Crypto VC Funding: AlloyX Limited dominates with $350m deal

Crypto venture funding surged past $700 million last week, driven by a blockbuster $350 million M&A deal and a wave of AI- and infrastructure-focused projects.

From Aug. 31 to Sept. 6, 13 crypto ventures collectively raised $709.6 million, with AlloyX Limited’s M&A transaction leading the pack. Infrastructure platforms and AI-powered startups, including Kite AI, Aria Protocol, and Everlyn, dominated funding rounds, highlighting investors’ growing appetite for scalable blockchain solutions and artificial intelligence applications.

- Crypto VC funding hit $709.6m across 13 projects from Aug 31–Sept 6.

- AlloyX’s $350m M&A deal was the largest, driving infrastructure growth.

- AI-focused projects like Kite AI, Aria Protocol, and Everlyn raised capital.

Here’s a detailed breakdown of this week’s crypto funding developments as per Crypto Fundraising data :

AlloyX Limited

- Raised $350 million through M&A

- AlloyX is a payment infrastructure and stablecoin platform

Etherealize

- Etherealize, an institutional business development firm, secured $40 million in an unknown round

- Investors include Electric Capital, Paradigm, and Vitalik Buterin

Utila

- Utila, a non-custodial wallet platform, now has $22 million in a Series A round ($51.5 million total)

- It’s backed by Redstone Venture Capital, Nyca Partners, and Wing VC

Kite AI

- Kite AI, an EVM-compatible Layer 1 blockchain, gathered $18 million in a Series A round

- Investors include Immersion Ventures, General Catalyst, and 8VC

Aria Protocol

- Aria Protocol raised $15 million in a Seed round

- Polychain Capital, Neoclassic, and Story Protocol took part in the fundraise

Everlyn

- Everlyn secured $15 million from Mysten Labs, Selini, and Nesa

- The startup has a fully diluted valuation of $250 million

Projects > $15 Million

- RISC Zero (Boundless), $13.7 million in a Public sale with $290 million fully diluted valuation

- Tangany, $11.64 million in a Series A round

- Plural, $7.13 million in a Seed round

- Kea, $7 million in a Seed round with $47 million fully diluted valuation

- Reflect, $3.75 million in a Seed round

- Wildcat Labs, $3.5 million in a Seed round

- Maiga AI, $2 million in a Strategic round

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

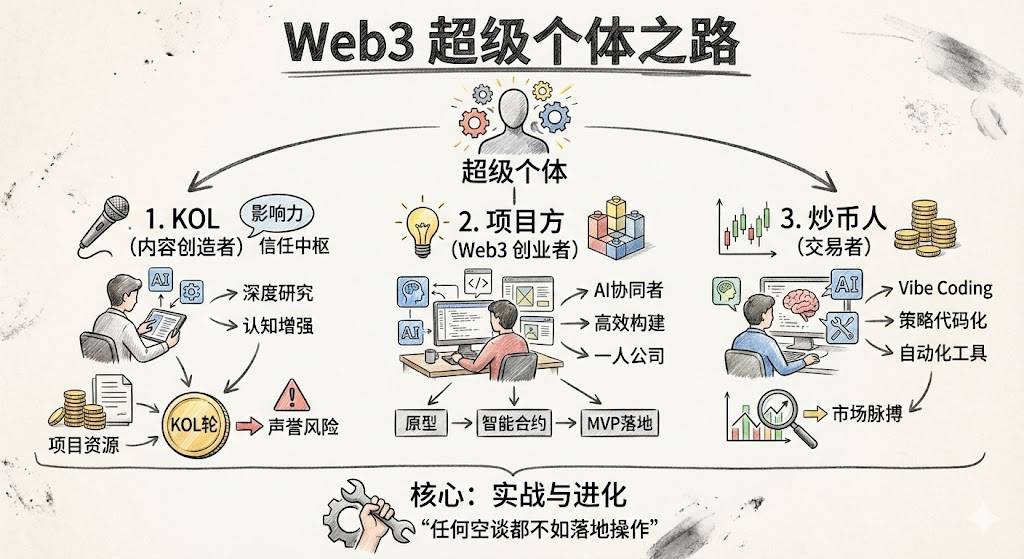

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.