Hyperliquid to cut fees and put USDH stablecoin up for validator vote

Key Takeaways

- Hyperliquid is initiating an on-chain validator vote to select a team for the USDH stablecoin ticker.

- The protocol will reduce spot trading fees by 80% to enhance liquidity and user experience.

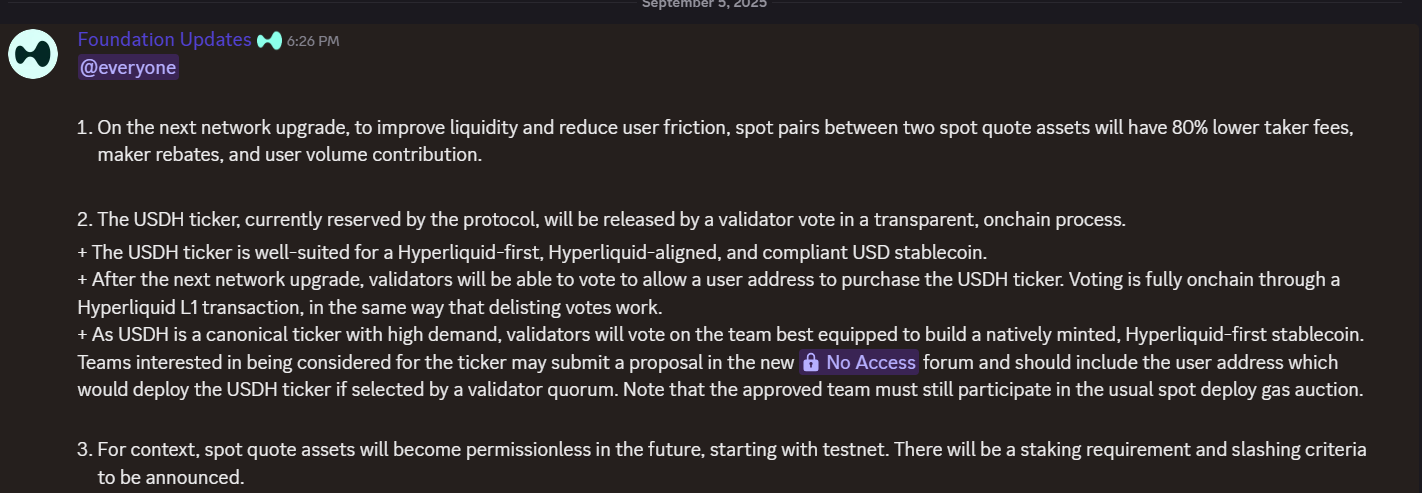

Hyperliquid will implement reduced fees for spot trading pairs and open a validator voting process for its USDH stablecoin ticker, the project announced on Discord.

The protocol plans to cut taker fees, maker rebates, and user volume contributions by 80% for spot pairs between two spot quote assets in its next network upgrade to enhance liquidity and reduce friction.

The USDH ticker, currently held by the protocol, will be released through an on-chain validator voting process. Teams seeking to acquire the ticker must submit proposals, including their deployment address. The selected team will need to participate in a spot deploy gas auction.

Validators will vote through Hyperliquid L1 transactions to approve a user address for purchasing the USDH ticker, following the same mechanism used for delisting votes. The protocol seeks teams capable of developing a “Hyperliquid-first, Hyperliquid-aligned, and compliant USD stablecoin.”

The platform also revealed plans to make spot quote assets permissionless in the future, starting with testnet implementation. This change will include staking requirements and slashing criteria, which will be announced later.

This is a developing story.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!