Ethereum outperformance in August was clear: ETH surged roughly 18.8% while Bitcoin fell about 6.5%, driven by a reclaim of the 0.04 ETH/BTC resistance and smart-money rotation. This structural divergence boosts the probability of a September continuation, with ETH targets near $5,700 if momentum persists.

-

ETH surged +18.78% in August vs BTC’s -6.49%.

-

ETH/BTC reclaimed the 0.04 level, signaling a rotation into Ethereum.

-

ETH’s August ROI outpaced BTC by ~3×, suggesting a potential September setup toward $5,700.

Meta description: Ethereum outperformance: ETH surged ~18.8% in August as BTC dropped 6.5%, reclaiming 0.04 ETH/BTC resistance. Read analysis and September outlook.

What was the scale of Ethereum’s August outperformance?

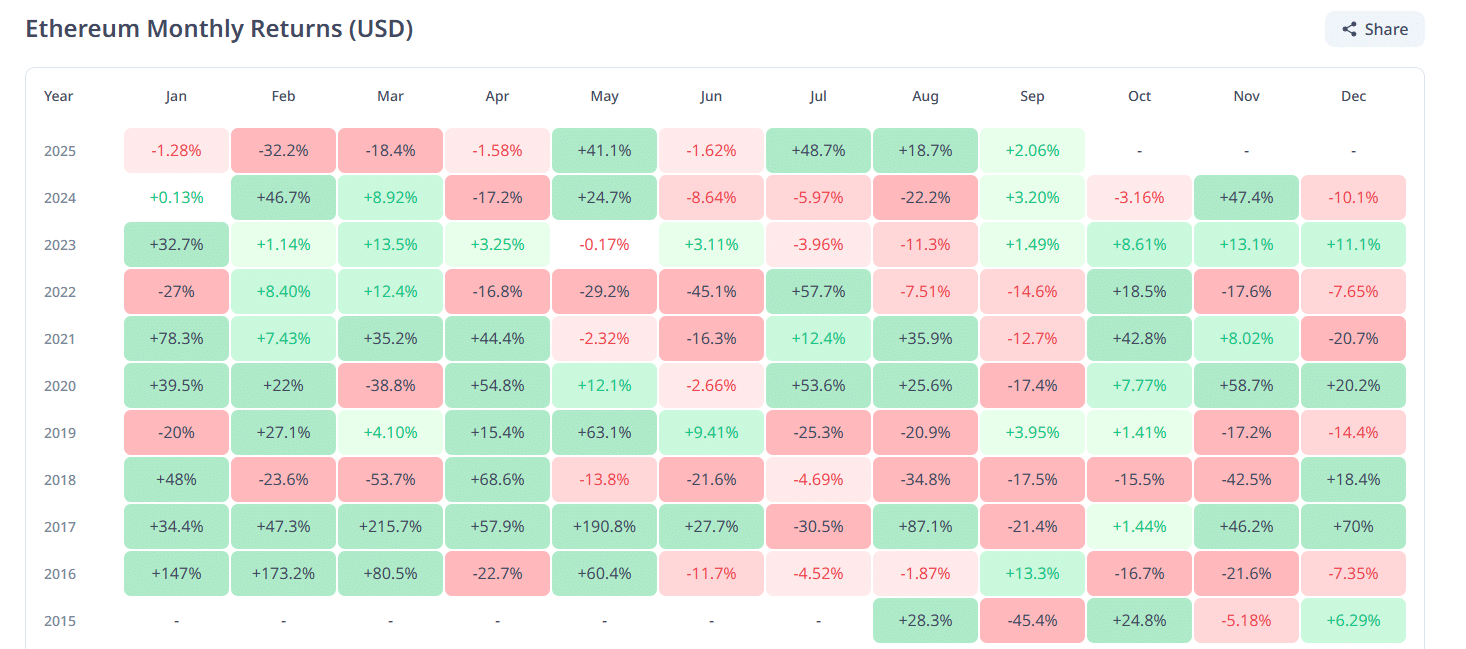

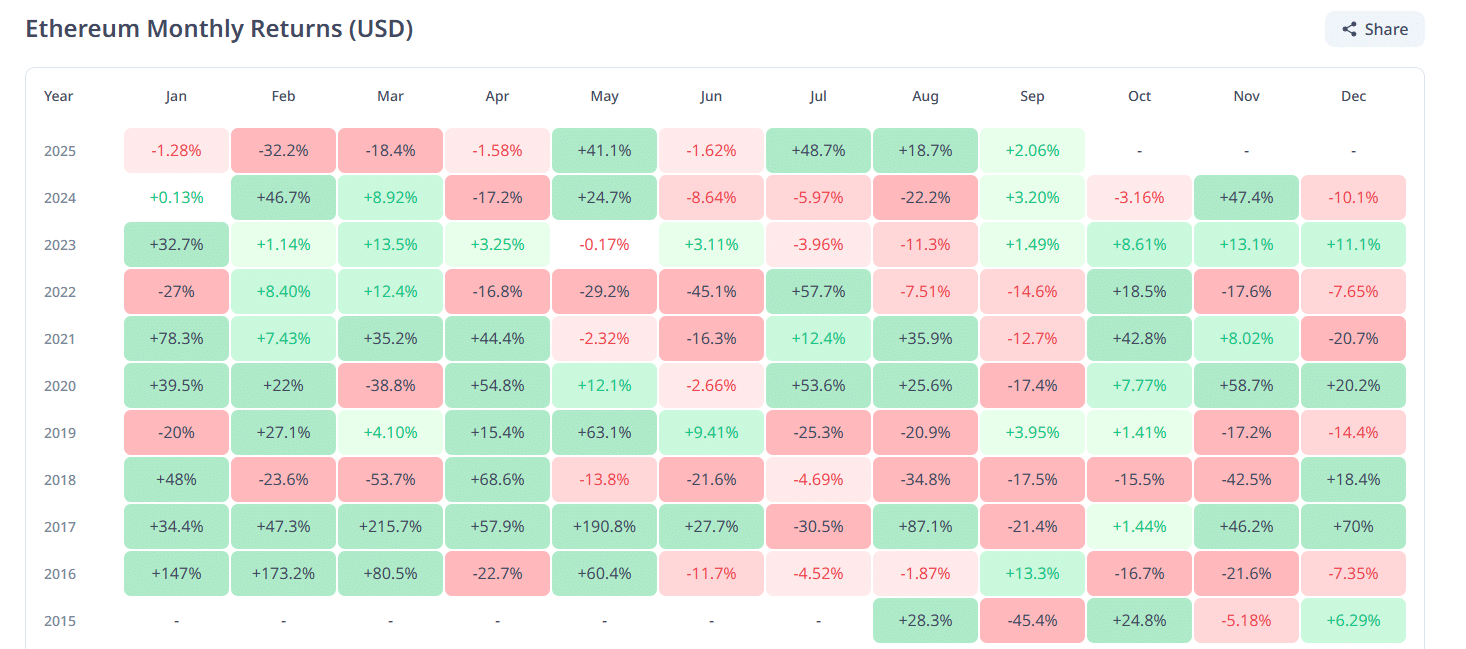

Ethereum outperformance was pronounced in August: ETH rose about 18.78% while Bitcoin slipped ~6.49%, producing one of the clearest monthly divergences in recent years. The move was driven by smart-money rotation, improved ETH/BTC momentum and stronger month-on-month ROI for Ethereum.

How did the ETH vs BTC dynamics change in August?

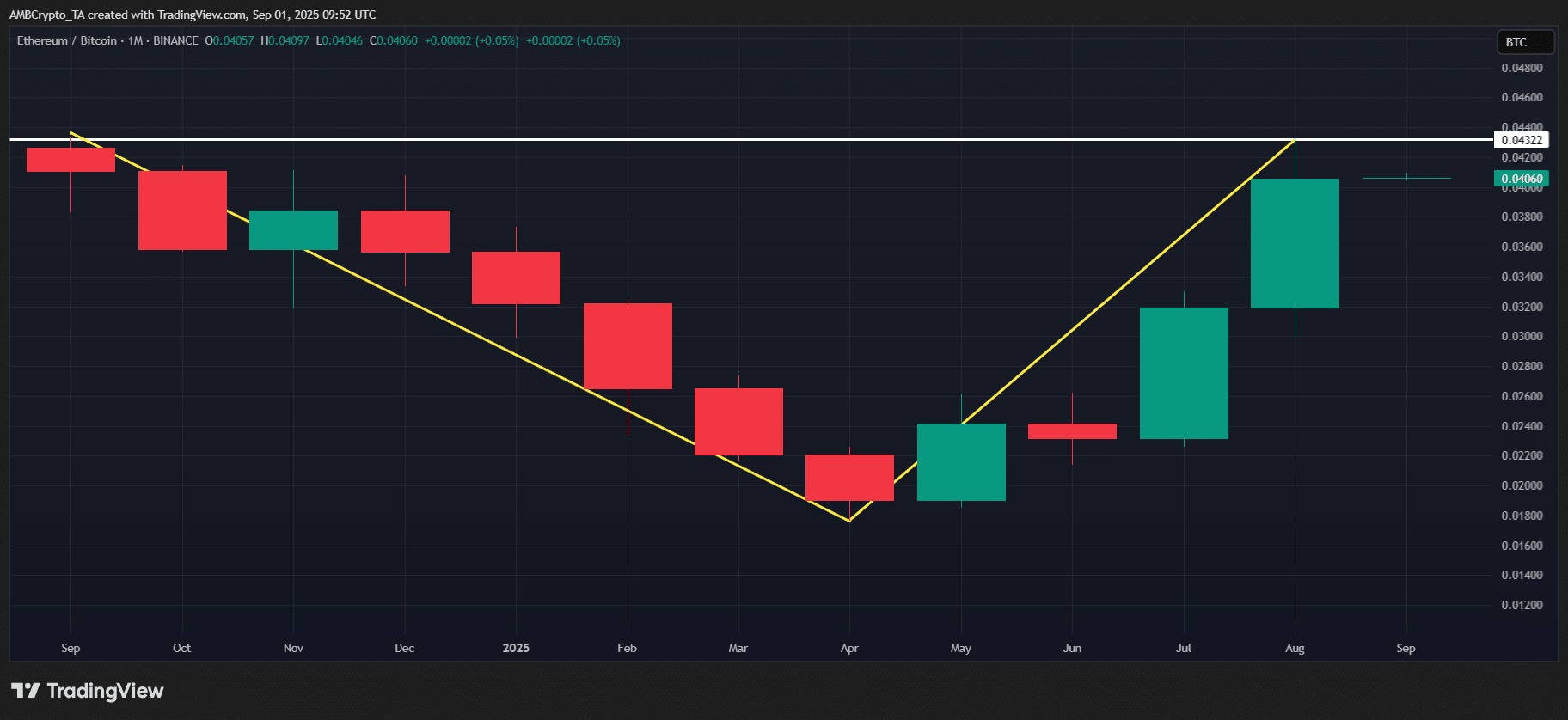

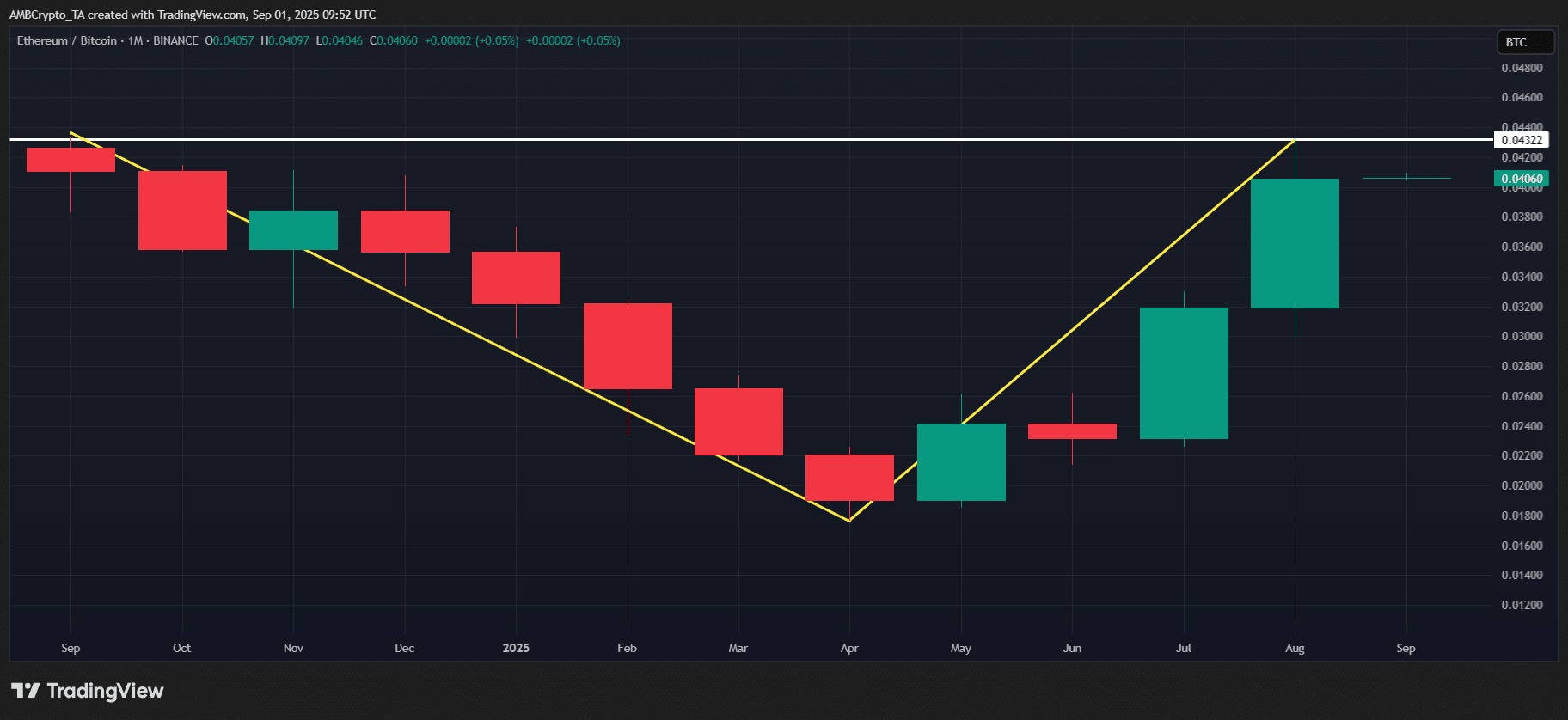

August marked a decisive change in ETH vs BTC dynamics. The ETH/BTC ratio closed the month up roughly 27.05% from its 0.031 open and reclaimed the 0.04 resistance for the first time since election month. That reclaim reinforced a clear structural divergence, separating ETH price action from Bitcoin’s recent weakness.

Ethereum’s August run reversed a recent pattern: between 2022–2024 ETH averaged larger drawdowns but this year ETH managed a breakout while BTC lagged. The net effect: ETH’s first convincing monthly divergence in years, confirmed by on-chain flows and trading desks noting capital rotation into Ethereum products.

Source: CryptoRank

How did the ETH/BTC ratio drive Ethereum’s momentum?

The ETH/BTC ratio’s move was central. Reclaiming the 0.04 resistance turned a key technical level into support and suggested relative strength for Ethereum. When the ratio advances, capital historically redistributes into ETH-denominated trades and derivatives, amplifying ETH’s USD upside even if BTC remains flat or weak.

Source: TradingView (ETH/BTC)

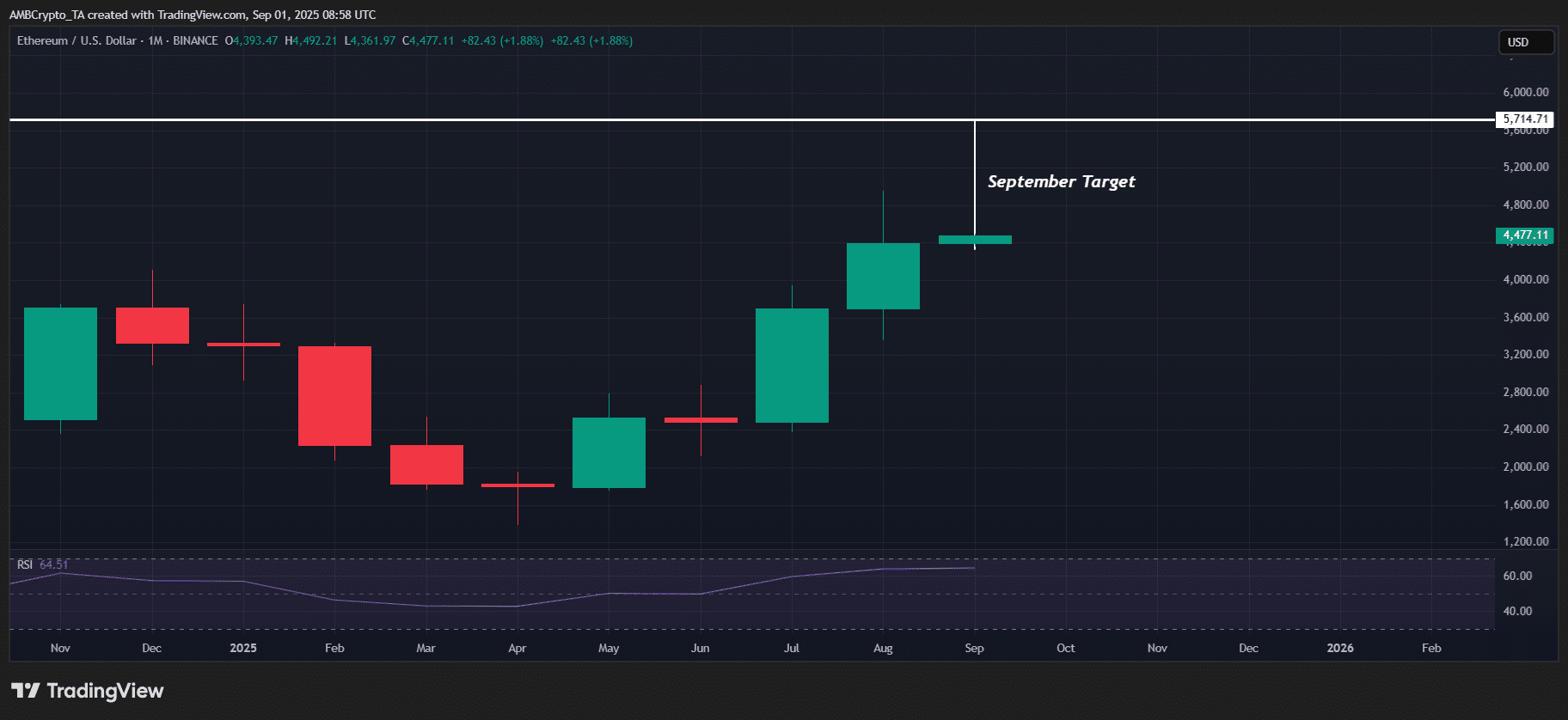

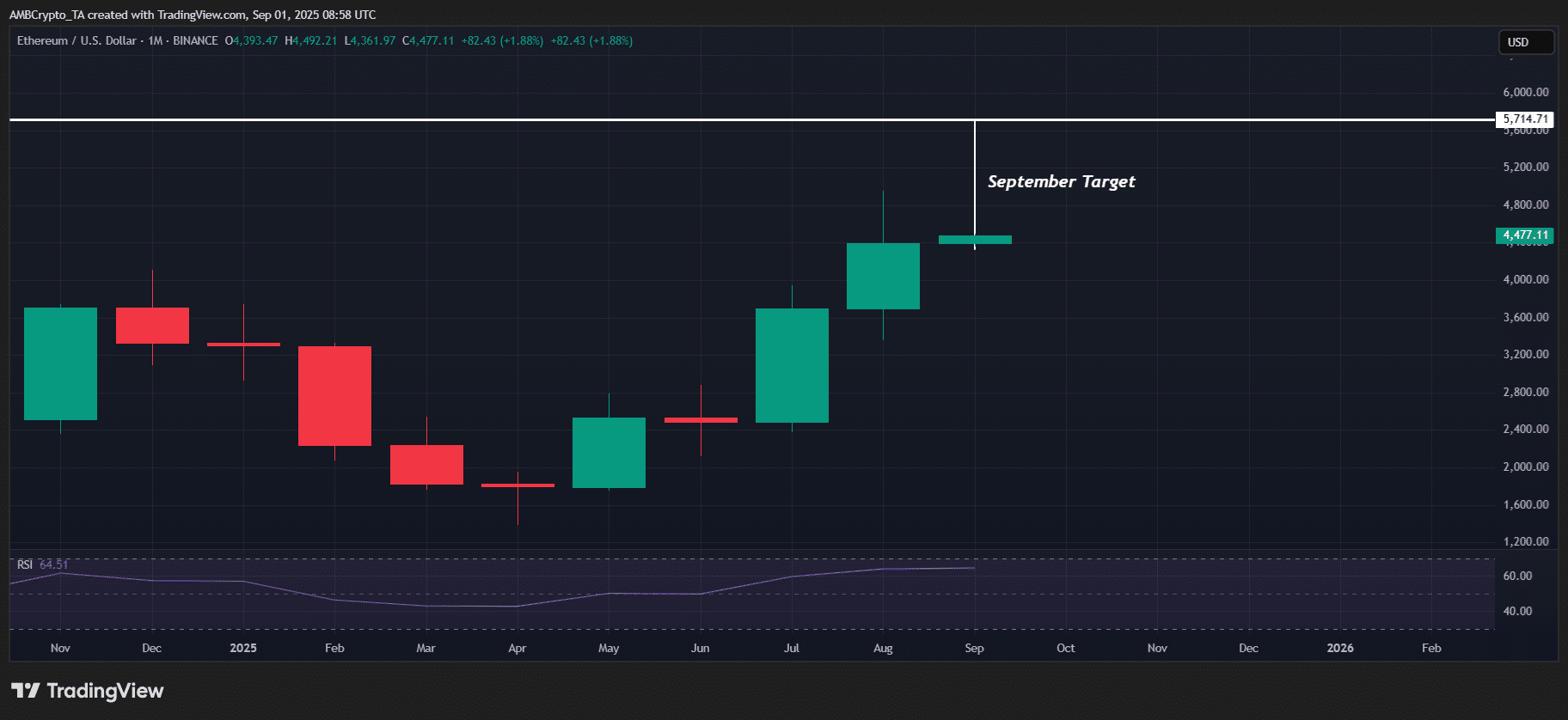

When could this divergence turn into a broader September rally?

If liquidity continues rotating into Ethereum, a repeat of August-style relative performance is plausible. Scenario analysis: if Bitcoin posts a +10% move while ETH maintains a 3× relative outperformance, ETH could test around $5,700. Key drivers to watch are continued ETH/BTC ratio strength, inflows into ETH derivatives and on-chain indicators that show smart-money accumulation.

Source: TradingView (ETH/USDT)

Frequently Asked Questions

Why did ETH outperform BTC in August?

ETH outperformed due to a combination of smart-money rotation into Ethereum, the ETH/BTC ratio reclaiming key resistance at 0.04, and stronger monthly ROI for ETH. Technical reclaim plus flows created a momentum divergence that favored Ethereum.

Is the ETH/BTC reclaim a long-term bullish signal?

Reclaiming 0.04 is bullish from a relative-strength perspective, but long-term confirmation requires sustained ratio support and continued inflows into ETH products. Monitor on-chain metrics and derivatives positioning for confirmation.

What would push ETH toward $5,700 in September?

A scenario where BTC gains ~10% while ETH holds a 3× relative outperformance would place ETH near $5,700. The move depends on continued rotation, ratio strength and Smart Money accumulation in ETH markets.

Key Takeaways

- August divergence: ETH rose ~18.8% while BTC fell ~6.5%, marking a clear monthly split.

- ETH/BTC momentum: Reclaim of 0.04 turned resistance into support and drove relative strength.

- September setup: If rotation continues, ETH could extend gains toward ~$5,700 under a 3× relative-outperformance scenario.

Conclusion

Ethereum’s August surge and the ETH/BTC ratio reclaim highlight a meaningful rotation of liquidity into ETH. With smart-money flows and technical confirmation, the divergence increases the odds of a September continuation. Readers should watch ratio support, on-chain inflows and derivatives positioning as the next validation points. COINOTAG will monitor updates and publish follow-up analysis.