Bitcoin Faces Triple ‘Death Cross’ Warning Amid Historically Weak September

September brings heightened caution for Bitcoin as analysts warn of three death crosses across key indicators. While past patterns hint at volatility, ETF stability and the Fed’s rate cut decision may offset bearish risks.

September has historically been Bitcoin’s weakest month. Adding to the concern, analysts point out that rare death cross signals have just appeared across major timeframes.

A death cross occurs when a short-term moving average or indicator falls below a longer-term one. It often signals the start of a bearish trend. While these signals do not guarantee a market downturn, they tend to make traders and investors more cautious.

First Death Cross: MVRV Ratio

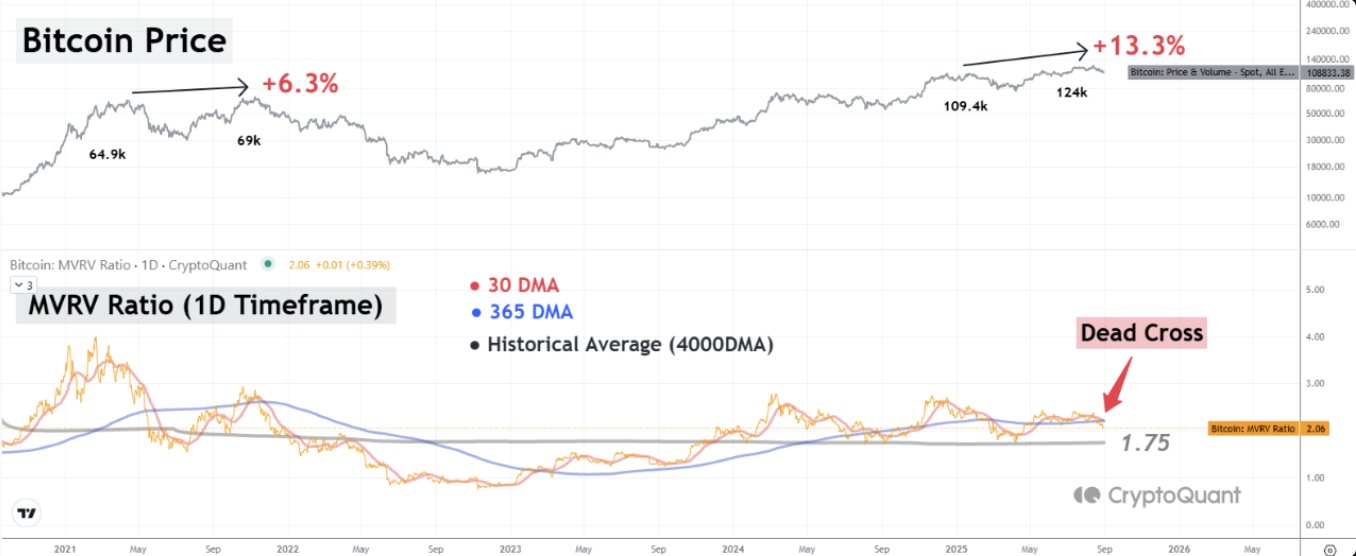

The first warning comes from the Market Value to Realized Value (MVRV) ratio, which pseudonymous analyst Yonsei_dent explained.

MVRV is an on-chain metric that compares Bitcoin’s market capitalization with its realized value — the average price at which coins last moved. A high ratio indicates potential overvaluation, while a low ratio suggests undervaluation.

Bitcoin Price & MVRV Ratio. Source:

Bitcoin Price & MVRV Ratio. Source:

In a recent CryptoQuant post, Yonsei_dent noted that MVRV has just formed a death cross. The 30-day moving average fell below the 365-day average.

Historically, such crossovers have preceded corrections. They show that short-term enthusiasm is fading relative to the long-term trend. For instance, MVRV death crosses in 2022 coincided with major pullbacks during the bear market.

“This doesn’t necessarily mean the same outcome is coming — Bitcoin ETFs have introduced more structural stability to the market. But history doesn’t repeat, it rhymes — and the signals from MVRV deserve attention,” Yonsei_dent said.

Second Death Cross: Weekly MACD

The second signal comes from Bitcoin’s weekly MACD indicator.

MACD measures momentum by tracking the difference between exponential moving averages (EMAs). A death cross occurs when the MACD line drops below the signal line. This usually indicates weakening buying pressure and downside risk.

Bitcoin Price & MACD Indicator. Source:

Bitcoin Price & MACD Indicator. Source:

Historically, this signal has been reliable in spotting market tops or extended corrections. Similar events in April 2024 and February 2025 marked 30% declines.

“Death cross on Bitcoin $BTC weekly MACD. Historically, a warning of downside risk!” analyst Ali commented.

Third Death Cross: EMA

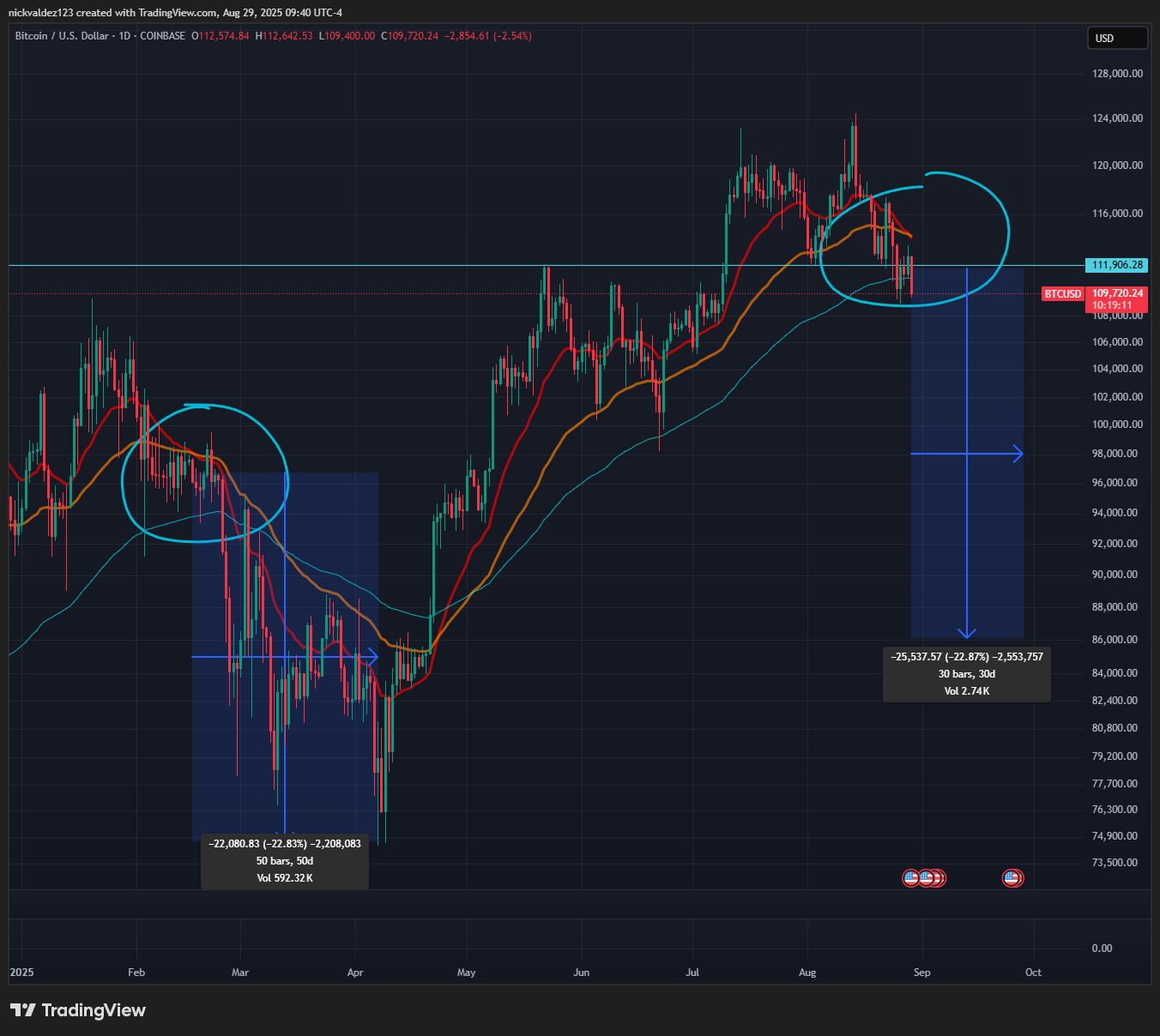

The third warning comes from analyst Deezy, focusing on Bitcoin’s exponential moving averages.

He highlighted that the 20-day EMA has just crossed below the 50-day EMA — a classic death cross pattern.

Deezy pointed to the last similar event in February 2025, when Bitcoin dropped another 23%. If history repeats, the adjustment could decrease the price to $86,000.

Bitcoin Price & EMAs. Source:

Bitcoin Price & EMAs. Source:

“The last time this happened in February 2025, BTC fell another 23%. A 23% drop from here would put Bitcoin at $86,000,” Deezy predicted.

Three death cross signals — MVRV, MACD, and EMA — now align in September 2025. Together, they paint a cautious outlook for Bitcoin.

History shows that death crosses often lead to volatility. However, they can also become false alarms during strong bull markets. This time, the stakes are higher as investors await the Federal Reserve’s interest rate cut decision in September — a move expected to boost sentiment toward crypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?