Tether Moves Beyond Stablecoins With AI Chat App Powered by Crypto Transfers

This move reflects Tether’s broader expansion into AI, Bitcoin mining, and other sectors as it seeks to position itself beyond stablecoin issuance.

Tether is preparing to merge its artificial intelligence platform, QVAC AI, with its peer-to-peer messaging app Keet, aiming to deliver fully private, device-based operations.

The move, announced by Tether CEO Paolo Ardoino on September 6, underscores the company’s push to extend its reach beyond stablecoins and into privacy-focused communications.

Tether’s Keet App Combines Crypto Payments And Private AI

According to Ardoino, QVAC AI will give Keet capabilities such as instant language translation and audio transcription. It will also support conversation summarization and chatbot functions.

The messenger will also process digital asset transactions, including Bitcoin, USDT, XAUT, and Lightning payments.

In addition, the company aims to remove reliance on cloud infrastructure and strengthen user control over personal data by keeping all functions on-device.

Ardoino described the project as the first attempt to deliver “all conversational AI features, 100% local on device and private.”

“Keet + QVAC AI will be the first and probably only messaging app that will enable all conversational AI features, 100% local on device and private,” he stated.

This comment highlights Tether’s focus on privacy at a time when most messaging services store and analyze user data on external servers.

Holepunch powers Keet as a platform that enables “unclouded” applications, connecting users directly without centralized intermediaries. QVAC AI, meanwhile, is structured to run natively on everyday devices such as smartphones and wearables.

When combined, the two tools are expected to produce a communication service that merges AI utilities with secure payments. The setup ensures that data remains in the hands of users.

The Keet integration follows Tether’s broader strategy of applying QVAC AI across different products.

Earlier this year, the company confirmed plans to embed the technology into its Bitcoin Mining OS. The upgrade is intended to help operators track real-time performance and optimize output.

These moves build on a series of expansions that have taken Tether into fields such as artificial intelligence, Bitcoin mining, digital education, and even gold markets.

Through these initiatives, Tether is positioning itself as a diversified technology firm rather than solely a stablecoin issuer.

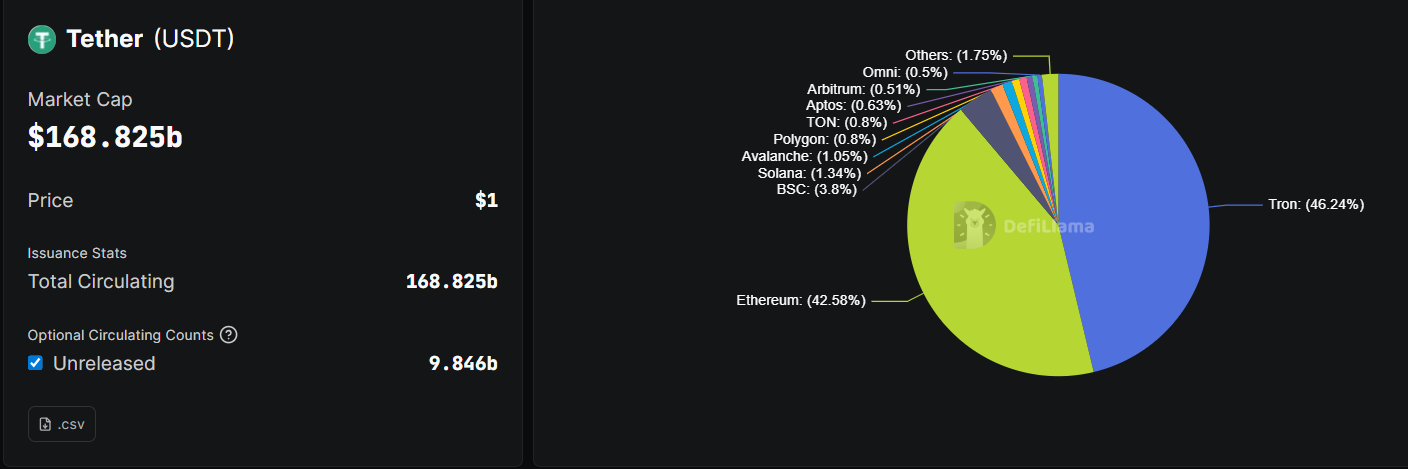

Tether’s USDT Stablecoin’s Market Cap. Source:

DeFiLlama

Tether’s USDT Stablecoin’s Market Cap. Source:

DeFiLlama

Notably, Tether’s flagship USDT stablecoin is the largest in the industry with a market capitalization of nearly $170 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump admin considers annual license for Samsung, SK Hynix to operate chip factories in China

Share link:In this post: The U.S. is considering annual “site licenses” for Samsung and SK Hynix to export chipmaking supplies to their Chinese factories. The new system would require yearly approvals with exact shipment quantities. South Korea welcomes the compromise, but officials have voiced concern over supply disruptions and added regulatory burdens.

Metaplanet adds 136 BTC to treasury in ongoing Bitcoin strategy

Share link:In this post: Metaplanet has bought an additional 136 BTC at an average price of roughly 111,666 per Bitcoin. The company’s latest acquisition also brings its total Bitcoin holdings to 20,136 BTC at an average price of approximately 15.1 million yen per BTC. Metaplanet plans to raise $880M to issue up to 555 million new shares directed towards BTC purchases.

OECD warns most crypto investors face high risks from low literacy

Share link:In this post: The OECD says most adults who know or own crypto show weak money and digital skills. Many investors do not understand that crypto is not legal tender or that losses are often permanent. The OECD urges governments to teach money skills and set stronger protections for small investors.

SOL Strategies secures Nasdaq listing under STKE