Correction, Not Capitulation: Bitcoin Price Recovery To $115,000 On The Cards

Bitcoin is regaining strength above $110,000, with easing risk signals and resilient supply positioning BTC for a push toward $115,000

Bitcoin has experienced a notable pullback since reaching its all-time high earlier this year. The cryptocurrency dipped below $110,000 briefly, raising concerns of sustained bearish pressure.

However, current data suggests the move was more of a short-term fluctuation than the beginning of a prolonged downtrend, hinting at recovery potential.

Bitcoin Is Secure

Risk signals in the Bitcoin market are easing. According to Bitcoin Vector, the Risk-Off Signal is retreating, moving toward a low-risk regime. This shift suggests that market conditions are stabilizing after weeks of volatility.

At the same time, Bitcoin has broken free from a price compression that had been in place since the $124,500 all-time high. Reclaiming $110,000 confirmed the end of this compression zone. With resistance weakened, BTC now has room to move higher, increasing the chances of recovery in the coming weeks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Bitcoin Risk-Off Signal. Source:

Swissblock – Bitcoin Vector

Bitcoin Risk-Off Signal. Source:

Swissblock – Bitcoin Vector

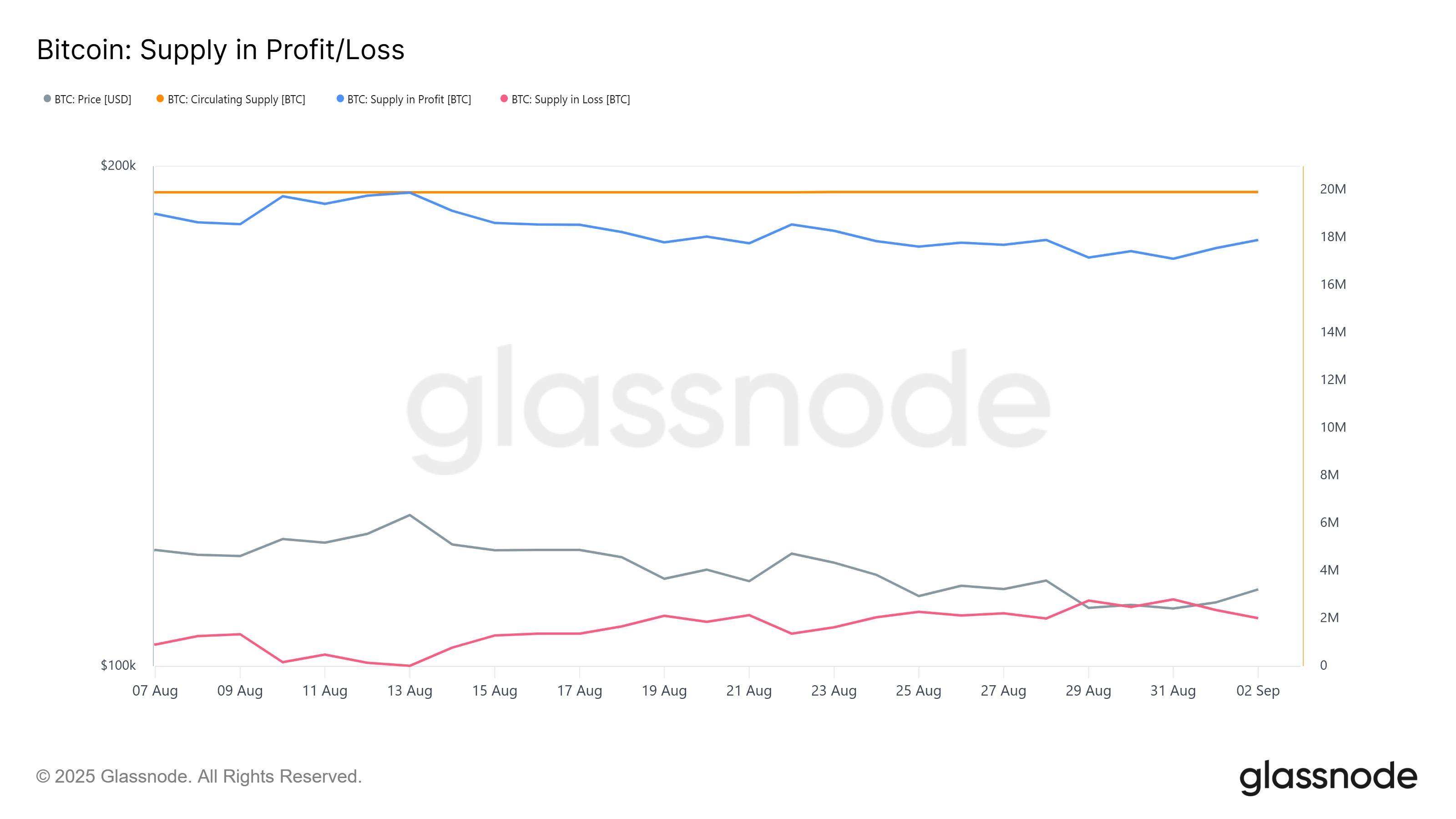

On-chain data supports this outlook. Of the 19.91 million BTC in circulation, only about 2.73 million coins are currently lost. This represents just 13.71% of supply, well below the threshold historically associated with bear markets, where losses typically extend above 50% of circulating Bitcoin.

This indicates Bitcoin is far from capitulation territory. Despite recent price dips, the vast majority of holders remain in profit, showing resilience. The limited supply in loss reflects strong investor conviction, suggesting BTC has a solid foundation to withstand selling pressure and sustain upward momentum in the near term.

Bitcoin Supply In Profit/Loss. Source:

Glassnode

Bitcoin Supply In Profit/Loss. Source:

Glassnode

BTC Price To Continue Its Rise

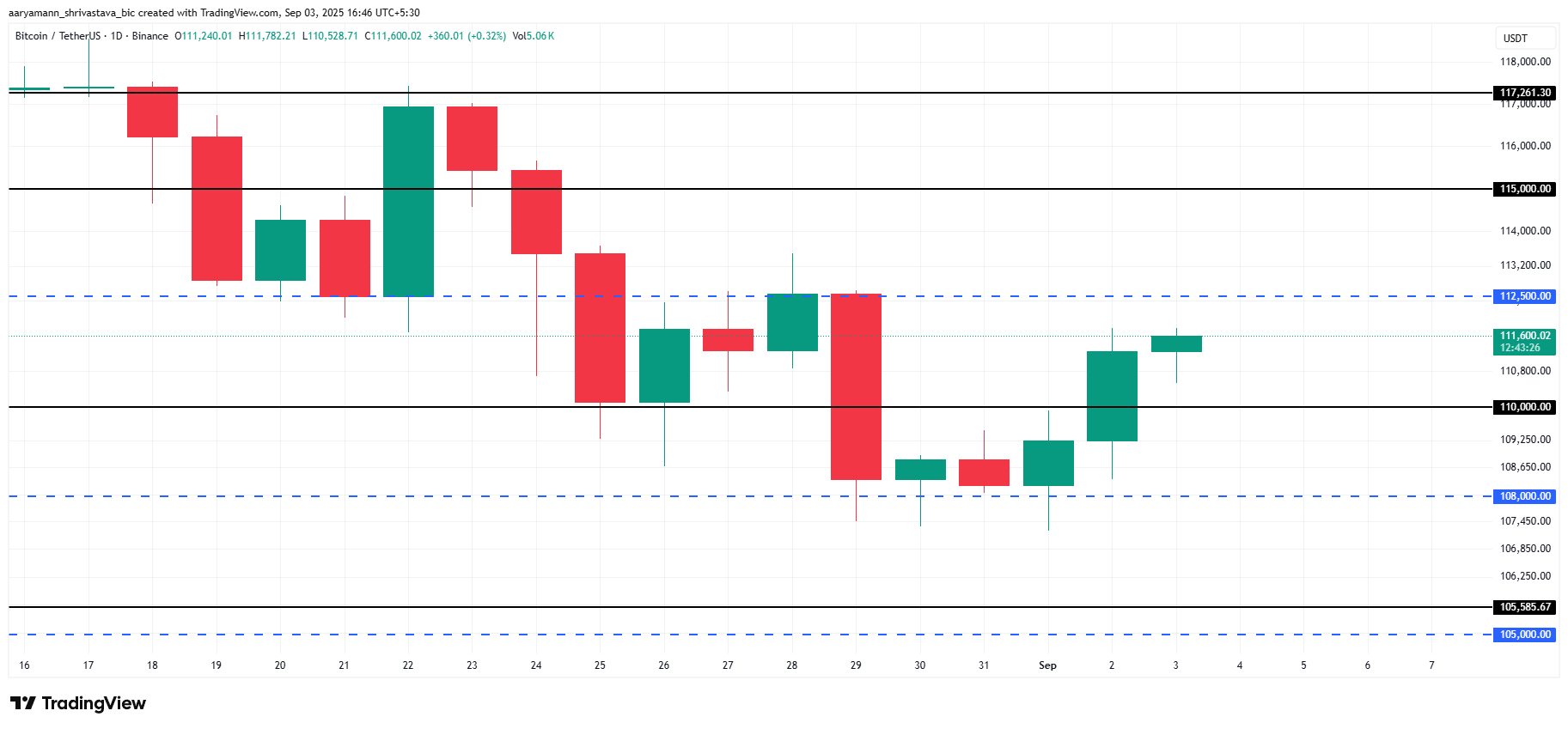

Bitcoin trades at $111,600 at the time of writing, just under the $112,500 resistance. The asset bounced back from $108,000 earlier this week, showing renewed strength. Holding above $110,000 provides stability, giving BTC the base it needs to attempt further recovery against prevailing market pressures.

If current momentum holds, Bitcoin is likely to continue climbing. A breakout above $112,500 could open the path toward $115,000, reinforcing bullish sentiment. This move would confirm the improvement of the market structure and signal a renewed attempt at recovery.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, risks remain if selling pressure reemerges. Should Bitcoin fail to maintain momentum, a decline back to $110,000 is possible. In a deeper correction, the price could revisit $108,000, raising concerns among investors about potential short-term weakness.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.