset sales. That risk is inherent where leverage and liquidity constraints exist.

Key Takeaways

- Acquisition scale: Metaplanet now holds 20,000 BTC after buying 1,009 BTC.

- Funding mix: Recent warrant exercises and share issuance funded bond redemptions and treasury activity.

- Risk profile: Falling share prices and potential dilution raise liquidity and execution risks for future BTC accumulation.

Conclusion

Metaplanet’s latest purchase underscores the continuing appeal of corporate Bitcoin treasuries but also highlights execution risks tied to equity markets and funding structures. Investors should weigh Metaplanet’s enlarged BTC position against dilution and liquidity dynamics as the firm pursues further capital raises.