South Korea Caps Crypto Lending Interest at 20%, Bans Leveraged Loans

Contents

Toggle- Quick Breakdown

- FSC Tightens Grip on Crypto Lending

- New Compliance Requirements for Exchanges

- Growing Scrutiny Amid Rising Popularity

Quick Breakdown

- South Korea’s FSC capped crypto lending interest at 20% and banned leveraged loans.

- Only top 20 tokens or those listed on three or more local exchanges qualify for lending.

- Exchanges must fund lending with their own capital and provide user training before loans.

FSC Tightens Grip on Crypto Lending

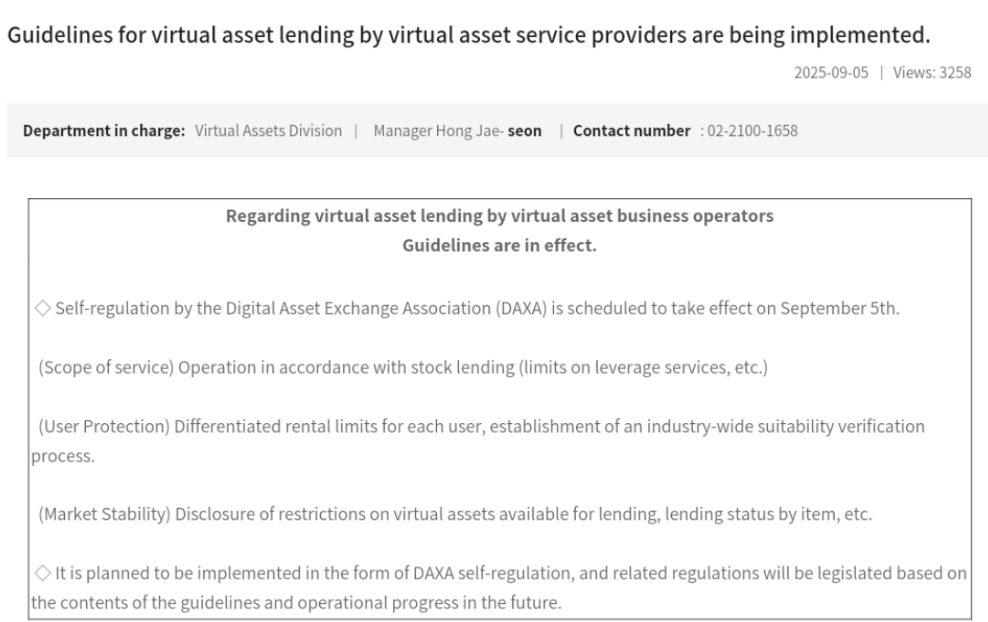

South Korea’s Financial Services Commission (FSC) has rolled out new regulations governing cryptocurrency lending services. Announced on Friday, the rules impose a 20% interest rate ceiling, ban leveraged lending, and restrict lending to the top 20 digital assets by market capitalization or tokens listed on at least three won-based exchanges.

Source:

FSC

Source:

FSC

The measures come after regulators hinted in late July at plans to enhance oversight following the introduction of leveraged lending services by local crypto platforms. In August, South Korea’s FSC ordered all domestic crypto exchanges to suspend lending products, citing risks to investors and market stability.

New Compliance Requirements for Exchanges

Under the new framework, exchanges must ensure stricter compliance before offering lending services. First-time borrowers are now required to complete online training and suitability assessments organized by the Digital Asset eXchange Alliance (DAXA).

In the event of forced liquidations, platforms must notify users in advance and allow them to add collateral to prevent liquidation. Additionally, exchanges must fund lending operations with their own capital outsourcing or collaborating with third parties is explicitly prohibited to prevent regulatory loopholes.

Growing Scrutiny Amid Rising Popularity

The FSC explained that the rules were prompted by industry concerns over the absence of formal lending regulations. The move reflects South Korea’s increasingly cautious stance toward crypto, with FSC chairman nominee Lee Eok-won recently stressing that digital assets carry “extreme volatility, lack monetary function, and have no intrinsic value.”

Meanwhile, adoption continues to rise. By March, more than 16 million South Koreans over 30% of the population were registered crypto exchange users, with much of the surge driven by financially pressured young people. A recent report revealed that wealthy families and family offices around Asia are doubling their crypto allocations, with some making plans to allocate around 5% of their portfolios to the asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid’s USDH Ticker Assigned via Onchain Vote

Bitcoin’s Bull Run Continues Despite Short-Term Corrections

HYPE Token Soars as Paxos Aims to Lead USDH Stablecoin

Michael Saylor’s Strategy Acquires 1,955 Bitcoin