Revised US Jobs Report Creates Economic Worries But Optimism For Crypto

US Jobs data raises odds of three interest rate cuts, but while gold soars, crypto faces uncertainty as recession fears weigh on ETF inflows

The Bureau of Labor Statistics (BLS) is reviewing its March 2025 US Jobs report, which shows far worse data than anticipated. This may spur up to three cuts to US interest rates.

In the short term, these measures could become bullish catalysts for the crypto market. However, a full-blown recession may severely hamper institutional ETF inflows.

US Jobs Data: Interest Rate Cuts Soon?

The last US Jobs Report painted a grim picture of America’s economic situation, showing the weakest data since 2020. President Trump’s decision to fire the BLS Chief after this report cast doubt on future data, stoking fiscal worries.

Today, the BLS retroactively revised a report from March, showing that it was also worse than first believed:

The economy added 911,000 fewer jobs (or -0.6% of total employment) than initially reported during the 12 month period ending March 2025. The administrative data used to make this preliminary revision will produce a final revision in February.

— Nick Timiraos (@NickTimiraos) September 9, 2025

This US Jobs data is fueling fears of a recession, bringing gold futures to a new all-time high. In the short term, though, there may be an upside for crypto markets.

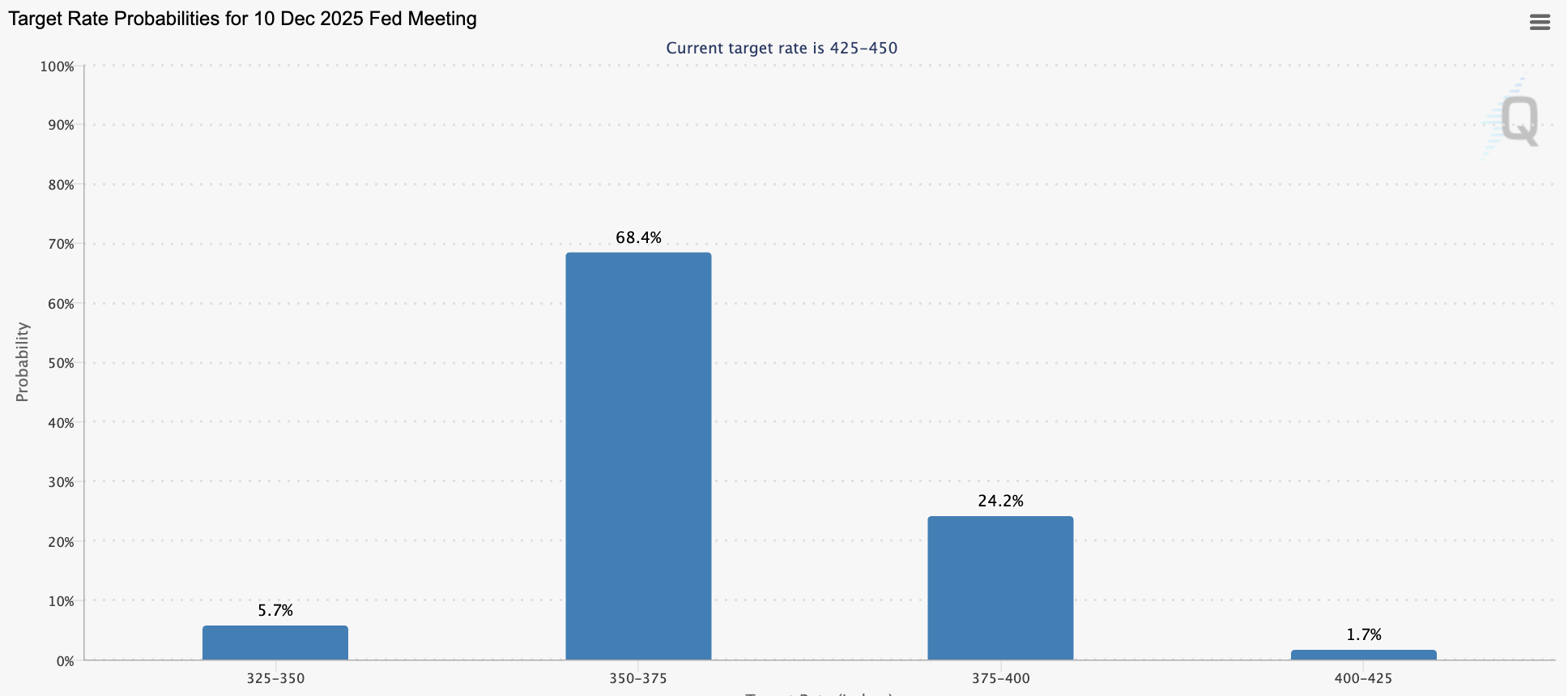

Fed Chair Jerome Powell already signaled his willingness to cut interest rates, and crypto already priced one cut in. Now, however, the CME’s FedWatch is predicting three cuts this year:

US Interest Rate Cut Odds. Source:

US Interest Rate Cut Odds. Source:

Specifically, the CME is virtually certain (92%) that the Fed will cut US interest rates later this month, has a >70% confidence that there will be a subsequent cut after that, and 68% belief in a third one in December.

The crypto market has been desperate for these measures, and President Trump threatened to fire Powell over his reluctance.

How Will Crypto React?

Still, although Bitcoin is a safe haven during a recession, these US interest rate cuts might not necessarily be the big win crypto was hoping for. After Powell’s Jackson Hole speech, traders already anticipated at least one cut, but this had a negligible impact on BTC and other token prices.

Institutional ETF inflows are now a substantial component of the global crypto market, and these actors have many concerns. In a vacuum, US interest rate cuts would signal heavy investment in risk-on assets like crypto.

However, three cuts in a few months indicate deep economic fears. That sort of environment is less likely to encourage risk.

Overall, it’s hard to predict what will happen after this data. US crypto traders are likely to receive their coveted interest rate cuts, but there’s no guarantee of success.

In the short term, at least, this will probably be bullish. Theoretically, the recession hasn’t begun yet (although this is disputed), opening a potential window for profit-taking.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

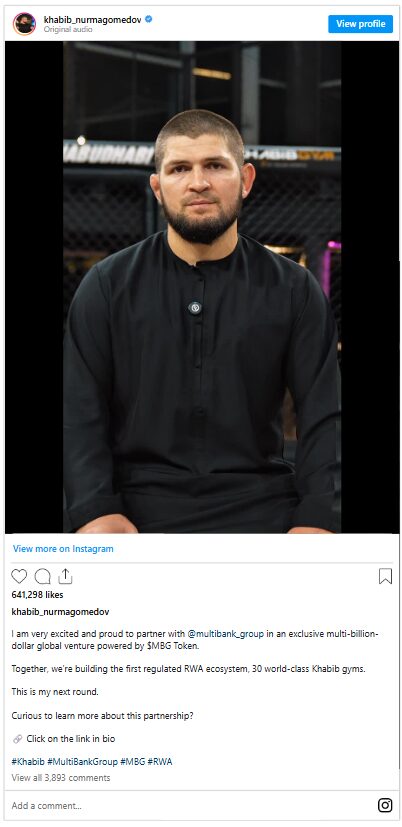

UFC Star Khabib Nurmagomedov’s MultiBank Partnership Tokenizes His Global Gym Brand on Mavryk

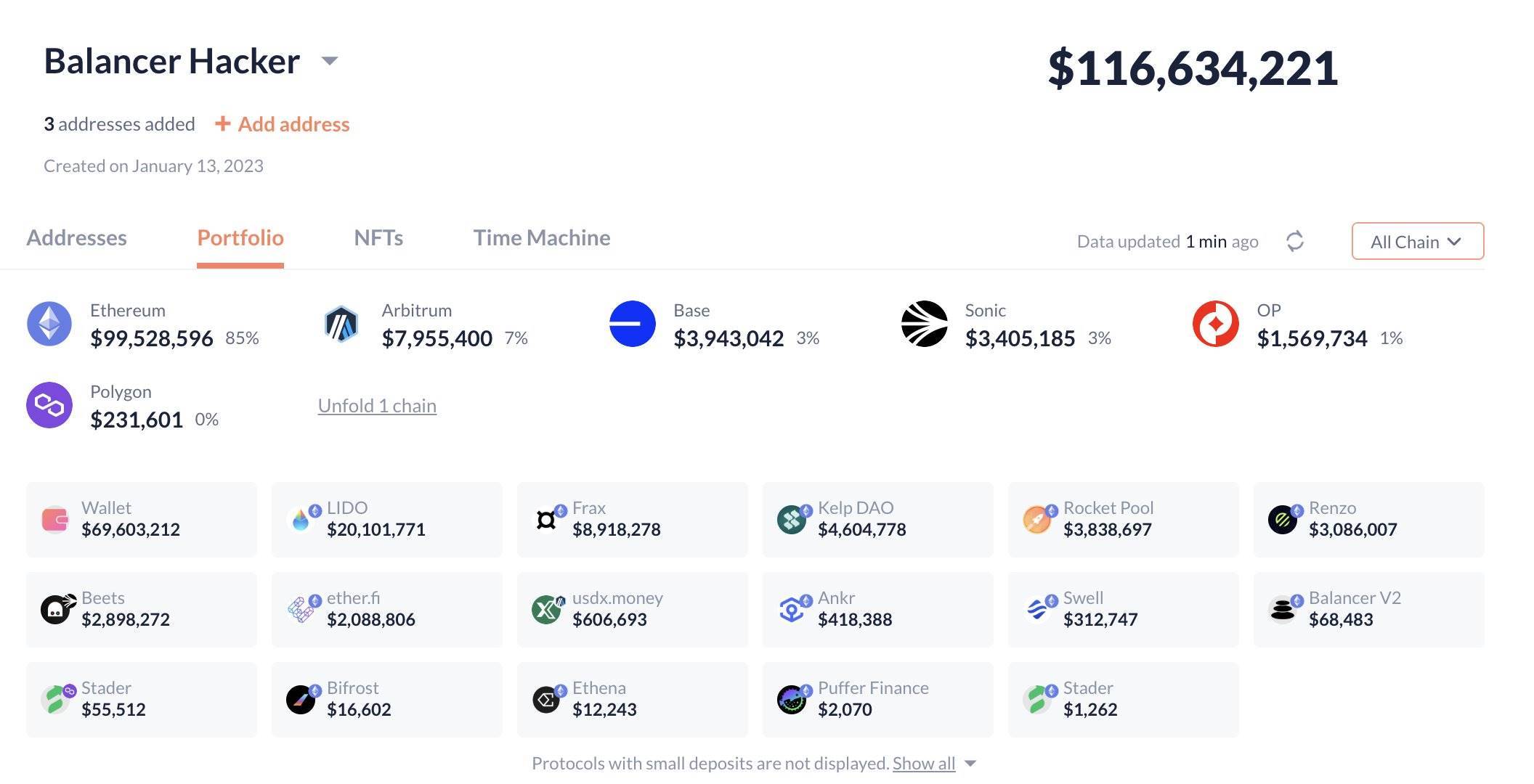

Six incidents in five years with losses exceeding 100 millions: A history of hacker attacks on the veteran DeFi protocol Balancer

For bystanders, DeFi is a novel social experiment; for participants, a DeFi hack is an expensive lesson.

Review of Warplet: How a Small NFT Sparked the Farcaster Craze?

A meme, a mini app, and a few clicks—just like that, the Farcaster community has a brand new shared story.

Hong Kong’s HKMA Launches Fintech 2030 to Drive Future Financial Innovation