XRP Price: Regulatory Transparency and Growing Institutional Interest Spark a Surge in 2025–2026

- SEC's 2025 case dismissal reclassified XRP as a digital commodity, unlocking institutional capital and removing legal uncertainty. - Strategic partnerships with major banks and the ProShares XRP ETF drove $1.2B in inflows, with 16 ETF applications pending. - XRP Ledger upgrades including EVM compatibility and AMM stabilization enhanced scalability and institutional readiness. - Market trends show XRP capturing 12% market cap as altcoins outperform, with price projections targeting $5-$7 by year-end.

The cryptocurrency landscape in 2025 stands at a decisive turning point, propelled by clearer regulations, increased institutional involvement, and ongoing technical advancements. For

Regulatory Clarity: Transforming the Landscape

The joint withdrawal of the SEC’s appeal with Ripple in August 2025 signaled a landmark shift. The court’s confirmation that XRP transactions on public exchanges do not constitute securities dealings—though institutional sales remain under securities regulations—has established a well-defined legal context. This distinction is vital: it enables XRP to function as a utility asset in secondary trading environments, similar to Bitcoin’s treatment as a commodity, while allowing institutional players to participate within a structured framework.

This outcome also indicates a broader realignment in the SEC’s stance under Chairman Paul Atkins, a vocal supporter of crypto who introduced “Project Crypto” to update digital asset oversight. The project features regulatory sandboxes, explicit custody protocols, and a focus on policies that encourage innovation. For XRP, this translates to lower risks of future regulatory crackdowns and a more transparent setting for institutional activity.

Institutional Adoption: From Banking Giants to ETFs

Ripple’s alliances in 2025 have reinforced XRP’s integration into the world’s financial systems.

Confidence among major investors has also grown with the debut of the ProShares Ultra XRP ETF (UXRP), which attracted $1.2 billion in its first month following the legal resolution. With 16 more XRP ETF applications awaiting approval, the asset is expected to receive $8.4 billion in institutional funding by the end of the year. This influx is driven not by speculation, but by XRP’s practical functions: serving as a bridge for global payments, collateral for stablecoins, and as a component in tokenized finance infrastructure.

Network Upgrades: Advancing the XRPL

Enhancements to the XRP Ledger in 2025 have significantly improved its scalability, security, and appeal to institutions. Key updates include:

- EVM Sidechain: Allowing

- Automated Market Maker (AMM) Optimization: Minimizing slippage and arbitrage opportunities for liquidity providers.

- Decentralized Identity (DID) Solutions: Supporting KYC/AML compliance for institutional participation in DeFi.

- CBDC Compatibility: Encouraging central banks to pilot digital currency projects on XRPL.

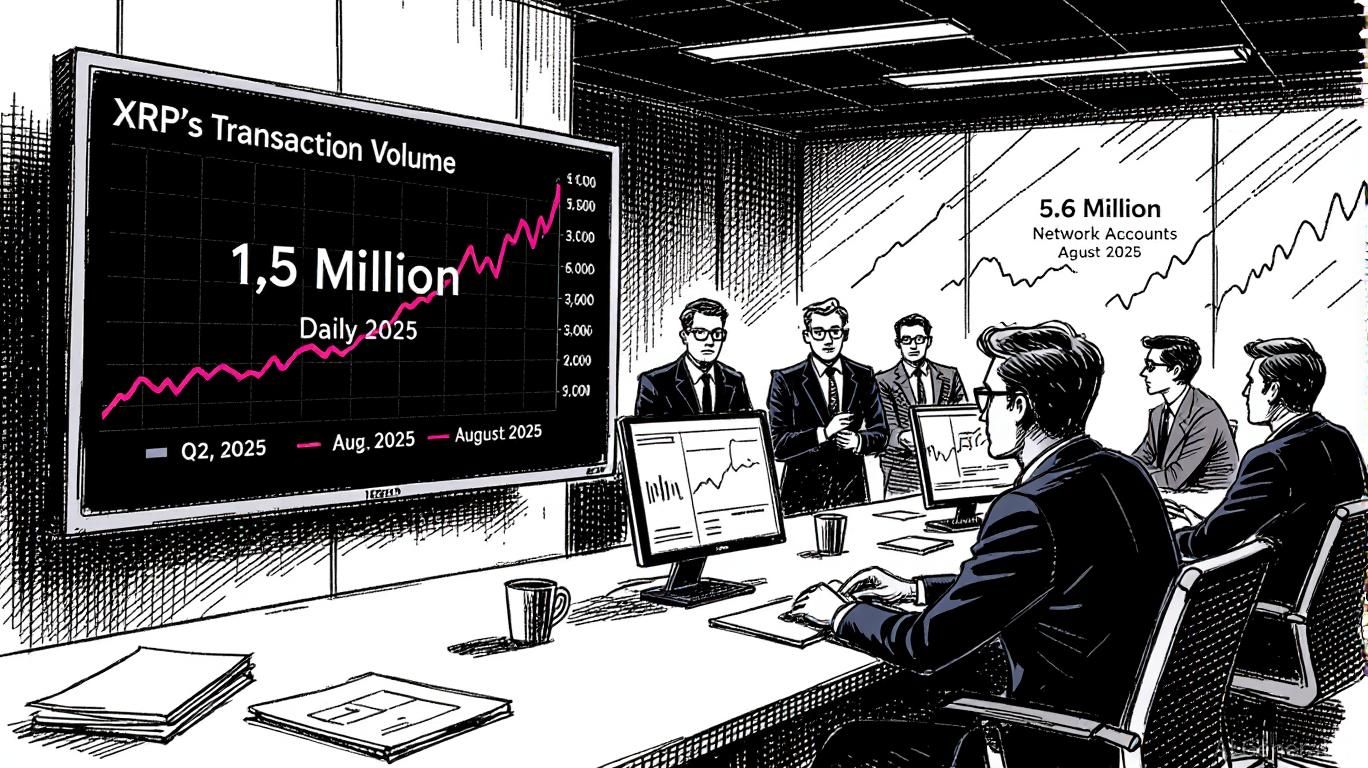

These improvements have established XRP as a hybrid solution that connects traditional financial systems with decentralized networks. The ledger’s minimal transaction fees ($0.0002 each) and ultra-fast settlements (75% within five seconds) make it particularly attractive for large-scale, cost-efficient transfers.

Macro Crypto Trends: Expanding Beyond Bitcoin

By 2025, Bitcoin’s share of the market has dropped to 59% as institutional investors increasingly turn to altcoins with practical uses. Although Ethereum remains robust, it faces headwinds from the shift to Layer-2 solutions and shrinking protocol revenues. Meanwhile, XRP’s updated classification and the wave of ETF investments have elevated it to a leading altcoin with a 12% share of the total market capitalization.

The Altcoin Season Index, now at 68%, illustrates a maturing sector where projects offering genuine utility—such as XRP’s international payment role—are outperforming purely speculative tokens. Should the Federal Reserve execute a rate cut in September 2025 as anticipated, risk appetite could further boost XRP’s traction.

Investment Outlook: Poised for a Breakout in 2025–2026

XRP offers investors a rare blend of regulatory certainty, institutional momentum, and favorable macro conditions. Major drivers include:

1. ETF Launches: A 95% likelihood that all 16 pending XRP ETFs secure approval by October 2025.

2. Economic Catalysts: The Fed’s anticipated rate reduction and an overall accommodative monetary policy.

3. Network Expansion: Sustained growth of the ODL system, further integration of stablecoins, and new central bank collaborations.

Currently, XRP’s price is fluctuating between $2.77 and $3.10. Should it surpass $3.10, a rise toward $5 by year’s end is possible, whereas a dip below $2.77 could see it revisit $2.50. Expert forecasts for 2025 span from $1.50 to $3.50, with bullish projections suggesting a potential run to $7 if conditions are especially favorable.

Conclusion: Entering a New Phase for XRP

The end of the SEC dispute, alongside institutional adoption and ongoing network improvements, has elevated XRP from a speculative investment to a fundamental piece of the global financial puzzle. As the crypto industry matures, XRP’s capabilities in cross-border settlements, stablecoin environments, and tokenized platforms place it in a strong position for 2025–2026. For those considering investment, the mix of regulatory stability and positive economic trends makes XRP an attractive long-term option—though attention should still be paid to potential delays or shifts in the broader economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing NFLXUSDT, FUTUUSDT, JDUSDT, RDDTUSDT, QQQUSDT STOCK Index perpetual futures

Bitget Trading Club Championship (Phase 15)—Trade spot and futures to share 120,000 BGB, up to 2200 BGB per user!

CandyBomb x COMMON: Trade futures to share 1,111,111 COMMON!