Chainlink (LINK) holds critical $23 support while trading near $22.52; analysts note whale accumulation of 1.25M tokens and $1.84M exchange outflows, strengthening LINK’s structure. A decisive break above $31 could target $47 and higher, making LINK price action pivotal for the coming sessions.

-

LINK holds $23 support; $31 resistance is the key breakout level.

-

Whales bought 1.25M LINK and $1.84M left exchanges, tightening supply and reinforcing stability.

-

LINK trades above the 50-day ($20.99) and 200-day ($16.07) SMAs; 24hr volume near $1.55B supports active participation.

Chainlink price: LINK holds $23 support with $31 resistance; watch for a breakout toward $47 — read the analysis and trade levels.

What is the current Chainlink price outlook?

Chainlink (LINK) price is holding a key support zone at $23 while trading around $22.52, with analysts highlighting 1.25 million token whale buys and $1.84 million in exchange outflows. A confirmed break above $31 would open a path toward $47 and higher targets.

How is on-chain activity affecting LINK support and supply?

Large-holder behavior has reduced available supply: over two days, whales accumulated about 1.25M LINK and exchanges reported $1.84M in outflows. This on-chain dynamic supports the $23 support area and can increase upward pressure if spot demand continues.

How does technical structure define LINK’s next moves?

LINK maintains a bullish structure, trading above the 50-day SMA at $20.99 and the 200-day SMA at $16.07. Short-term consolidation is visible under the 20-day average ($24.28), indicating a pause before a potential continuation. Fibonacci retracements place deeper downside zones between $10.70 and $6.90, with longer-term support near $4.62.

What are immediate resistance and upside targets?

Near-term resistance sits at $27.87 followed by the main $31 barrier. Upside projections include $47.46, $68.16, and $85.05. Technical counts (including an Elliott Wave read) show corrective phases but an overall upward path remains intact if key resistances are breached.

What are the recent market activity and on-chain observations?

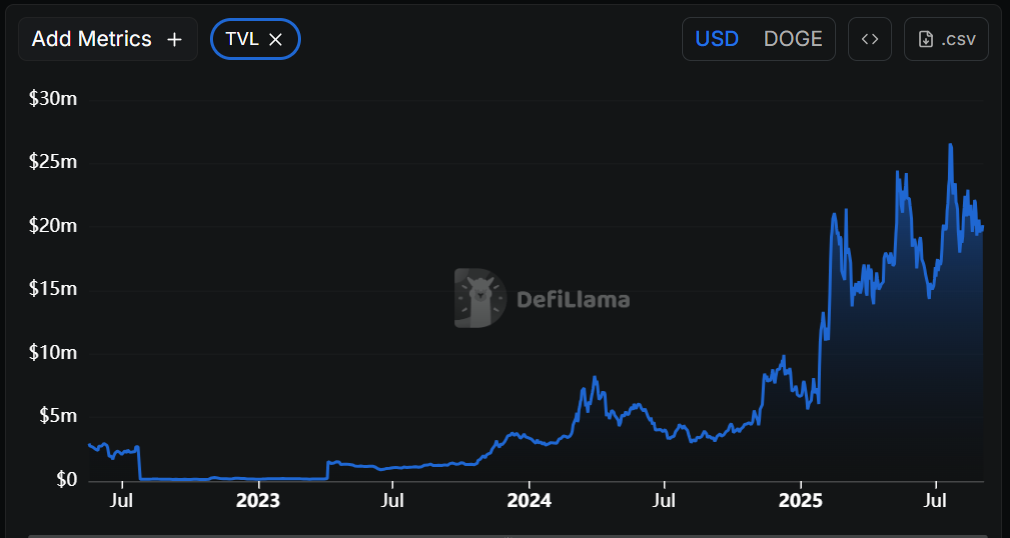

Chainlink has traded inside a rising channel since mid-2023, progressing from roughly $13.15 into the current range, according to on-chain analysis noted by Ali Charts. Support zones at $18.00 and $15.00 remain relevant, while a move past $27.00 could open intermediate targets at $34.00 and $44.00.

$LINK might offer one the cleanest structures in the sector right now. $23 key support respected for now. $31 resistance ahead. Break it and we’re talking $47+. Watch for RSI resistance above. #Chainlink pic.twitter.com/B3JYPCYhom — More Crypto Online (@Morecryptoonl) September 3, 2025

Trading volume for LINK stands near $1.55 billion for the past 24 hours, with spot markets showing higher participation levels. Analysts emphasize that clearing $31 is required to confirm the next stage of expansion; failing that, the token could revisit the $23 support or lower SMA levels.

Why is whale accumulation important for LINK support?

Whale accumulation reduces circulating supply on exchanges and can amplify upward momentum when demand resumes. The recent 1.25M LINK buy and $1.84M in exchange outflows lower short-term sell pressure, strengthening the $23 support and improving the odds of a controlled breakout scenario.

How should traders use these levels in risk management?

Traders should treat $23 as the primary support reference and $31 as the breakout trigger. Manage position sizing around the 20-day average ($24.28) and watch for RSI resistance to signal potential short-term pullbacks. Use layered entries and defined stop risks below the $23 zone to limit downside exposure.

Frequently Asked Questions

Is $23 a strong support for LINK now?

$23 is a critical support level, reinforced by whale accumulation (1.25M LINK) and $1.84M in exchange outflows, which reduce immediate sell pressure and back the $23 floor in the current market structure.

What price would confirm a bullish breakout for Chainlink?

A decisive daily close above $31 would confirm a bullish breakout and likely target $47.46 as the next significant level, with extended targets at $68.16 and $85.05 if momentum continues.

Key Takeaways

- Support and resistance: $23 support holds; $31 is the breakout level to watch.

- On-chain impact: 1.25M LINK whale buys and $1.84M exchange outflows tighten supply.

- Trading plan: Use moving averages and volume for confirmation; manage risk with stops below $23 and scale after a confirmed close above $31.

Conclusion

Chainlink (LINK) remains technically constructive while holding the $23 support, backed by whale accumulation and reduced exchange supply. Traders should watch $31 for a confirmed breakout toward $47 and beyond. For now, combine on-chain signals, SMA alignment, and volume to form disciplined, risk-aware entries as the next directional move develops.

Chainlink (LINK) holds $23 support as whales accumulate 1.25M tokens, with analysts watching $31 resistance for a breakout toward $47.

- LINK holds $23 support with $31 resistance ahead; break could open a path toward $47.

- Whale accumulation of 1.25M LINK and $1.84M outflows reduce supply, reinforcing stability.

- Chainlink trades above its 50-day and 200-day SMAs, maintaining bullish structure within the rising channel.

Chainlink’s LINK token is drawing market attention as it maintains its structure within a key trading range. LINK might offer one of the cleanest structures in the sector right now. The token is currently trading at $22.52, with $23 acting as a crucial support level and $31 as the next resistance point. Market watchers suggest that a break above $31 could push LINK toward the $47 level and beyond.

Technical Structure and Market Levels

According to analysis prepared by More Crypto Online, LINK has respected the $23 support zone after rebounding from lower retracement areas. The token trades above both the 50-day simple moving average at $20.99 and the 200-day average at $16.07, showing strength in the broader trend.

$LINK might offer one the cleanest structures in the sector right now. $23 key support respected for now. $31 resistance ahead. Break it and we’re talking $47+. Watch for RSI resistance above. #Chainlink pic.twitter.com/B3JYPCYhom — More Crypto Online (@Morecryptoonl) September 3, 2025

However, it is consolidating under the 20-day average at $24.28, suggesting a short-term pause. Fibonacci retracement levels place downside areas between $10.70 and $6.90, while broader support lies near $4.62.

Upside projections mark potential targets at $47.46, $68.16, and $85.05. The Elliott Wave count identifies corrective phases but shows that LINK is still following a clean upward path. Traders point to $27.87 as a near-term resistance before the larger $31 barrier.

Market Activity and On-Chain Developments

According to an observation by Ali Charts, LINK has traded inside a rising channel since mid-2023, advancing from $13.15 toward the present range. Support zones are noted at $18.00 and $15.00, while a move above $27.00 could open targets at $34.00 and $44.00.

Source: AliCharts(X)

Whale accumulation has also supported LINK’s stability. Over the past two days, large holders bought 1.25 million tokens while exchange outflows reached $1.84 million. This reduction in circulating supply adds strength to the support structure.

Trading volume stands near $1.55 billion in the past 24 hours, with spot market activity showing higher participation. According to analysts, LINK must clear the $31 resistance to confirm the next stage of expansion. A decisive break could extend toward the $47 level, keeping LINK in focus among traders looking for structured setups.