Ethereum ETFs extend losing streak for third straight day with $38m

Ethereum exchange-traded funds have hit a rough patch, posting losses for three days in a row. The trend highlights cooling sentiment around Ether as Bitcoin funds continue to attract steady inflows.

- Ethereum ETFs recorded net outflows of $38.2 million on September 3, marking a three-day streak of redemptions.

- BlackRock’s ETHA fund drove the largest outflows at $151 million, partially offset by inflows into Fidelity’s FETH, Grayscale’s spot ETH fund, and Bitwise’s ETHW.

- Despite recent outflows, Ethereum ETFs had previously seen six consecutive days of inflows totaling over $1.8 billion.

Ethereum spot ETFs posted $38.2 million in net outflows on September 3, marking the third consecutive day of redemptions. According to SoSoValue data , the day’s negative balance was largely driven by BlackRock’s ETHA fund, which recorded outflows of about $151 million.

The redemptions were partly offset by inflows into Fidelity’s FETH at $65.8 million, Grayscale’s ETH at $26.6 million, and Bitwise’s ETHW at $20.8 million, while the rest of the funds were flat on the day.

Even so, the $38.2 million in losses were modest compared to the sharp outflows in the two sessions before, when more than $300 million left Ethereum products. The streak of withdrawals coincided with ETH’s own price struggles, reflecting cooling investor interest and demand.

Altogether, Ethereum ETFs shed around $338 million over the three-day stretch, cutting into what had been a strong run. Just days earlier, the funds had logged six straight days of inflows, attracting more than $1.8 billion. Meanwhile, Bitcoin ETFs have performed more positively , attracting over $634 million in a two-day streak of inflows.

Ethereum ETF outflows cool as price eyes $5k

The reduced outflows in ETH ETFs come as the asset’s price slightly recovers. ETH started the day near $4,400, rebounding from an earlier dip toward $4,200 per market data from crypto.news. Trading at $4,414 at the time of writing, the second-largest cryptocurrency is up about 0.95% on the day, though it remains roughly 4% lower for the week and around 11% below its all-time high.

Analysts have highlighted the $4,500 level as a critical breakout threshold. A break above this could unlock fresh upside momentum, while failure to hold above it may risk pushing price back toward the $4,100–$4,000 range.

ETH price chart showing support and resistance levels and moving averages | Source: TradingView

ETH price chart showing support and resistance levels and moving averages | Source: TradingView

Still, price action in recent weeks shows Ethereum maintaining a bullish trend, with price holding above key moving averages. Some target forecasts point to a move toward $5,000, with a stretch possibility toward $6,000 if momentum sustains.

Whale and institutional activity reinforce the outlook. On-chain data show multiple entities accumulating ETH, and this increased demand may help stabilize the price while providing a stronger foundation for further gains.

If positive momentum persists, ETH could be poised for a near-term recovery, potentially restoring strong inflows into Ethereum exchange-traded funds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UFC Star Khabib Nurmagomedov’s MultiBank Partnership Tokenizes His Global Gym Brand on Mavryk

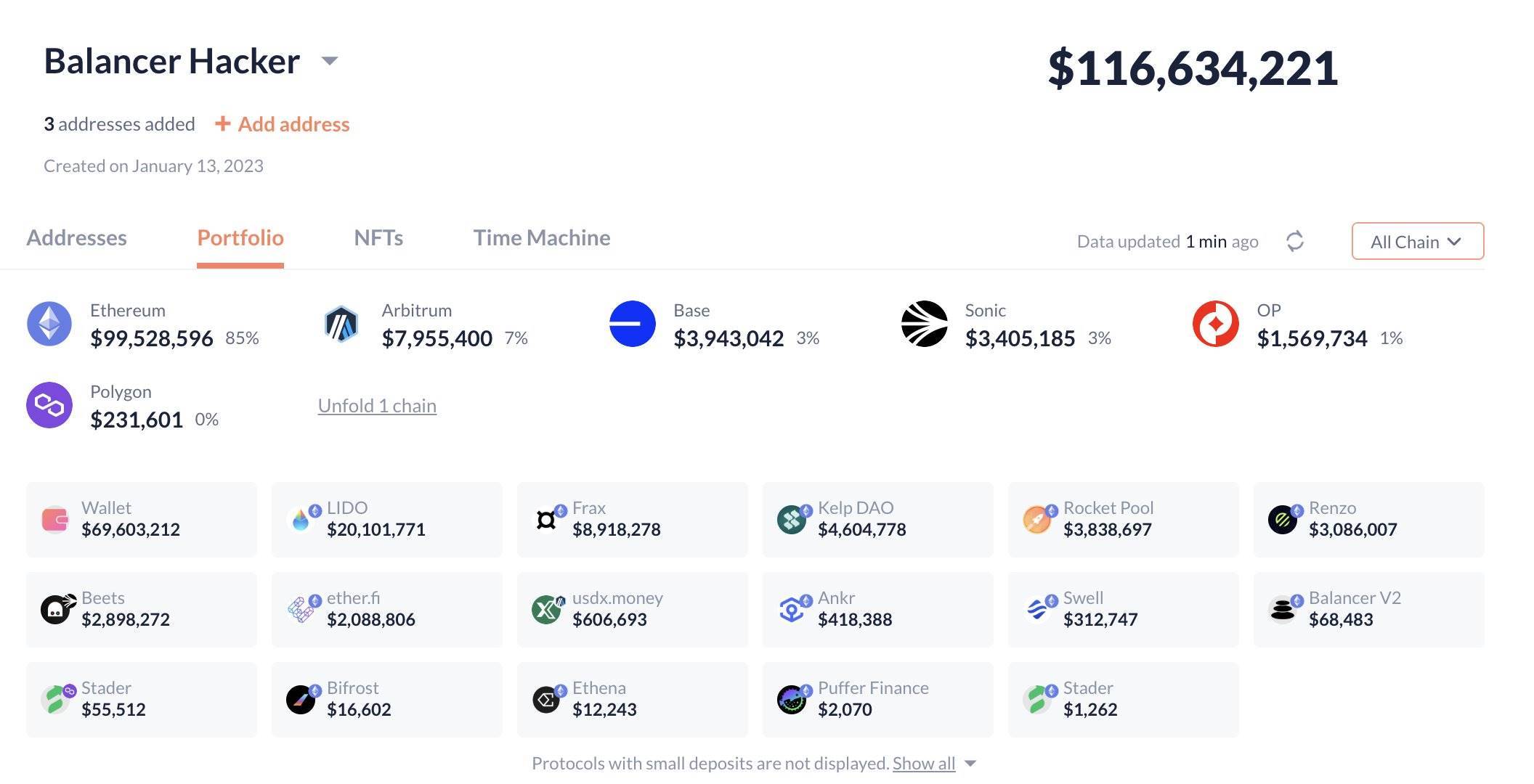

Six incidents in five years with losses exceeding 100 millions: A history of hacker attacks on the veteran DeFi protocol Balancer

For bystanders, DeFi is a novel social experiment; for participants, a DeFi hack is an expensive lesson.

Review of Warplet: How a Small NFT Sparked the Farcaster Craze?

A meme, a mini app, and a few clicks—just like that, the Farcaster community has a brand new shared story.

Hong Kong’s HKMA Launches Fintech 2030 to Drive Future Financial Innovation