Bitcoin Inches up to $112K as Stocks Hit Record Highs

Bitcoin made small gains on Monday morning, but stocks took center stage as the Nasdaq put up another record high during intraday trading.

Record Stocks Paired With Rising Bitcoin on Monday

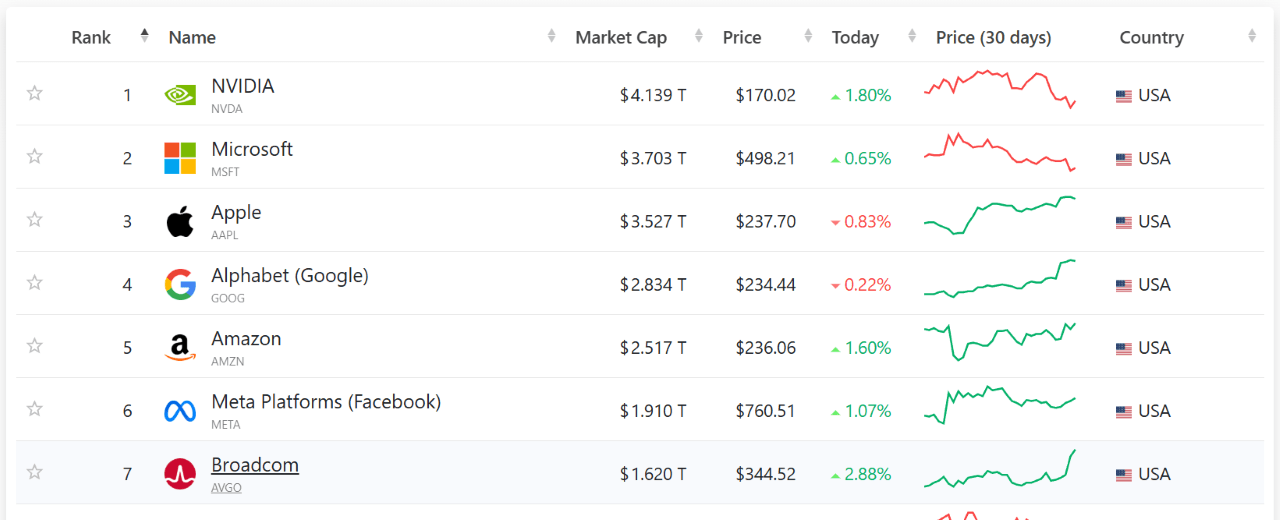

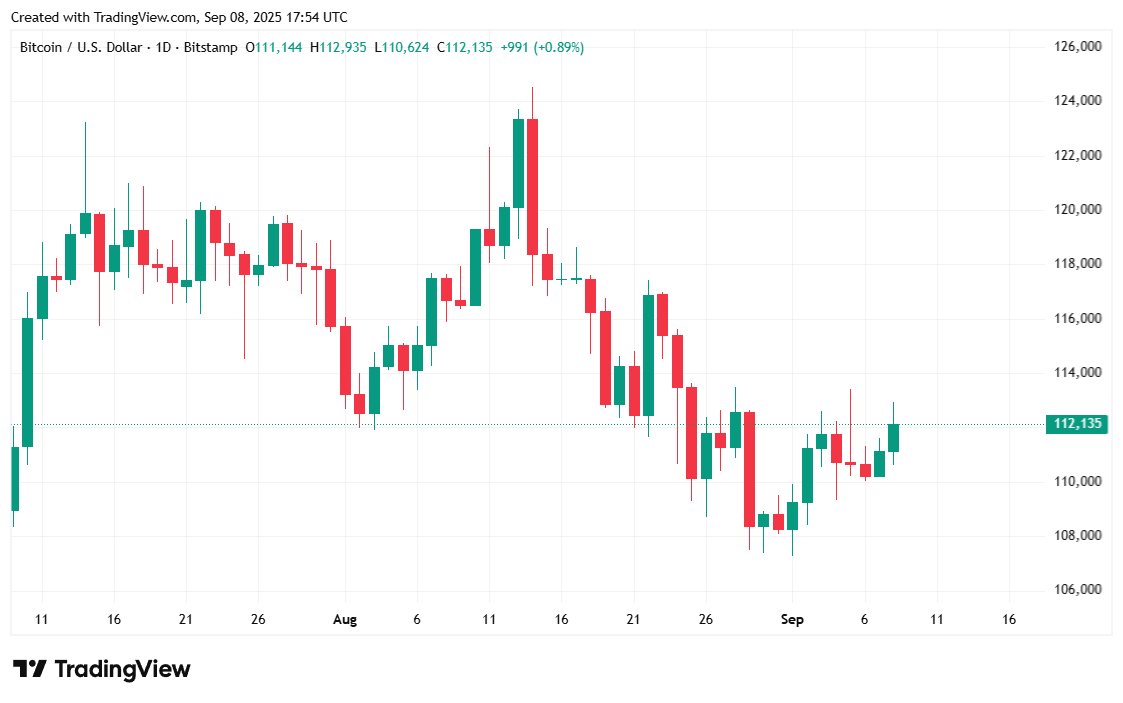

The Nasdaq Composite posted a fresh all-time high of 21,885.62 during intraday trading on Monday, marking another strong performance for tech stocks this year. AI chipmakers Broadcom (Nasdaq: AVGO) and Nvidia (Nasdaq: NVDA) led the rally, but tech giants like Microsoft and Meta also made gains. Bitcoin ( BTC) was up 1%, but still well below its $124,457.12 record from last month.

Although $4 trillion behemoth Nvidia has hogged the spotlight in the wake of the recent AI boom, Broadcom, another major player in the semiconductor space, hasn’t been too far behind. Avago Technologies merged with Broadcom in 2016 and the company has experienced significant growth ever since. Broadcom’s market capitalization currently exceeds $1.6 trillion according to Companiesmarketcap.com.

The Nasdaq’s record performance appears to have defied the weak employment data published last week, which ironically affected bitcoin more than it affected tech stocks. And now, with all eyes on the inflation data due later this week, it will be interesting to see whether stocks and bitcoin remain resilient or stumble as BTC did last week after two weak jobs reports were revealed.

Overview of Market Metrics

Bitcoin was trading at $112,244.75 at the time of writing, up 1.04% over 24 hours and 3.22% for the week, according to Coinmarketcap. BTC has hovered between $110,630.61 and $ $112,869.24 since yesterday.

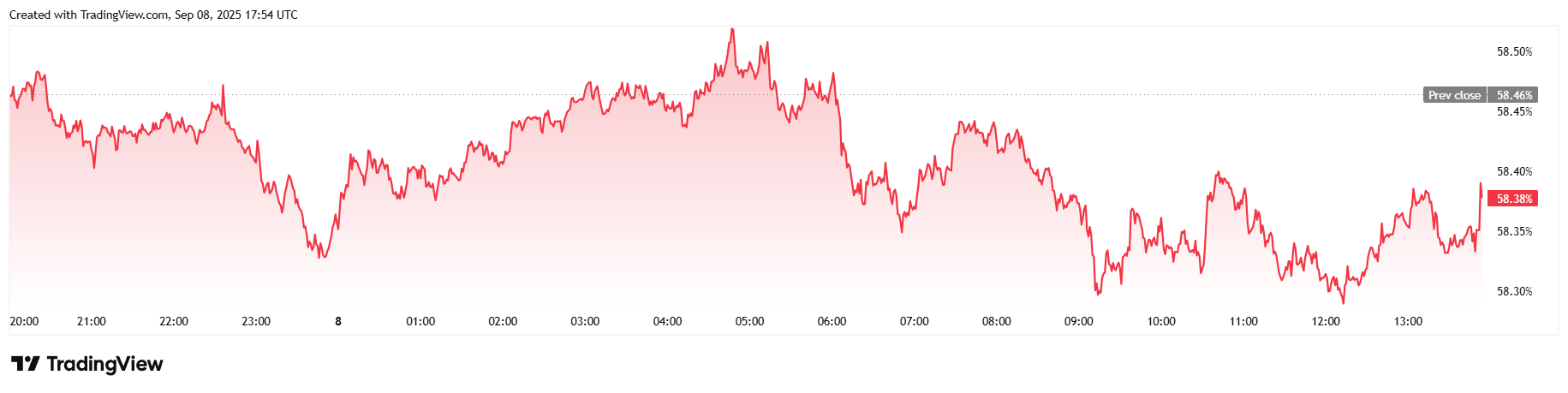

Trading volume over the past 24 hours climbed 61.13%, mostly due to the usual post-weekend increase, reaching a thinner-than-usual $39.27 billion. Market capitalization, much like price, was up 1.1% at $2.23 trillion. But bitcoin dominance fell to 58.38%, down 0.17% for the day.

Total bitcoin futures open interest jumped 3.56% to $81.77 billion over 24 hours, according to Coinglass. Bitcoin liquidations totaled $29.39 million, with most of that being short liquidations at $23.21 million and the rest being longs at $6.18 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Practical Analysis: How Traders Achieve a Comeback Victory in AI-Dominated Crypto Competitions

Crypto "No Man's Land": Cycle Signals Have Emerged, But Most People Remain Unaware

Bitcoin price gets $92K target as new buyers enter 'capitulation' mode

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.