3 Altcoins at Risk of Major Liquidations in the First Week of September

Several altcoins entered September with imbalances on their liquidation maps, highlighting a clear gap between bullish and bearish sentiment. These conditions create a favorable setup for large-scale liquidations. The following are three altcoins at risk of liquidations in the first week of September, based on liquidation data and the latest news likely to influence their … <a href="https://beincrypto.com/altcoins-at-major-liquidations-risk-first-week-september/">Continued</a>

Several altcoins entered September with imbalances on their liquidation maps, highlighting a clear gap between bullish and bearish sentiment. These conditions create a favorable setup for large-scale liquidations.

The following are three altcoins at risk of liquidations in the first week of September, based on liquidation data and the latest news likely to influence their price movements.

1. Ethereum (ETH)

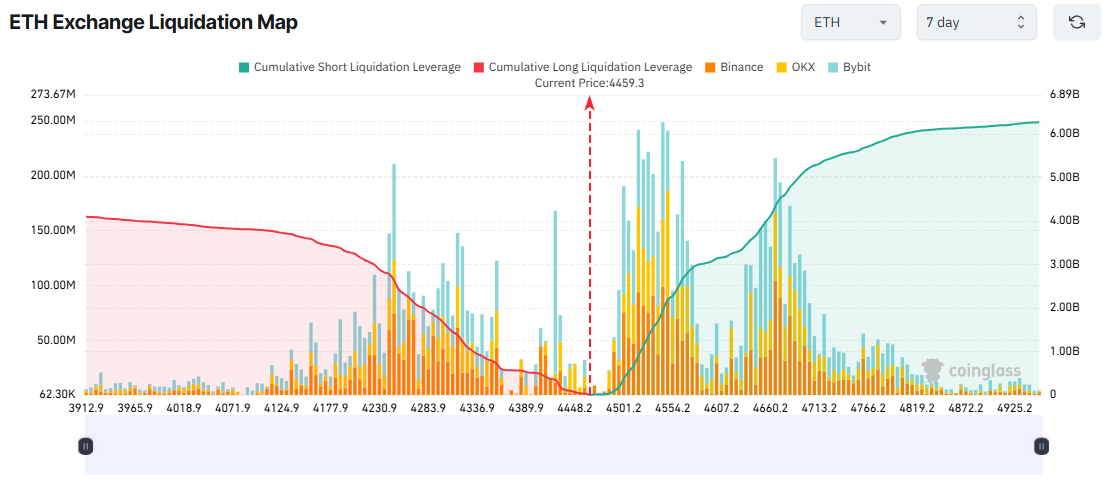

Ethereum’s 7-day liquidation map shows a major imbalance. If ETH rises to $4,925 this week, accumulated short liquidations could exceed $6 billion.

On the other hand, if ETH falls below $4,000, long positions worth about $3.96 billion would be liquidated.

ETH Exchange Liquidation Map. Source:

Coinglass

ETH Exchange Liquidation Map. Source:

Coinglass

Data indicates that short-term traders are leaning toward shorting Ethereum this week. They placed larger bets and used higher leverage on short positions.

However, they may face setbacks. On-chain data from the first day of September shows large whale transactions selling BTC to buy ETH.

Lookonchain reported that Bitcoin whale wallets continuously sold BTC to purchase more than $4 billion worth of ETH.

This Bitcoin OG has sold another 2,000 $BTC($215M) and bought 48,942 $ETH ($215M) spot over the past 4 hours.In total, he has bought 886,371 $ETH($4.07B).

— Lookonchain (@lookonchain) September 1, 2025

This whale activity of swapping BTC for ETH could affect trader sentiment. It may drive ETH’s price higher and inflict losses on short positions.

2. XRP

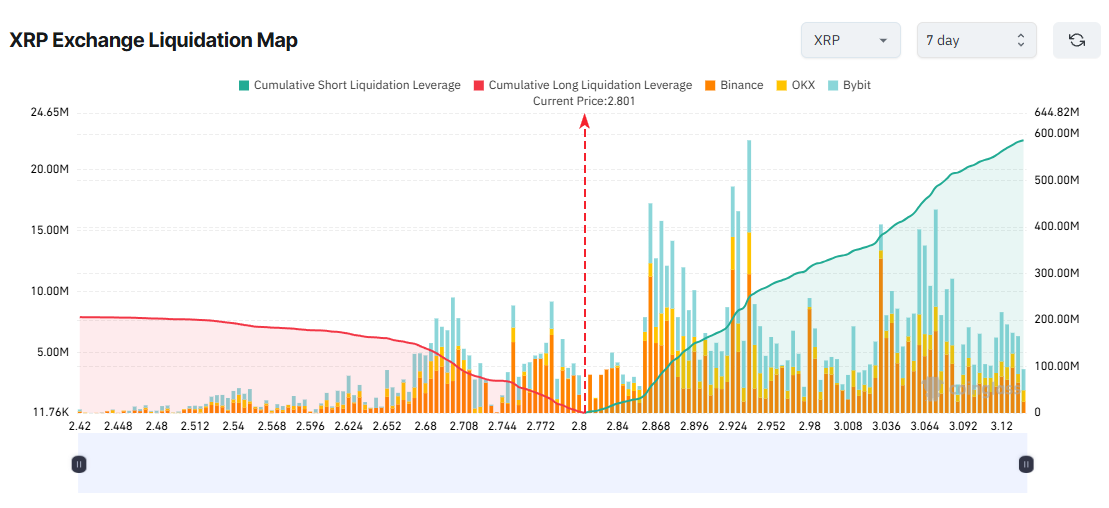

XRP’s 7-day liquidation map shows a severe imbalance. Short liquidations far outweigh long liquidations. Many short-term traders appear to be betting heavily on XRP’s decline in the first week of September.

If XRP climbs to $3, over $500 million in short positions would be liquidated. In contrast, if XRP falls to $2.42, only about $200 million in long positions would face liquidation.

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

From a technical perspective, analysts warn that the current $2.70 level acts as strong support. Prices may rebound from here, putting short positions at high risk.

In addition, 15 XRP ETF applications are still pending with the SEC. Any positive news regarding these ETFs could ignite a bullish wave among XRP investors.

3. Pyth Network (PYTH)

On August 28, the US Department of Commerce surprised crypto investors by partnering with Pyth and Chainlink to put GDP data on the blockchain. PYTH’s price doubled in one day.

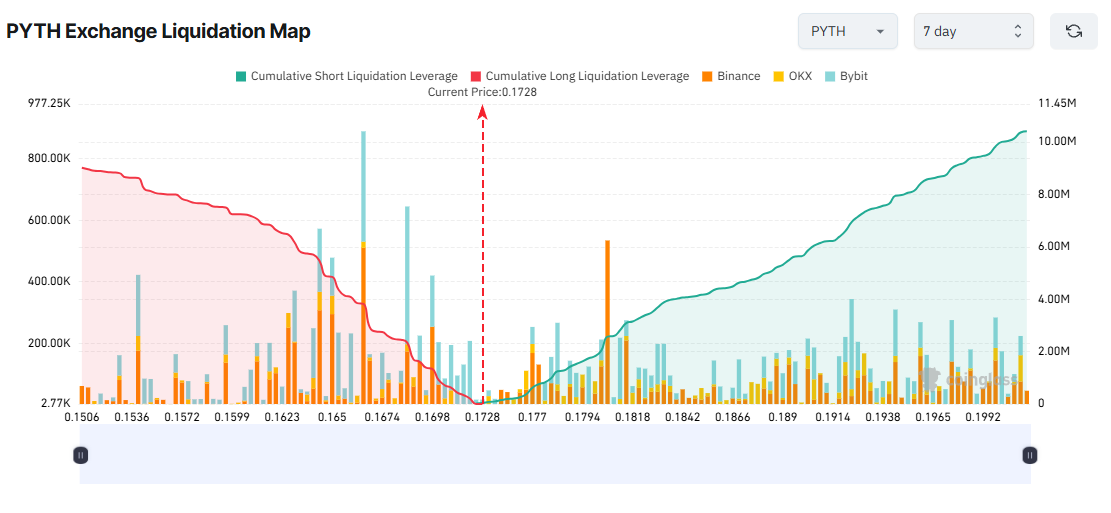

That positive sentiment appears to be spilling into September. Short-term traders are actively going long on PYTH. They risk nearly $9 million in losses if PYTH drops to $0.15 this week.

Charts show that long liquidations accelerate faster as the price declines, reflected by taller bars on the left side of the distribution.

PYTH Exchange Liquidation Map. Source:

Coinglass

PYTH Exchange Liquidation Map. Source:

Coinglass

Conversely, if PYTH rises to $2 this week, accumulated short liquidations could reach $10 million.

Good news may fuel excessive short-term euphoria. Yet it could also trigger a “sell the news” event, as early buyers take profits. If that happens, PYTH may undergo a deeper correction than long traders expect.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price gets $92K target as new buyers enter 'capitulation' mode

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.