Americans Lose $8,900,000,000 To Scams in One Year, Says Federal Reserve – Here’s the Top Five Fraudulent Attacks Now Underway

The Federal Reserve Bank of Kansas City is warning about a surge in new financial scams targeting Americans in the last five years.

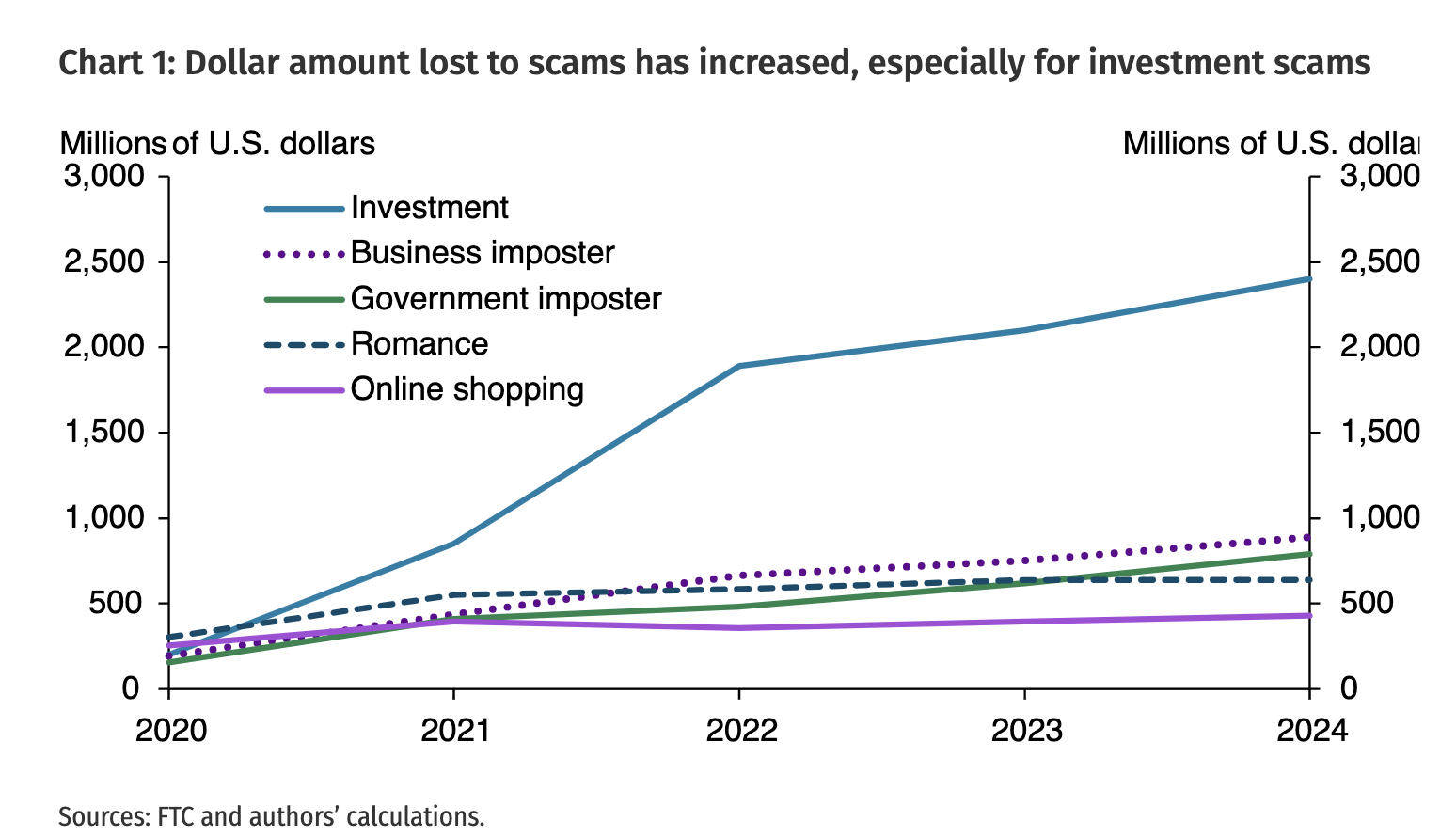

According to a new briefing from the Kansas City Fed, the amount of money U.S. consumers lost to scams has more than tripled between 2020 and 2024, skyrocketing from around $2.6 billion to $8.9 billion last year.

The top five most lucrative scam types – ranging from investment schemes and imposter fraud techniques like posing as businesses or government agencies, to romance and online shopping scams – now account for 60% of total fraud losses, up from 42% in 2020.

Each scam category saw dramatic growth. Investment scams led the pack with losses increasing nearly twelvefold, while imposter scams surged about fivefold, according to the Kansas City Fed.

New contact methods like social media, pop-ups, and mobile apps are now more effective than traditional methods like mail, phone, email, text – and consumers are falling for them at higher rates.

On the payments side, the trend is toward more digital methods. For investment fraud, cryptocurrency now accounts for about 40% of payment methods, while bank transfers have surged across nearly all scam types.

Source: Kansas City Fed

Source: Kansas City Fed

Says the bank,

“These trends have implications for scam mitigation efforts. Social media and digital platforms have important roles to play in stopping scams, as scammers increasingly use social media and web- or app-based methods to contact consumers.

Financial institutions and other payment service providers may need to develop and adopt mitigation tools that identify scams quickly and intercept payments before they reach scammers, as scammers may increasingly target newer payment methods, including real-time payments and payment apps.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Chair’s Dovish Tone Signals Rate Cuts May Resume in September; Slower Capital Inflows and Sector Rotation Lead to BTC Correction (08.18~08.24)

After the dovish remarks from the Federal Reserve Chairman, non-farm payrolls and August inflation data have become the main trading focuses for the market going forward.

US employment data supports restarting interest rate cuts in September, new SEC regulations cool down treasury companies, BTC weekly increase of 2.66% (09.01~09.07)

The new SEC regulations will slow down the pace and scale of acquisitions by treasury companies, which the market views as a significant bearish factor.

Gachapon on the blockchain is already a hundred-million dollar market

From Labubus to Pokémon

The "perfect macro narrative" is forming—will the crypto market usher in the start of a new quarterly trend?

If rate cuts are completed and a dovish stance is expressed, it may drive the market to break through resistance. If an unexpectedly hawkish stance occurs (a low probability event), it could trigger a pullback.

Trending news

MoreFed Chair’s Dovish Tone Signals Rate Cuts May Resume in September; Slower Capital Inflows and Sector Rotation Lead to BTC Correction (08.18~08.24)

US employment data supports restarting interest rate cuts in September, new SEC regulations cool down treasury companies, BTC weekly increase of 2.66% (09.01~09.07)