Trader Spots Bitcoin Flashing Signal That Precedes Bear Markets, Updates Outlook on One Ethereum Competitor

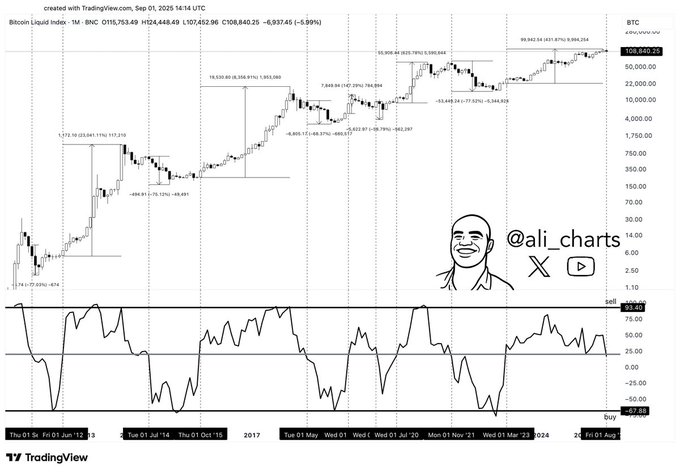

Cryptocurrency analyst and trader Ali Martinez says that one indicator is signaling a bearish outlook for Bitcoin ( BTC ).

Martinez tells his 153,900 followers on X that the Chande Momentum Oscillator (CMO), an indicator used in technical analysis to measure the strength of a trend, dipped last month to a level that is typically associated with a bear market.

“Bitcoin CMO above 20 has signaled bull markets, and below 20 has marked bear markets.

August’s close just pushed it back below 20.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading at $110,911 at time of writing.

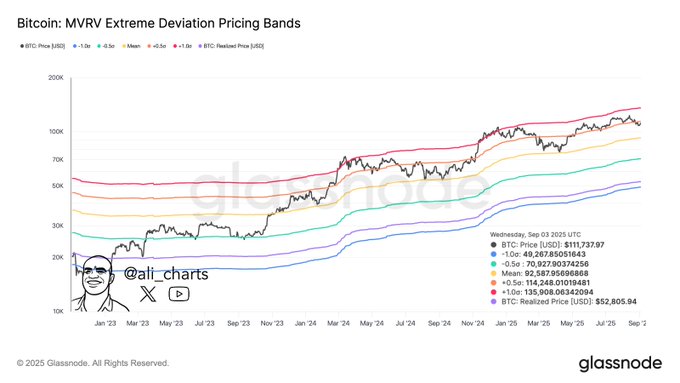

The analyst further says that the market value to realized value (MVRV) pricing bands of Bitcoin, which are used to identify potential resistance and support levels, are signaling that the crypto king could drop drastically if it fails to climb above a key price area.

“MVRV Pricing Bands show that as long as Bitcoin BTC stays below $114,250, key support sits at $92,600.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Next up is Cardano ( ADA ). Martinez says the 11th-largest crypto asset by market cap is forming a falling wedge pattern, a pattern that can signal a potential reversal of a downtrend in technical analysis. According to Martinez, Cardano could go up by a little over 10% from the current level and hit a price of $0.94.

Source: Ali Martinez/X

Source: Ali Martinez/X

Cardano is trading at $0.83 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!