Three-Stage Script of the Crypto Market: Short-Term Volatility, Mid-Term Boom, Long-Term Concerns — Cycle Analysis of BTC, ETH, and Altcoins

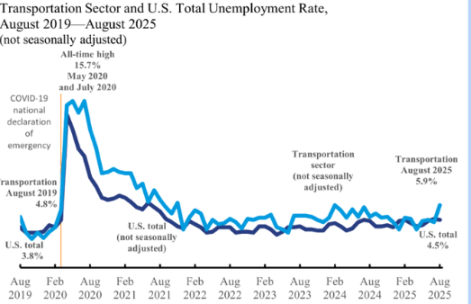

Recently, a turning point has emerged in the US macroeconomy: the unemployment rate has risen to 4.3% (the highest since 2021), and non-farm payrolls increased by only 22,000, far below market expectations. This is the first time since the pandemic that there has been a dual warning of "rising unemployment + slowing job growth."

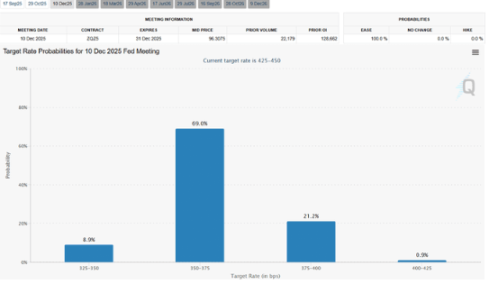

The market responded quickly: futures have fully priced in a rate cut in September (most likely 25 basis points, but 50 basis points is still possible), and traders expect at least three rate cuts in 2025. The Federal Reserve's policy pivot is now a foregone conclusion.

However, a rate cut does not mean that risk assets will immediately enter a unilateral uptrend. For the cryptocurrency market, the short-term, mid-term, and long-term will each display completely different logic in their trends.

1. Short-term (next 3–4 weeks): Panic and Correction

Weak economic data triggers concerns about recession;

Gold hits a record high, while risk assets come under pressure;

Bitcoin may retest previous lows, while Ethereum and altcoins could drop by 10–20%;

This is not the end of the bull market, but rather a risk-averse reaction at the onset of bad news.

2. Mid-term (2025 Q4 – 2026 Q1): Liquidity Drives New Highs

The implementation of rate cuts will drive bond yields lower, increase borrowing and spending, and strengthen corporate profits and the stock market;

Historical patterns show that when stocks rise, Bitcoin and altcoins often see even greater gains;

The unique aspect of this cycle is the entry of institutional funds:

Spot Bitcoin and Ethereum ETFs have opened funding channels for pension funds and asset management companies;

Altcoin ETF approvals are approaching;

Once the $7.2 trillion money market funds start to flow out due to declining Treasury yields, even if only 1% flows into the crypto market, it would be enough to push BTC and altcoins to new all-time highs.

Therefore, Q4 2025 will be a key window for an explosion of liquidity in the crypto market.

Bitcoin is likely to strengthen first, while the frenzy phase for altcoins may play out in early 2026.

3. Long-term (after 2026 Q1): Inflation Returns and Cycle Risks

The new tariffs implemented in 2025 will gradually be reflected in inflation data after 6–8 months;

If inflation rebounds while unemployment remains high, the Federal Reserve may be forced to pause rate cuts or even resume hikes, putting the market at risk of stagflation;

History shows that this often signals the peak of the stock and crypto market cycles, followed by a bear market.

Conclusion

Overall, the script for the crypto market is roughly as follows:

Short-term (next 3–4 weeks): turbulence and correction, with BTC, ETH, and altcoins possibly seeing a 10–20% pullback;

Mid-term (2025 Q4 – 2026 Q1): liquidity-driven rally, BTC likely to hit new highs, and altcoins entering a frenzy phase;

Long-term (from 2026 Q1): inflation risk and policy reversal may trigger the end of this bull market.

Core takeaway:

Short-term corrections are instinctive responses to economic signals and do not signal the end of the bull market. The real big opportunity lies in Q4 2025, but investors must also plan ahead for risk management and exit strategies in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.