Ethereum price surges as Tom Lee’s BitMine buys $358M ETH

Ethereum’s price momentum is getting a boost from big-money moves. BitMine Immersion Technologies has just added hundreds of millions worth of ETH to its holdings, marking one of the largest single-day purchases this year.

- BitMine bought 80,325 ETH worth $358 million, boosting its total stash to 1.87 million ETH valued at $8.1 billion.

- Corporate treasuries now hold over 4.7 million ETH, with BitMine leading ahead of SharpLink Gaming and The Ether Machine.

- The company is pursuing its “alchemy of 5%” goal, aiming to secure 5% of ETH’s supply as part of its long-term infrastructure strategy.

On-chain data from Arkham shows BitMine acquired 80,325 ETH ( ETH ) in its latest move, a purchase worth about $358 million. Of this, 14,665 ETH valued at $64.7 million came through Galaxy Digital’s over-the-counter desk, executed in six separate transactions.

The remaining bulk of the purchase was sourced from FalconX, where the firm pulled in over 65,000 ETH worth nearly $293 million. Combined, the transactions mark one of the largest institutional Ethereum acquisitions seen so far this year.

With this latest haul, the Tom Lee-led company has taken its ETH reserves to new highs, strengthening its position as a dominant force among institutional buyers. The company has been vocal about its long-term ambition of amassing as much as 5% of the total ETH supply, a milestone it describes as the centerpiece of its Ethereum accumulation strategy.

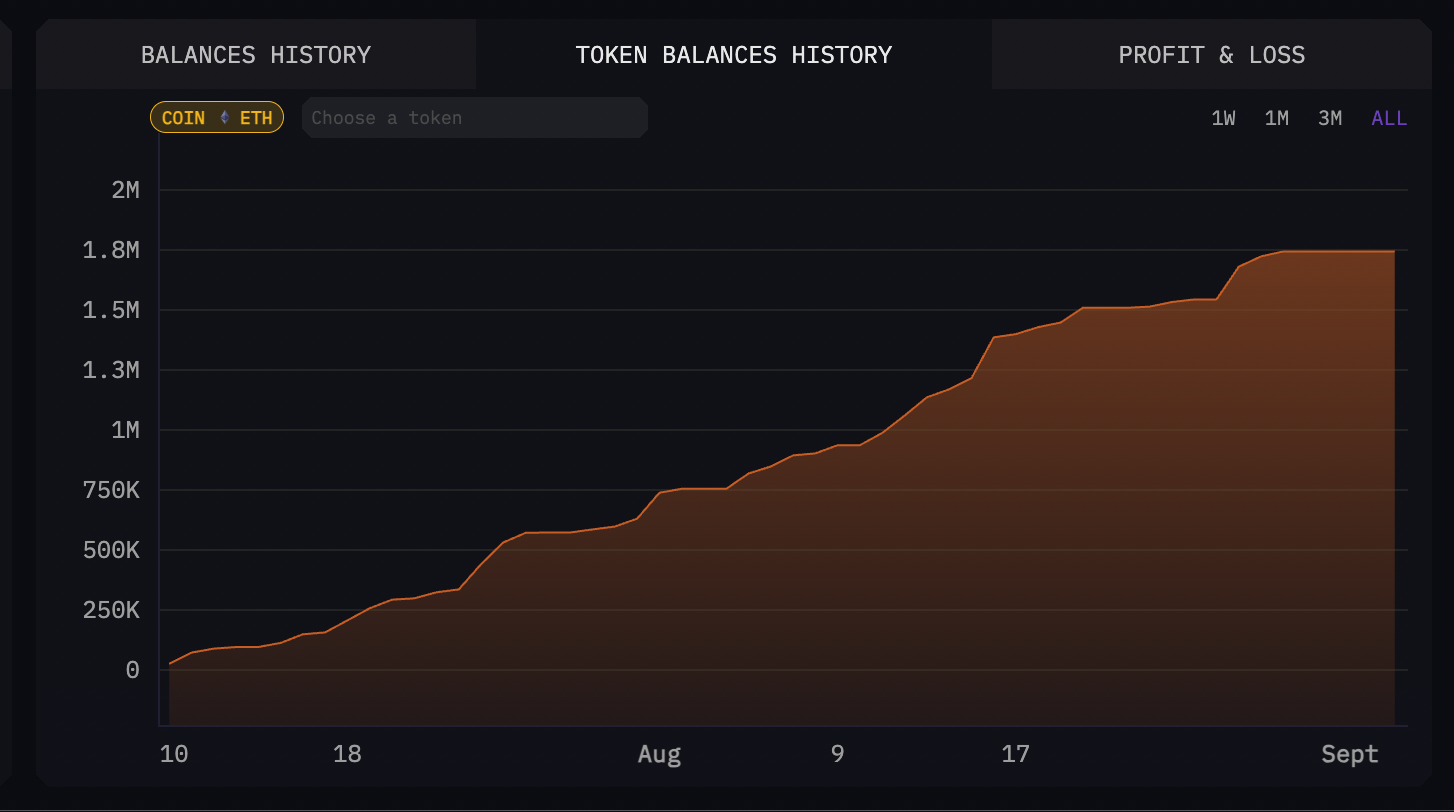

Chart showing BitMine’s Ethereum holdings growth over time | Source: Arkham

Chart showing BitMine’s Ethereum holdings growth over time | Source: Arkham

BitMine now holds approximately 1.87 million ETH valued at around $8.1 billion, making it the largest institutional Ethereum holder in the world. This reserve, which already account for more than 1 percent of circulating ETH, highlights the scale of its accumulation drive and set the stage for its move towards its “alchemy of 5%” goal.

Corporate ETH treasuries and BitMine’s vision

Corporate ETH treasuries continue to grow across the board. According to data compiled by crypto.news, public firms collectively hold over 4.7 million ETH worth over $20 billion at current prices. This marks an era where Ethereum is increasingly trusted as a durable, yield-generating reserve asset.

Among these players, BitMine remains the largest, followed closely by firms including SharpLink Gaming and The Ether Machine, each contributing significant ETH reserves to the growing corporate treasury ecosystem.

BitMine views ETH as more than just a digital asset. As Chairman Tom Lee put it, “ETH Treasuries are providing security services for the ethereum network, by native staking and thus, BitMine is a critical digital infrastructure partner for ethereum.” This mindset positions the company’s holdings as strategic, permanent infrastructure, not speculative bets.

BitMine’s long-term ambition is bold and infrastructure-focused. The firm recently appointed David Sharbutt, a former American Tower director known for scaling infrastructure-heavy companies, to its board, underscoring its intention to methodically grow and operationalize its ETH strategy.

Meanwhile, ETH has reclaimed the $4,400 mark, likely driven by the latest buying activity. This represents a modest recovery after days of being stuck around $4,300. The asset is up 1.13% on the day, though it remains down roughly 4% for the week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Boros: Swallowing DeFi, CeFi, and TradFi to Unlock Pendle's Next 100x Growth Engine

The profit potential of Boros yield space can even surpass that of Meme.

SUI Targets Wave 3 Rally as $1.71 Level Defines Bullish Breakout Path

VELO Holds $0.0084 as Price Consolidates Above Fib 0.236, Mirroring 1,500% Historical Rally Setups

Fetch.ai Holds $0.26 Support as Chart Confirms Long-Term Bullish Channel Setup