Cardano has entered the Wyckoff markup stage, trading near $0.83 with a Total Value Locked (TVL) of $375.49M and strong on-chain activity. This markup signals buyer-dominated momentum with potential upside toward $1.45 if volume and demand persist.

-

Cardano confirmed in Wyckoff markup stage at $0.83

-

On-chain metrics: TVL $375.49M, 24,955 active addresses, daily DEX volume $6.81M

-

Whale flows: 50M ADA sold in 48 hours; ADA still up 9% month-over-month

Cardano Wyckoff markup stage: ADA trades at $0.83 with $375M TVL, whale flows, and technical targets to $1.45 — read levels, on-chain metrics, and outlook now.

What is the Cardano Wyckoff markup stage?

Cardano Wyckoff markup stage is the phase in the Wyckoff cycle where demand outpaces supply, driving sustained price appreciation. ADA trading at ~$0.83 and leaving a multi-year accumulation range indicates buyers are pushing price higher, consistent with typical markup-stage characteristics.

How strong is Cardano’s on-chain data supporting the markup?

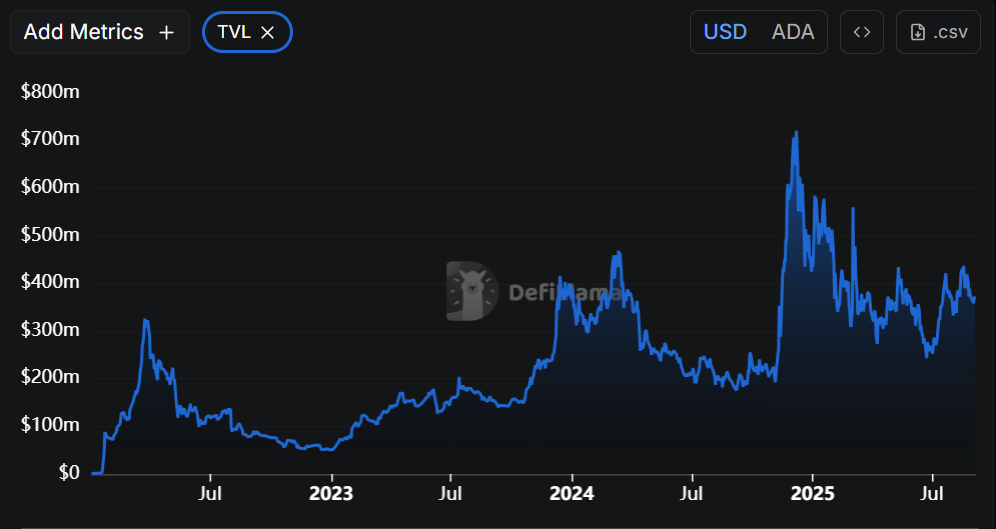

On-chain indicators point to growing ecosystem engagement. Cardano’s TVL is reported at $375.49 million, stablecoin capitalization at $38.83 million, and daily DEX volume at $6.81 million. Active addresses reached 24,955 in 24 hours, showing steady user activity.

| Total Value Locked (TVL) | $375.49M |

| Stablecoin Capitalization | $38.83M |

| Daily DEX Volume | $6.81M |

| Active Addresses (24h) | 24,955 |

| Market Cap | $30.79B |

| Fully Diluted Valuation | $37.97B |

Why does whale activity not invalidate the markup?

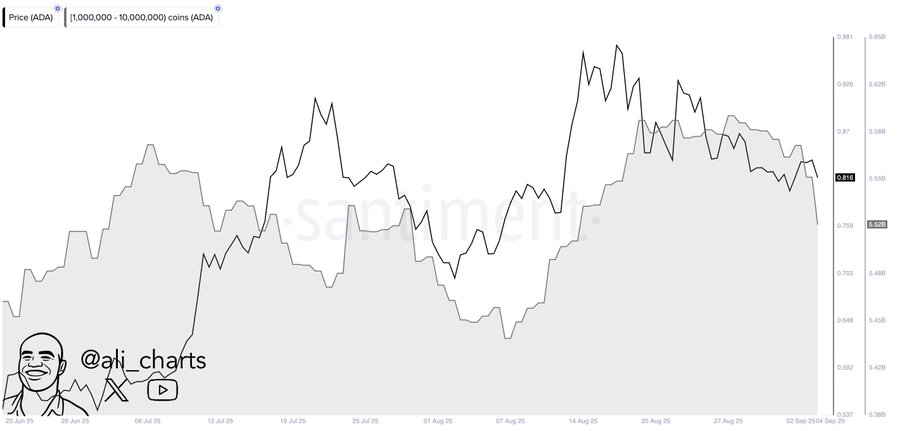

Large-scale selling occurred — 50 million ADA moved off-chain over 48 hours — but market absorption remained strong. Despite whale sales, ADA posted a 9% gain over the past month, showing buyers are stepping in and maintaining upward pressure.

What are the key technical levels traders are watching?

Immediate resistance: $0.84 and $0.88. Higher targets: $0.92 and $1.01. Support levels: $0.78 and $0.72. Analysts note that staying above $0.78 preserves the parabolic markup thesis; a sustained breakout above $0.88 with rising volume would increase the likelihood of reaching distribution zones near $1.45.

BREAKING NEWS:

CARDANO JUST ENTERED ITS PARABOLIC PHASE 😱😱😱

Cardano $ADA may have just entered its parabolic phase, according to the Wyckoff cycle.

The stage is known for explosive price action and rapid upward momentum.

Will Cardano set new all-time highs from here? pic.twitter.com/7U5GRe7PTC

— Mintern (@MinswapIntern) September 4, 2025

Source: DeFiLlama

Source: DeFiLlama

Volume patterns show higher participation during recent sessions as price exits the long accumulation band observed between 2022 and 2023. This aligns with a classic Wyckoff markup: consolidation, breakout, then accelerating trend as more participants enter.

How should traders and investors interpret this phase?

Traders should watch volume confirmation and support at $0.78. Investors focused on fundamentals can note growing TVL and active address metrics as signs of network utility. Risk management remains important: set stop levels below key supports and size positions to account for volatility typical of parabolic moves.

Source: AliCharts (X)

Source: AliCharts (X)

Frequently Asked Questions

Is Cardano in a parabolic phase?

Current price action and Wyckoff structure indicate Cardano is entering a parabolic markup phase. Confirmation requires sustained volume and price holding key supports above $0.78.

What on-chain metrics support Cardano’s rally?

TVL at $375.49M, stablecoin cap $38.83M, daily DEX volume $6.81M, and ~24,955 active addresses in 24 hours support increased network use and liquidity.

Key Takeaways

- Wyckoff markup confirmed: ADA trading at ~$0.83 suggests buyer-led momentum.

- On-chain strength: TVL $375.49M and near-25k active addresses indicate healthy activity.

- Watch levels: Support $0.78; resistance $0.84–$0.88; upside target near $1.45 if volume continues.

Conclusion

Cardano’s move into the Wyckoff markup stage, supported by $375.49M TVL, active addresses, and absorbed whale selling, points to a bullish technical backdrop. Traders should monitor volume and $0.78 support. For investors, on-chain growth and market structure warrant continued observation and disciplined risk management.