Is HBAR Price Rebound on the Cards as Bears Lose Grip?

HBAR price is flashing early rebound signals. While the daily chart still looks fragile, dip buying and a hidden divergence hint that bears may be losing control.

HBAR price has shown signs of life, rising 2.6% in the past 24 hours to trade near $0.219. Despite this short-term bounce, the token is still down about 7% on the monthly chart. Yet over the past year, HBAR has gained more than 330%, proving the broader trend remains bullish.

The daily structure still looks fragile, but multiple indicators — from dip-buying signals to momentum shifts — suggest bears could be losing their grip.

Early Buying Signals Emerge on the 4-Hour Chart

On the 4-hour chart, the Money Flow Index (MFI) — which tracks inflows and outflows of capital — has been trending higher, even printing higher highs while the HBAR price kept falling. This hasn’t appeared on the daily chart yet because short-term dip-buying usually registers first on lower timeframes.

HBAR Dips Are Being Bought:

TradingView

HBAR Dips Are Being Bought:

TradingView

The significance: it hints that capital rotation into HBAR has already started. A move above 35.90 (previous high) on the MFI could confirm this accumulation-led bullishness

HBAR Bears Losing Grip:

TradingView

HBAR Bears Losing Grip:

TradingView

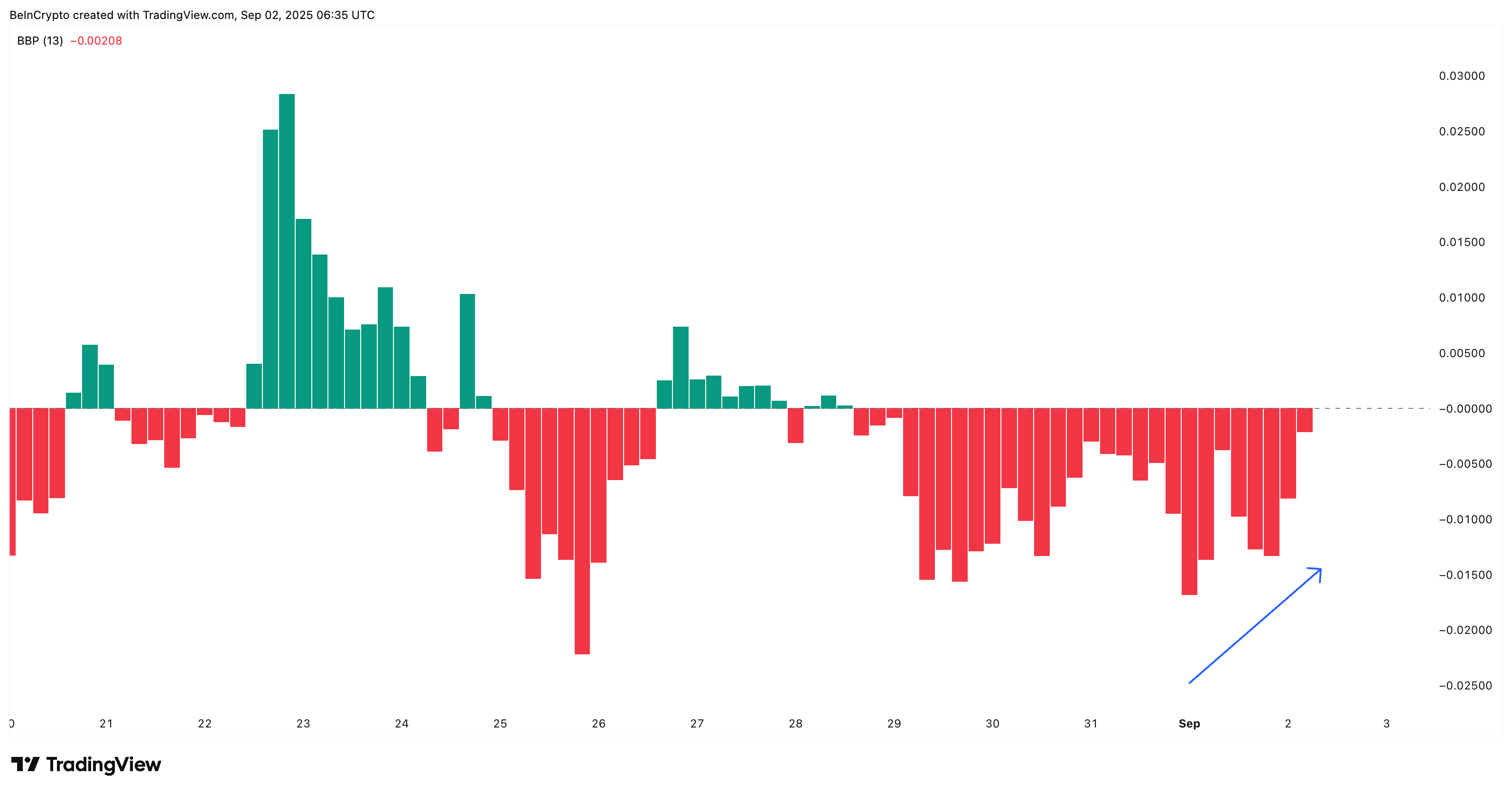

At the same time, Bull–Bear Power (BBP), which measures buyer vs seller strength, has been declining since September 1. That means bearish dominance is fading, while dip buying continues.

Together, these 4-hour signals suggest that while HBAR price is not out of the woods yet, the tide may be turning.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Daily HBAR Price Chart Divergence Could Spark a Rebound

On the daily chart, the HBAR price remains within a descending triangle, with Fibonacci retracement levels serving as markers. The critical support sits at $0.210 — losing it could open the door to $0.187. On the upside, reclaiming $0.235–$0.249 would be the first clear sign that bearish control is being invalidated.

And there is some validation for this optimism.

HBAR Price Analysis:

TradingView

HBAR Price Analysis:

TradingView

Between July 13 and September 2, HBAR price formed a higher low, while the Relative Strength Index (RSI) — which tracks momentum — carved a lower low.

This is a hidden bullish divergence, often signaling continuation of the broader trend. Considering HBAR’s 330% yearly gains, it aligns with the idea that the bigger picture remains intact, even if near-term pressures linger.

If buyers defend $0.210 and reclaim $0.235–$0.249, this divergence could be the spark for a sustained rebound and even a rally if the broader market conditions align.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!