Fed Rate Cut Hopes Rise: Bitcoin Price Doesn’t Follow

Weak US jobs data increased hopes for Fed rate cuts, but Bitcoin's price struggled to sustain a rally amid significant spot ETF outflows and a cooling market.

Welcome to the Asia Pacific Morning Brief—your essential digest of overnight crypto developments shaping regional markets and global sentiment. Monday’s edition is last week’s wrap-up and this week’s forecast, brought to you by Paul Kim. Grab a green tea and watch this space.

Expectations for three interest rate cuts this year have returned to the market following a weakening US jobs report. Major US stock indices rallied, but Bitcoin’s price saw a relatively muted response.

Jobs Report Worsens, Fuels Rate Cut Bets

Last week, Bitcoin (BTC) climbed 2.72% and Solana (SOL) rose 2.64%. However, Ethereum (ETH) underperformed, dropping 2.07% over the same period.

Last week’s most closely watched event in the risk asset market was the Friday release of the US August non-farm payrolls (NFP) report. This key indicator can significantly influence US interest rates and overall market liquidity.

Earlier, a surprisingly low NFP number of just 73,000 new jobs in July sparked fears of an economic crisis. These concerns prompted US Treasury Secretary Scott Bessent to suggest a 100 basis point rate cut this year, which helped propel Bitcoin to a new all-time high of $123,000.

The August data proved weaker than July’s, with only 22,000 non-farm jobs added. Furthermore, a revision of the June data revealed a loss of 13,000 jobs, marking the worst performance since 2021.

The unemployment rate also ticked up 0.1% to 4.3% from the previous month. While 4.3% is not a crisis level by historical standards, the dramatic slowdown in job growth is a concern. This suggests that the labor market could be at a turning point and may deteriorate rapidly.

According to the FedWatch Tool, the probability of three Fed rate cuts this year increased once again in response to the poor numbers. Bitcoin’s price quickly rebounded to the $113,000 level.

However, Bitcoin failed to hold onto its gains. A downturn in AI-related stocks led to a drop in the Nasdaq, which dragged Bitcoin’s price back down to the low $110,000s. There was also a wave of disappointment after Strategy(MSTR) failed to be included in the S&P 500 index.

The US spot ETF market, which has previously supported Bitcoin’s price during periods of uncertainty, also showed a weak response. On Friday, about $160.1 million flowed out of the BTC spot ETF market, with BlackRock’s IBIT seeing a $63.2 million outflow—its first in 10 days.

Ethereum’s Struggles Highlight Market Weakness

Ethereum’s situation is even worse. The weekly price trend shows it’s facing increasing downward pressure. Its biggest growth engine, the spot ETF market, saw over $780 million in net outflows last week alone, including a massive $446.71 million on Friday when the US jobs report was released.

Ethereum’s price has been somewhat resilient, likely due to continued buying from Digital Asset Treasury (DAT) companies. Public companies with extensive ETH holdings, such as Bitmine (152,300 ETH), SharpLink Gaming (39,000 ETH), and The Ether Machine (150,000 ETH), have continued to accumulate.

Ultimately, US jobs data has worsened, and rate-cut expectations have grown. Nevertheless, cryptocurrency prices have failed to see a significant or sustained rally.

While major altcoins, excluding ETH, have shown a relatively strong rebound, their gains could be limited if Bitcoin’s price fails to hold. This makes the direction of the market this week crucial.

Will the August CPI and PPI spark a BTC rally?

The US will release two key inflation reports this week: the Producer Price Index (PPI) and the Consumer Price Index (CPI).

August’s PPI, to be released on Wednesday, is expected to rise 0.3% month-over-month. Last month, a higher-than-expected PPI reading of 0.9% cooled rate-cut expectations and was a key reason Bitcoin’s price fell from the $120,000s to the low $110,000s.

Economists expect the CPI to increase 2.9% year-over-year on Thursday. Core CPI should rise 3.1%, a slight uptick from last month’s numbers. Weekly jobless claims due on Thursday are another indicator to watch.

If these inflation figures do not significantly exceed expectations, rate-cut hopes will grow even stronger. A rally in US risk assets could provide the needed momentum for Bitcoin and Ethereum. Here’s hoping investors have a profitable week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise Solana Spot Staking ETF Reaches $223 Million in Assets on First Day

x402 Protocol: A New Era of Internet Payments at the Intersection of AI and Web3

What the x402 protocol represents is far more than just an optimization of payment methods; it is a paradigm shift in the value exchange layer of the internet.

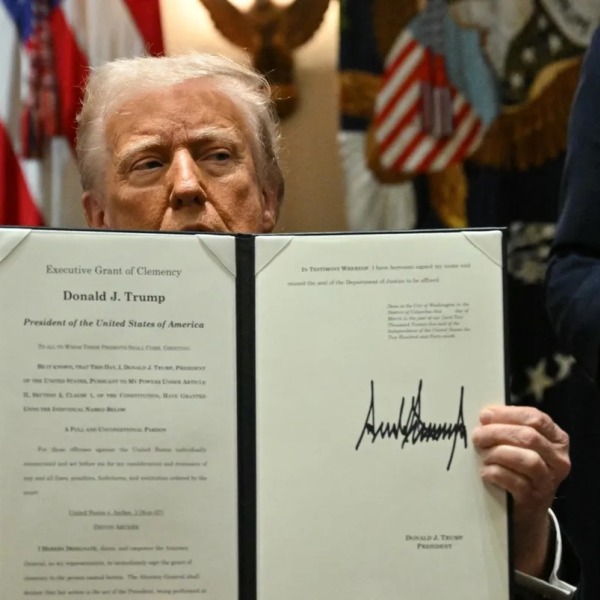

How powerful is the U.S. President’s pardon authority?

Through a workaround, the U.S. President could even pardon himself.

2025 Trading Guide: Three Essential Trading Categories and Strategies Every Trader Should Know

It is very important to clearly identify the type of trading you are involved in and make the appropriate adjustments.