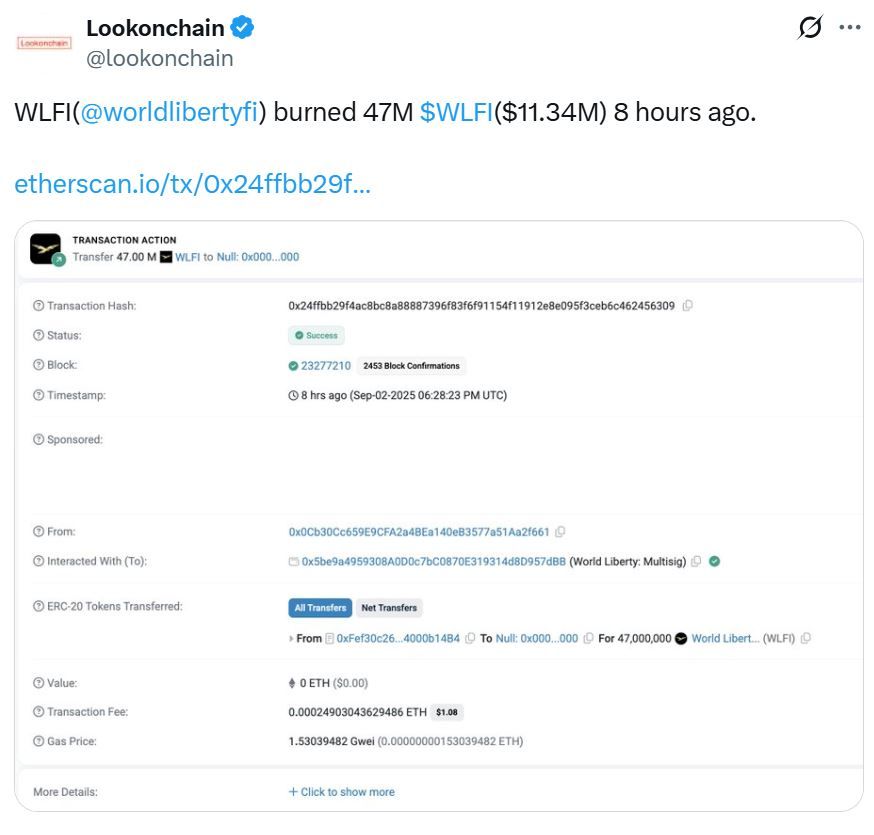

The WLFI token burn is a supply-reduction measure: World Liberty Financial sent 47 million WLFI to a burn address on Sept. 2, lowering total supply and aiming to tighten circulating tokens to support price recovery while protocol governance evaluates a wider buyback-and-burn plan.

-

47 million WLFI burned on Sept. 2

-

Burn equals roughly 0.19% of circulating supply; on-chain data reported by Lookonchain and visible on Etherscan.

-

Token down ~31% from launch peak; proposal for ongoing buyback-and-burn in governance comments (133 respondents).

WLFI token burn reduces supply to restore price momentum; read on-chain details, market impact and key takeaways from World Liberty Financial.

World Liberty Financial has turned to burning tokens in an attempt to stem a price drawdown its cryptocurrency has seen since it started trading publicly on Monday.

What is the WLFI token burn and why was it executed?

The WLFI token burn is an on-chain transfer of 47 million WLFI to a burn address executed on Sept. 2, intended to remove tokens from circulation to increase scarcity and support price stability. The move follows the token’s public trading debut and a subsequent price decline.

Source: Lookonchain

Source: Lookonchain

How much supply was affected and what do the on-chain figures show?

CoinMarketCap data indicates about 24.66 billion WLFI tokens are unlocked — just over 25% of the original 100 billion supply. The 47 million token burn represents approximately 0.19% of current circulating supply, reducing reported total supply to about 99.95 billion as reflected in Etherscan transaction records.

How is the market reacting to the WLFI burn and launch dynamics?

WLFI briefly peaked at $0.331 on launch day but has since fallen more than 31% from that high, trading near $0.23 as sellers took profits and short positions increased. The burn is a short-term protocol action; broader market confidence will depend on sustained liquidity, governance follow-through, and institutional uptake.

What governance steps are being proposed?

World Liberty Financial proposed a buyback-and-burn program funded by protocol-owned liquidity fees to increase token scarcity. Community feedback shows majority approval across 133 respondents, though a formal vote is pending. The proposal frames burns as a way to raise the relative ownership percentage for long-term holders.

Frequently Asked Questions

How can investors verify the WLFI burn on-chain?

Investors can verify the WLFI burn by checking the transaction hash reported in governance posts, viewing the transfer on an on-chain explorer to confirm tokens were sent to a burn address, and confirming the updated total supply.

Will a single burn reverse WLFI’s price decline?

A one-off burn is unlikely to fully reverse a significant price decline; it can modestly reduce supply and signal intent, but sustained price recovery typically requires liquidity, usage, or broader market demand.

Key Takeaways

- Immediate action: World Liberty Financial burned 47 million WLFI to reduce circulating supply.

- Scale: The burn equals about 0.19% of circulating supply and trimmed total supply to ~99.95 billion.

- Next steps: Governance proposed an ongoing buyback-and-burn funded by protocol liquidity fees; a formal vote is pending.

Conclusion

The WLFI token burn is a targeted supply-management maneuver by World Liberty Financial intended to support price stability after an aggressive public launch. On-chain sources such as Lookonchain, Etherscan and CoinMarketCap provide the transaction and supply figures in plain text; community governance now weighs a broader buyback-and-burn program. Watch governance votes and liquidity metrics for signals on long-term impact.