3 Altcoins Show Strong Accumulation in the 1st Week of September

Three altcoins—Ethereum, Euler, and Maple Finance—saw steep reserve declines in early September, signaling strong investor accumulation and possible price momentum ahead.

The crypto market cap in the first week of September moved within a narrow range around $3.8 trillion, awaiting the next move. Will it be a breakout or a sell-off? The market may soon have an answer. In this context, several altcoins recorded sharp declines in exchange reserves.

These altcoins carry their own momentum. If overall market sentiment turns positive, the synergy could benefit early buyers.

1. Ethereum (ETH)

Over the past two months, news of listed companies accumulating ETH has appeared almost daily.

Data from Strategic ETH Reserve shows that as of September 5, companies had purchased more than 4.7 million ETH worth over $20.5 billion for their strategic ETH reserves.

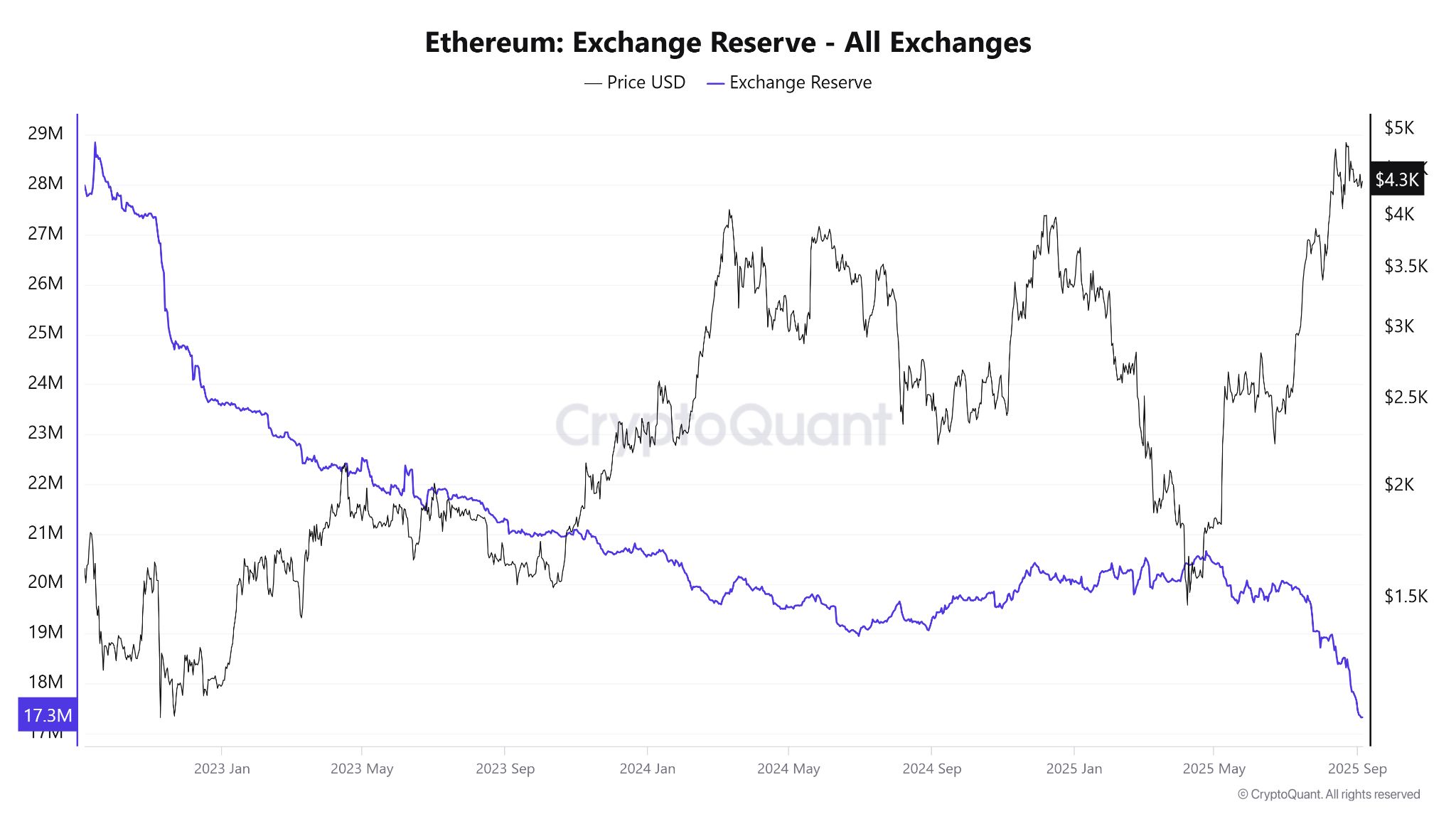

As a result, the amount of ETH on exchanges has dropped sharply. The pace of decline has accelerated in recent months, as shown by the steepening chart.

Ethereum Exchange Reserve. Source:

CryptoQuant.

Ethereum Exchange Reserve. Source:

CryptoQuant.

CryptoQuant data shows that by the first week of September, only about 17.3 million ETH remained on exchanges. A recent BeInCrypto report warned that ETH faces a rare supply shock.

Meanwhile, Ecoinometrics reported that Ethereum ETF inflows continue narrowing the Bitcoin gap. This highlights a shift in investor interest, as more attention appears toward ETH.

“Since mid-July, Bitcoin ETF flows have gone flat. Ethereum, by contrast, is in its strongest inflow streak since launch. While Bitcoin still has a large lead, Ethereum is catching up fast,” Ecoinometrics noted.

2. Euler (EUL)

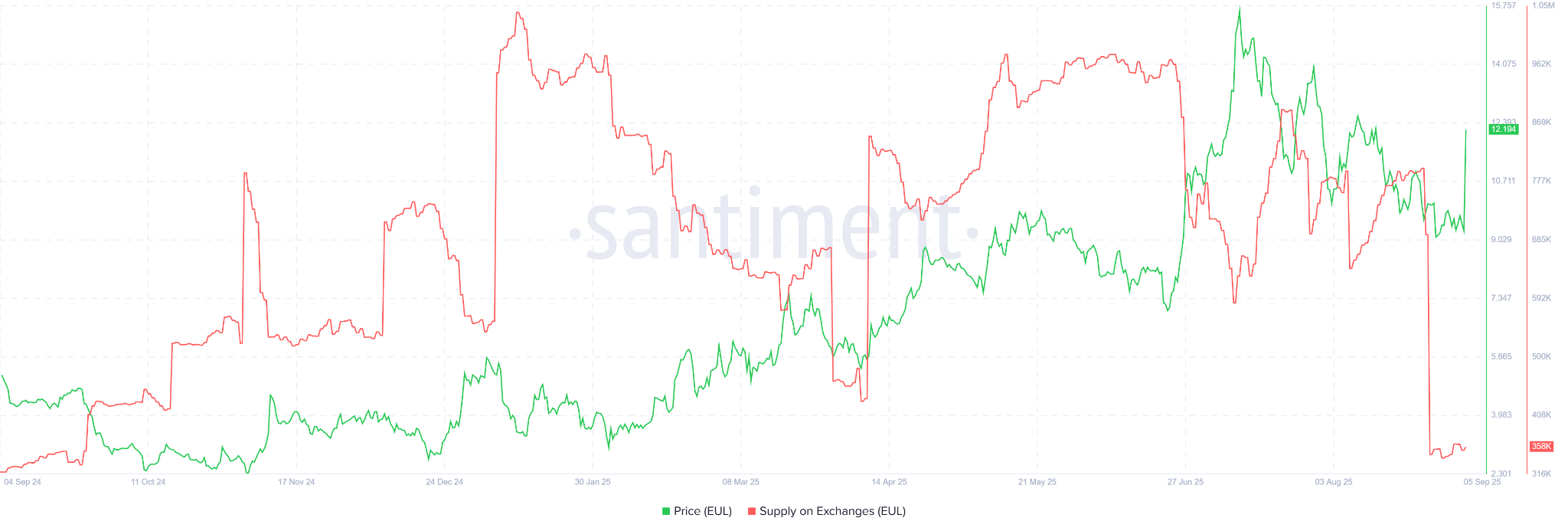

Santiment data shows that Euler (EUL) exchange reserves dropped to a one-year low of 358,000 EUL in the first week of September.

From the late-August peak of 795,000 EUL, more than 437,000 EUL have been withdrawn from exchanges.

Interestingly, this accumulation occurred one week before EUL was listed on Bithumb, which triggered a price surge of more than 30%.

EUL Supply On Exchanges. Source:

Santiment

EUL Supply On Exchanges. Source:

Santiment

On-chain data suggests that smart money moved early, accumulating EUL ahead of the announcement. However, the motivation may go beyond a simple “sell the news” trade. It could reflect growing investor confidence in the project.

A recent BeInCrypto report shows that this lending protocol’s total value locked (TVL) reached an all-time high of over $1.5 billion in September. Moreover, protocol revenue and fees surged by more than 500% in 2025, signaling strong user adoption.

3. Maple Finance (SYRUP)

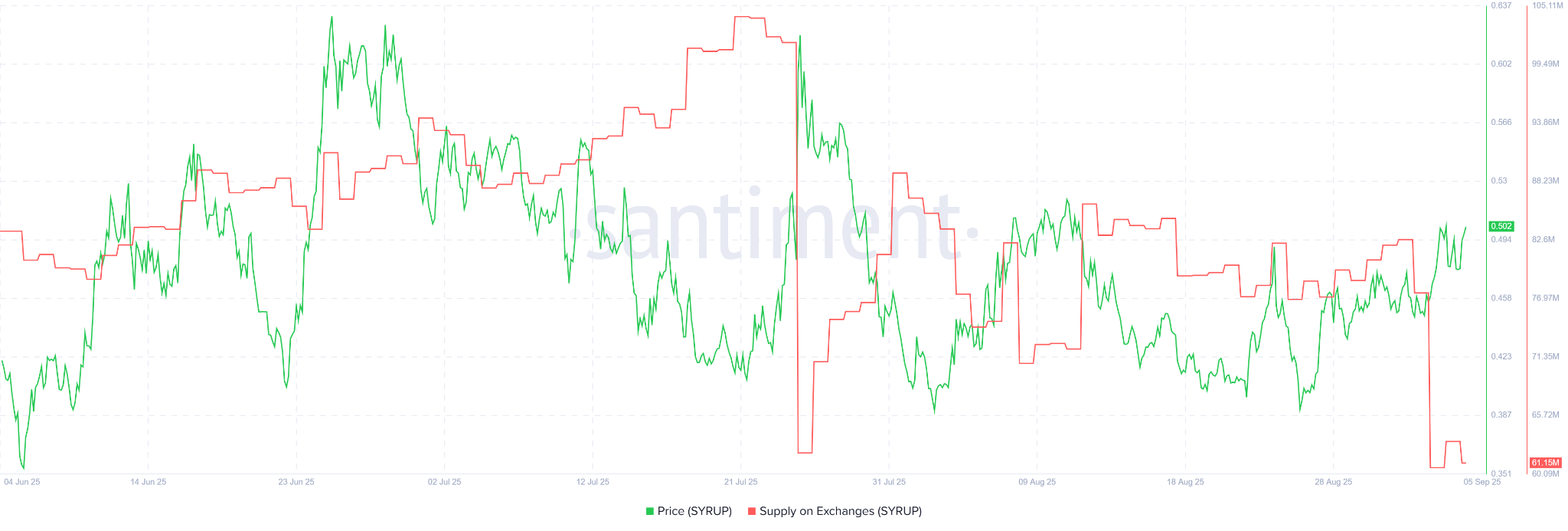

Santiment data reveals that SYRUP’s exchange reserves fell to a three-month low of 61.15 million SYRUP. Since the beginning of September, more than 20 million SYRUP have left exchanges.

The chart indicates that this downtrend started in July. Yet, SYRUP’s price has remained around $0.5 without breaking above $0.6.

SYRUP Supply On Exchanges. Source:

Santiment.

SYRUP Supply On Exchanges. Source:

Santiment.

This accumulation could signal renewed investor confidence in SYRUP, potentially laying the groundwork for a price rally.

Additional data from DeFiLlama shows that Maple Finance’s TVL jumped 600% this year, from $300 million at the start of 2025 to an all-time high of $2.18 billion in September. The digital asset lending platform now reports assets under management (AUM) of $3.35 billion. These figures underscore SYRUP’s upside potential.

All three altcoins share a common theme: Ethereum and projects in its ecosystem. This narrative could become a major driving force for the market through the end of the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink partners with Chainalysis to launch onchain compliance monitoring

Buying ZEC to Crash BTC? Four Industry Truths Behind the Privacy Coin Surge

The real cryptocurrency has long been dead.

Retail investors 'retreat’ to $98.5K: 5 things to know in Bitcoin this week