BTC whale now holds $3.8B in ETH, in sign of ‘market maturity’

The “Bitcoin OG” that began rotating its $11.4 billion fortune to Ether

ETH$4,476in August continued buying ETH over the weekend and now holds $3.8 billion of it, onchain data shows.

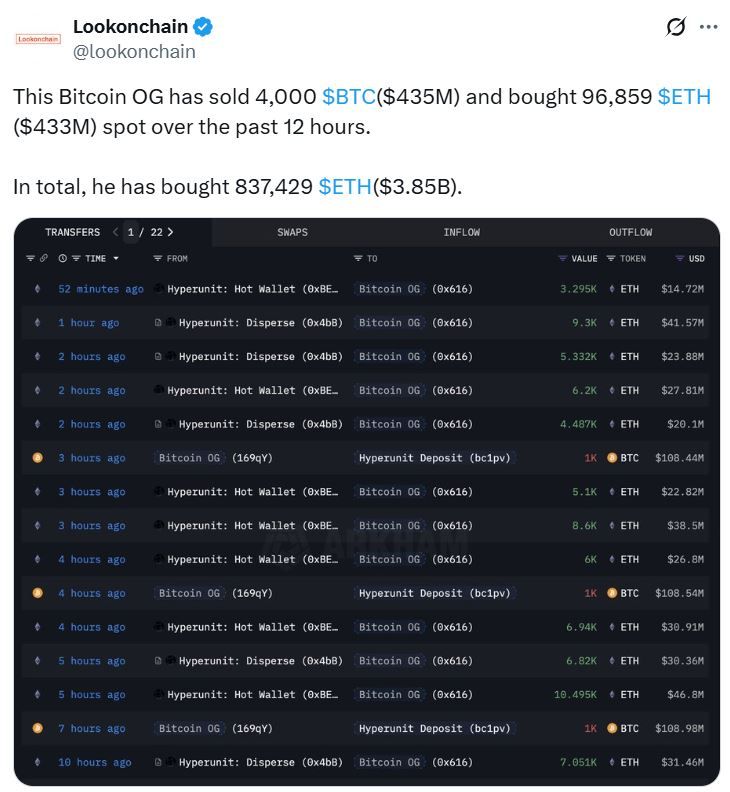

In its latest move, the Bitcoin whale sold 4,000 Bitcoin worth $435 million, exchanging it for 96,859 spot Ether over a 12-hour splurge, Lookonchain said in a post on Sunday.

The whale then deposited another 1,000 Bitcoin into decentralized exchange Hyperliquid on Monday, potentially for more Ether buying.

The blockchain analytics service first noticed the whale on Aug. 25, and calculated its total holdings at 100,784 Bitcoin, worth over $11.4 billion at current prices.

Source: Lookonchain

Source: Lookonchain

The “Bitcoin OG” joins a string of other whales who have been trading out Bitcoin and buying Ether for the first time . Analysts told Cointelegraph that it is a sign that the market is maturing and that whales are diversifying in light of positive regulatory moves in the US.

Whales diversifying as ETH momentum builds

Speaking to Cointelegraph, Henrik Andersson, chief investment officer of investment firm Apollo Crypto, said that it’s hard to know what individual whales are thinking, but historically, there has been a market rotation from Bitcoin to Ether, then to altcoins.

“After the GENIUS bill and pro-US regulations, there is more gravity behind some altcoins, especially Ethereum, and it could be some whales choosing to diversify in light of the positive backdrop,” he said.

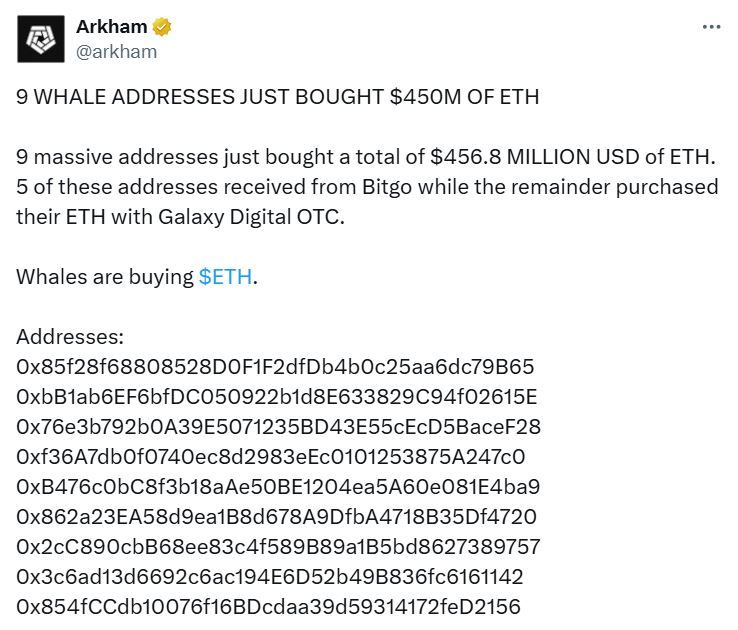

A pod of nine whale addresses bought a cumulative $456 million worth of Ether in late August. Source: Arkham

A pod of nine whale addresses bought a cumulative $456 million worth of Ether in late August. Source: Arkham

In July, President Donald Trump then signed the GENIUS Act into law . The legislation focuses on stablecoins and is the country’s first federal law focused exclusively on payment stablecoins.

Andersson said Ether has been gaining momentum since. It reached a new all-time high on Aug. 24, crossing above $4,946, according to CoinGecko. The token is now trading at $4,389, down 1.2% in the last 24 hours.

“Bitcoin has been going sideways for months while there is real momentum for Ethereum. We have seen the ETF flows in August heavily favouring Ethereum. In our view, this is likely to continue in the medium term.”

Crypto no longer a one-horse Bitcoin race

Ryan McMillin, chief investment officer of Australian crypto investment manager Merkle Tree Capital, told Cointelegraph that although long-standing Bitcoin holders are diversifying into Ether, it’s not an abandonment of the token; instead, it’s recognition that the crypto landscape has matured.

“After years of holding, many OG whales view Bitcoin as digital gold while Ether offers yield via staking, and exposure to the broader smart contract economy,” he said.

“For Bitcoin veterans, allocating into Ether is less about chasing hype and more about acknowledging that digital assets are no longer just about storing value, but a multi-protocol ecosystem with a diverse and growing use case set.”

However, McMillin said not every OG whale is rotating out; most are keeping their Bitcoin exposure intact. It’s just this subset that’s signaling that Ether has become a core holding rather than a speculative side bet.

At the same time, he speculates other altcoins could see some inflows from Bitcoin whales as well, with the timing hinting at a “classic altseason rotation,” when Bitcoin is strong and some capital “naturally flows into ETH as investors look for relative value.”

“If the ETH rotation gathers momentum, it wouldn’t be surprising to see flows extend into SolanaSOL$203.60next, given its traction in consumer apps and DeFi.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Faces Deadline for Grayscale XRP ETF Decision

Ethereum Bulls Remain Unfazed: Analyzing Market Confidence After $232 Million Liquidation

Ethereum’s price is fluctuating around $3,700, influenced by US credit and labor data, with traders cautiously avoiding high leverage. Whale activity indicates limited bearish sentiment, but there is insufficient confidence in a rapid rebound. No warning signals have been observed in the derivatives market, and a recovery will require clearer macroeconomic signals. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

BNY Mellon Empowers Crypto Ecosystem with Robust Infrastructure

In Brief BNY Mellon enhances its crypto ecosystem role through infrastructure services, not its own coin. The bank supports stablecoin projects instead of launching an altcoin amid positive market conditions. BNY Mellon prioritizes infrastructure over token issuance, promoting collaboration and ecosystem strength.

Crypto Surge Revives Investor Optimism

In Brief The crypto market exhibits signs of recovery post-major liquidations. Ethereum, Dogecoin, Cardano, and XRP have shown significant gains. Technological innovations and ETF expectations contribute to market optimism.