DeFi Development Corp. Surpasses 2 Million SOL as Price Outlook Strengthens

With DeFi Development Corp becoming the second-largest corporate SOL holder, Solana gains institutional traction, though price action hinges on a breakout or pullback.

DeFi Development Corp. has boosted its Solana (SOL) holdings beyond 2 million tokens worth over $400 million, becoming the second-largest corporate holder of the cryptocurrency.

The move comes amid a broader price rally in Solana, which has seen its value climb by double digits over the past month.

DeFi Development Corp. Becomes 2nd Largest SOL Holder

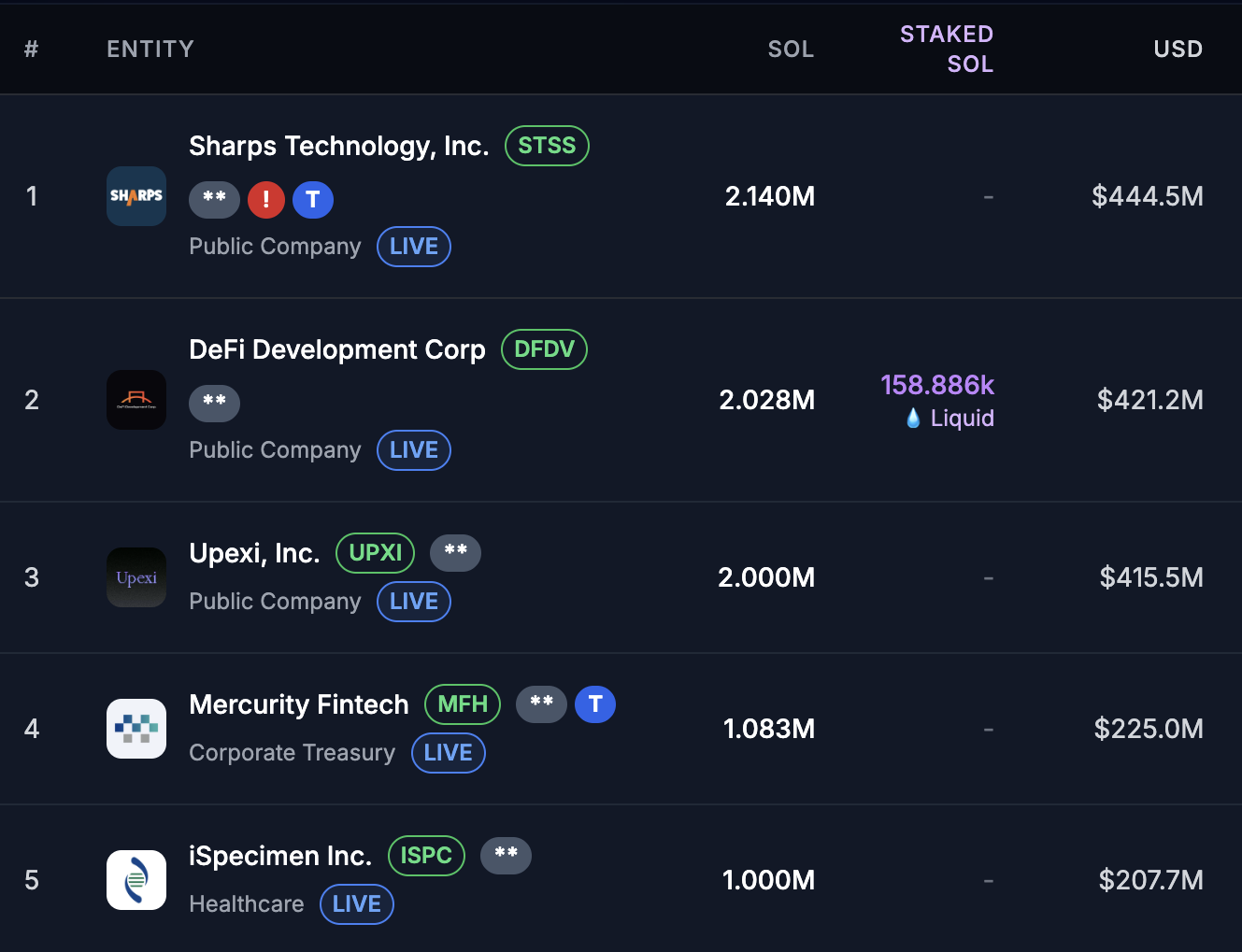

In a recent press release, the firm announced that it acquired 196,141 SOL. The average purchase price was $202.76 per coin. With this latest buy, DeFi Development Corp now holds 2,027,817 SOL, exceeding Upexi’s holdings of 2,000,518 SOL.

“The newly acquired SOL will be held long-term and staked to a variety of validators, including DeFi Dev Corp.’s own Solana validators to generate native yield,” the press release read.

Top 5 Corporate Solana Holders. Source:

Strategic Solana Reserve

Top 5 Corporate Solana Holders. Source:

Strategic Solana Reserve

The acquisition comes amid growing institutional interest in Solana. According to Ray Youssef, CEO of Noones, the move reflects a broader shift, as treasuries and asset managers boost exposure to Solana’s strengthening liquidity and growing prospects for an exchange-traded fund (ETF).

“Corporate treasuries and digital asset managers are also beginning to advance allocations, encouraged by Solana’s increasing structural liquidity depth and the prospect of an eventual ETF product. The recent decision by Galaxy Digital to tokenize shares in Solana adds extra weight to the institutional adoption story, giving credibility to its ecosystem,” Youssef told BeInCrypto.

SOL Price Forecast: Breakout or Pullback Ahead?

Meanwhile, this purchase wasn’t enough to trigger a massive rally for Solana. BeInCrypto Markets data showed that the altcoin was only up 0.4% over the past day amid a broader market slump. At press time, it traded at $207.96.

Solana Price Performance. Source:

BeInCrypto Markets

Solana Price Performance. Source:

BeInCrypto Markets

Over the past month, its value has risen by 23%, indicating strong broader momentum. Youssef stressed the token has become a clear favorite among institutions and the leading asset of the late-summer rally.

It has outpaced both Bitcoin and Ethereum. He emphasized that Solana is becoming the ‘market’s standout performer.’

“Solana has gained more than 27% against BTC in the past month and has strengthened over 8% against ETH. While BTC remains locked in a consolidation range near $112,000 and ETH cools off after a strong August run that saw it print a new all-time high, SOL has seen a breakout rally on the back of announcements of technical upgrades, ecosystem momentum, and rising institutional engagement,” he said.

Youssef added that Solana’s latest gains reflect the growing maturity of the digital asset market, with capital increasingly moving beyond the two largest coins into networks that offer everything from liquidity and scalability to institutional trust.

Nonetheless, he emphasized that many SOL-driven surges have often been short-lived. Thus, this raises concerns about the sustainability of the current rally.

“If the Alpenglow upgrade delivers on its promise and its ETF product launches as expected in Q4, the case for institutional accumulation and adoption grows even stronger; in that case, SOL’s recent performance may mark the early stages of a longer structural reevaluation and price discovery. If technical risks resurface and macro liquidity tightens, the rally could stall,” Youssef mentioned to BeInCrypto.

According to the executive, buyers are attempting to secure momentum by driving SOL above the $218 threshold. A confirmed breakout at that level could set the stage for a move toward $240, with the possibility of reaching $260 before year-end.

On the downside, if selling pressure caps the advance, the price risks sliding back to $190 and potentially to $180 should broader market conditions worsen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Faces Trendline Pressure While Ethereum Could Target $5,000 and Bitcoin Eyes Resistance

Tron Gas Fee Cut May Boost Adoption but Could Reduce Short‑Term Revenue

Hayes Suggests Bitcoin Could Be Increasingly Correlated With Stocks, Gold and the U.S. Dollar