Bitcoin and Ethereum Price Faces Critical Risk After Israel Strikes Qatar

Bitcoin and Ethereum fell after Israel’s strike in Qatar. Gold hit record highs, oil spiked, and $52M in crypto longs were liquidated in an hour.

Bitcoin and Ethereum fell sharply on Tuesday after Israel launched an unprecedented strike in Qatar, targeting senior Hamas officials. The escalation rattled global markets, sending investors rushing into gold and oil while crypto prices sank.

Bitcoin and Ethereum immediately dropped over 1%, while Solana and XRP each lost 1.5%. Dogecoin led losses, sliding 3.2%. Liquidation data reveals more concerning risks ahead.

Another Geopolitical Conflict To Derail The Bull Market?

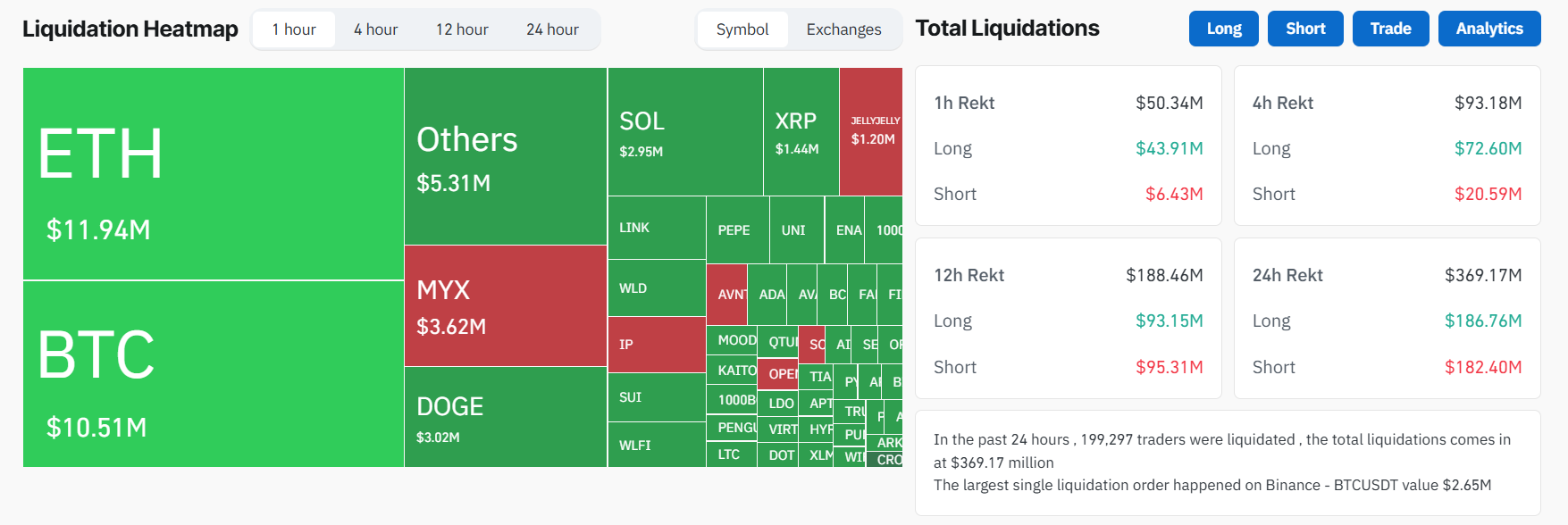

Data from Coinglass showed heavy liquidations as volatility surged. Nearly $52 million in leveraged positions were wiped out in the last hour.

Long traders bore the brunt, with $44 million liquidated. Ethereum accounted for $11.9 million in liquidations, followed by Bitcoin with $10.5 million.

The scale of losses highlights how quickly leverage unraveled. In total, liquidations amounted to $370 million over the past 24 hours. Most positions were long bets on continued gains, exposing optimism ahead of the strike.

Bitcoin and Ethereum Long Positions Liquidated After Israel’s Strike on Qatar. Source: Coinglass

Bitcoin and Ethereum Long Positions Liquidated After Israel’s Strike on Qatar. Source: Coinglass

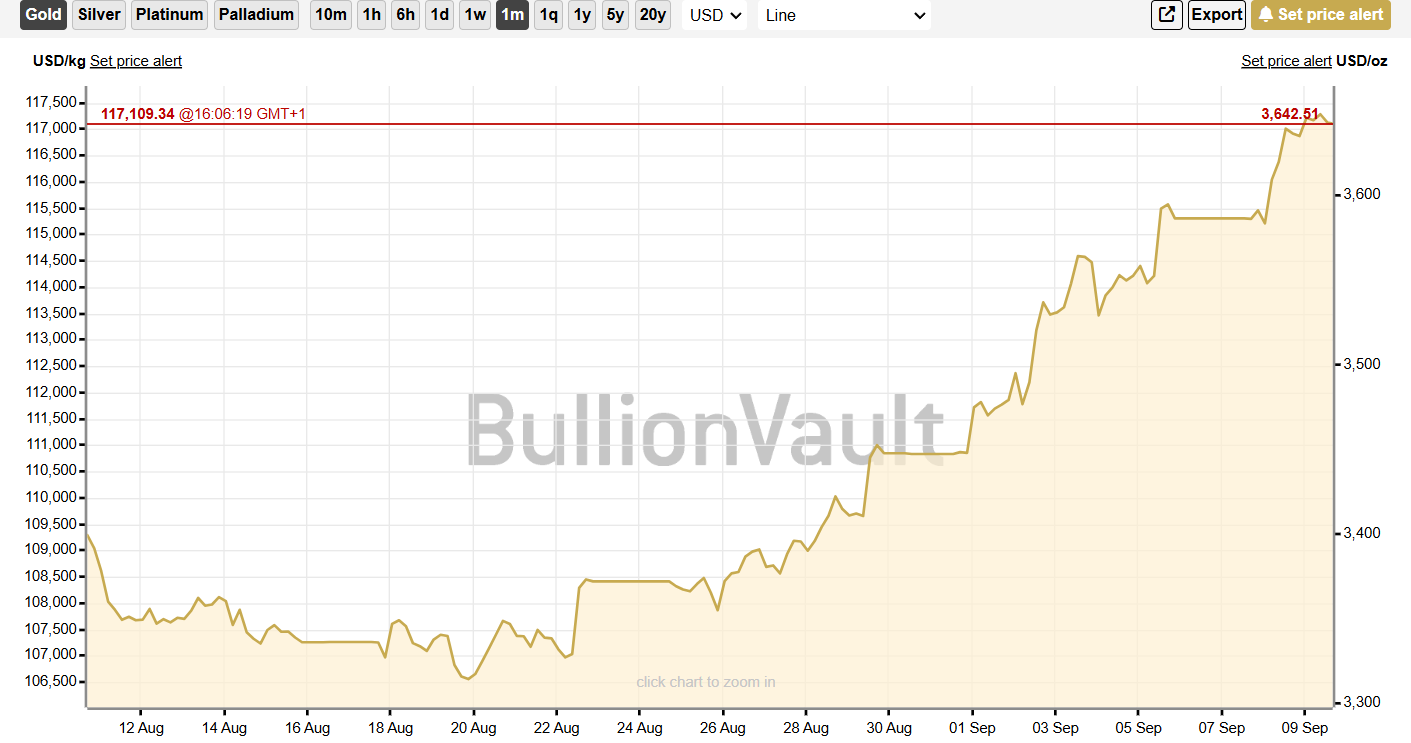

In contrast, gold surged to a record high immediately after Israel attacked Qatar as demand for safe-haven assets spiked.

Oil prices climbed by $1 per barrel, trading just under $67. Analysts called these moves rational responses to geopolitical risk, though oil gains may prove short-lived.

The divergence reflects Bitcoin’s struggle to live up to its “digital gold” label. While gold rallied, Bitcoin behaved like a high-beta risk asset.

Gold Price Chart. Source:

Gold Price Chart. Source:

Correlation data confirms the shift, with the 30-day rolling link between the two assets turning slightly negative.

The strike on Doha carries major diplomatic implications, but markets reacted first to its immediate risk signals. Traders rapidly de-risked, moving out of volatile tokens into stablecoins and traditional havens.

Until confidence in its safe-haven qualities strengthens, Bitcoin is likely to follow equities and risk assets during crises, rather than diverge from them.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Price predictions 12/10: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BCH, LINK, HYPE

Ether vs. Bitcoin: ETH price poised for 80% rally in 2026

Prediction markets bet Bitcoin won’t reach $100K before year’s end

Bitcoin rallies fail at $94K despite Fed policy shift: Here’s why