SEC and CFTC are jointly evaluating a shift to 24/7 markets to support onchain finance, proposing rules for crypto derivatives and perpetual futures; the move could increase capital velocity and global market alignment while raising operational and overnight risk for traders across time zones.

-

Regulators propose evaluating 24/7 trading to align U.S. markets with a global, always-on economy.

-

Focus areas include crypto derivatives, perpetual futures, FBOT oversight and quantum-resistant safeguards.

-

Expanding hours may boost liquidity but increases overnight exposure and systemic risk; assessments vary by asset class.

24/7 markets debate: SEC and CFTC examine always-on trading for crypto derivatives and equities — Read how this impacts traders, regulators, and market infrastructure.

A 24/7 trading cycle would create new opportunities and risks for traditional financial markets that do not operate on nights and weekends.

What would a move to 24/7 markets mean for U.S. capital markets?

24/7 markets would extend trading outside traditional hours to better serve global liquidity and onchain finance needs. Regulators say expanded hours could increase capital velocity and market access but would also require new rules for derivatives, surveillance, clearing and operational resilience across time zones.

How are the SEC and CFTC approaching 24/7 trading?

The SEC and CFTC issued a joint statement exploring 24/7 capital markets, stressing that a one-size-fits-all approach is unlikely. They prioritized regulatory clarity for event contracts and perpetual futures — futures without an expiry — and signaled that some asset classes may be more suitable for extended hours than others.

The agencies emphasized that scaling onchain finance requires continuous trading windows across asset classes to support decentralized settlement models. Key considerations include market surveillance, trade reporting, custody safeguards and cross-border coordination.

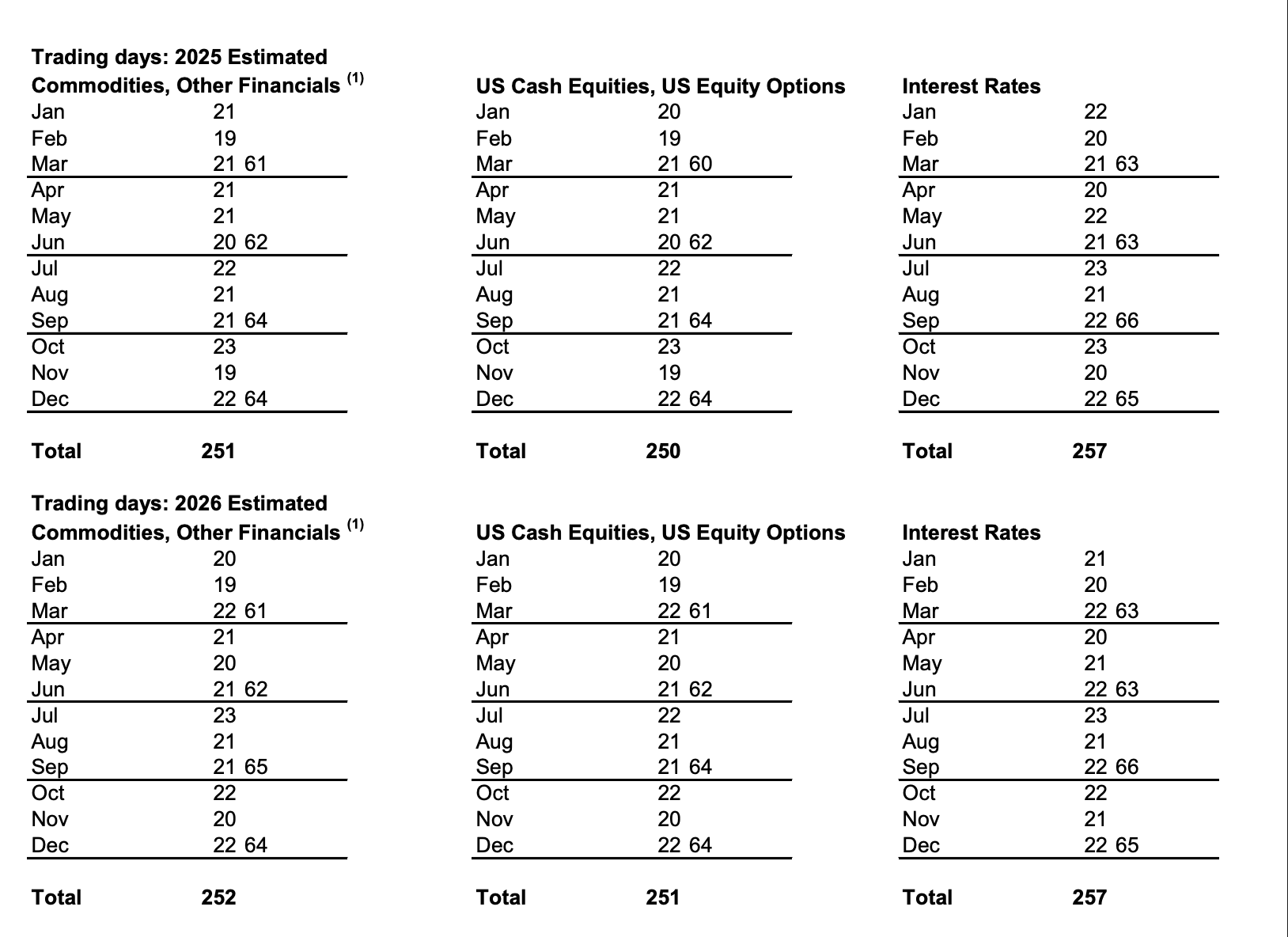

A table of eligible trading days for each month on the New York Stock Exchange (NYSE). Source: NYSE

Why are regulators linking 24/7 trading to crypto derivatives and perpetual futures?

Regulators view crypto derivatives and perpetual futures as central to onchain finance because these instruments trade continuously on many venues today. The SEC and CFTC are exploring tailored rules to manage unique risks such as counterparty exposure, funding rate mechanics and continuous settlement cycles.

Perpetual futures present specific challenges: without expiry, they rely on funding mechanisms to anchor prices, which complicates margining and default management in a continuous market.

When did this regulatory push accelerate?

The push accelerated after a July policy report from the U.S. executive branch that recommended interagency coordination on crypto oversight. The report directed the SEC and CFTC to cooperate, suggested the CFTC has clear authority over certain spot crypto markets, and encouraged frameworks like FBOTs for offshore exchanges serving U.S. clients.

In August, the CFTC outlined a pathway using the Foreign Board of Trade (FBOT) framework to allow regulated offshore exchanges to serve U.S. customers under oversight. The FBOT concept and the administration’s report also called for quantum-resistant architecture to protect cryptographic systems from future quantum threats.

How would 24/7 trading affect traders and market structure?

Always-on trading could increase capital velocity and provide continuous price discovery, benefiting global participants. However, continuous markets raise operational and systemic risks: overnight positions may be exposed to informed participants in other time zones, and infrastructure must handle round-the-clock settlement, surveillance and incident response.

Regulatory priorities include clear rules for event contracts, robust clearing frameworks for continuous derivatives, resilient custody solutions and quantum-resistant cryptography to future-proof market systems.

Frequently Asked Questions

How soon could 24/7 markets be implemented for crypto derivatives?

Implementation timelines depend on rulemaking, industry readiness and infrastructure upgrades. Regulators signaled intent but expect phased changes, beginning with pilot programs or asset-class-specific approvals rather than an immediate switch to round-the-clock trading.

Who would oversee offshore exchanges serving U.S. clients?

Regulators referenced the Foreign Board of Trade (FBOT) pathway for regulated offshore exchanges to serve U.S. customers under oversight. The FBOT framework aims to apply U.S. oversight standards to eligible offshore venues when appropriate.

Key Takeaways

- Regulatory review: SEC and CFTC jointly exploring 24/7 markets with asset-specific approaches.

- Risk vs reward: Always-on trading may increase liquidity and capital velocity but raises overnight, operational and systemic risks.

- Technical priorities: Focus on derivatives rules, clearing, custody, surveillance and quantum-resistant cryptography.

Conclusion

The SEC and CFTC’s joint exploration of 24/7 markets responds to the realities of onchain finance and global trading, balancing liquidity gains against increased operational and risk-management demands. Policymakers will likely pursue phased, asset-specific changes while emphasizing surveillance, clearing and cryptographic resilience. Stakeholders should prepare for pilot programs and evolving rulemakings.