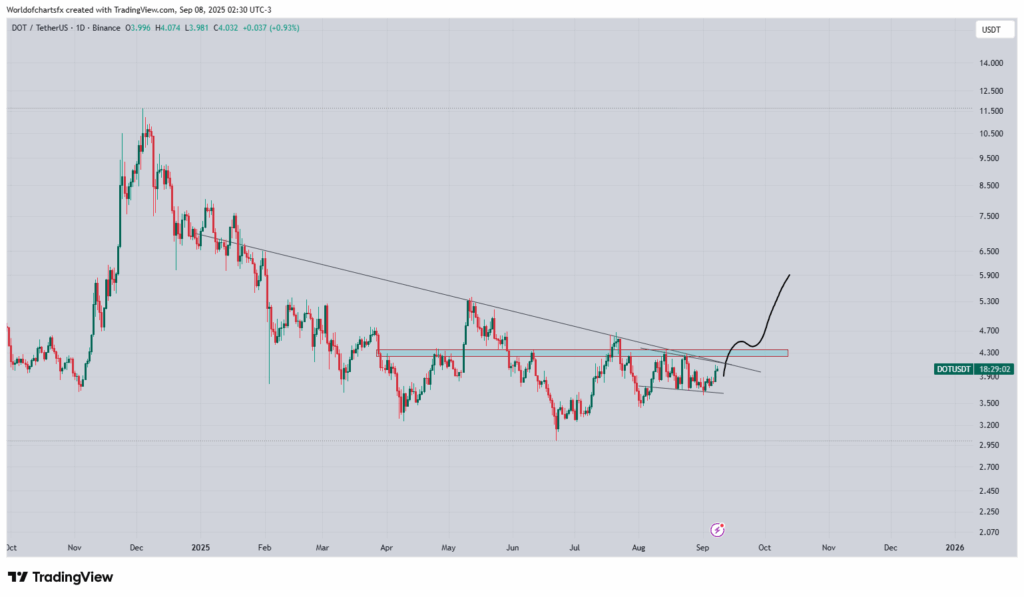

Polkadot breakout at $4.30 is a key technical pivot: a decisive close above $4.30 could convert resistance into support and open a potential move toward $6, backed by bullish MACD, RSI near 66, rising volume and a market-cap surge on September 7th.

-

DOT trades at key resistance $4.30 after consolidation within a descending triangle.

-

Bullish MACD crossover and RSI ~66 indicate expanding buying momentum.

-

Volume ~ $422M and market cap spike above $6.50B on Sept 7 signal renewed institutional/trader interest.

Polkadot breakout at $4.30 shows bullish momentum; watch for a retest and then a run to $6 if support holds — read market cues and act fast.

What is the Polkadot breakout at $4.30?

Polkadot breakout at $4.30 refers to DOT closing decisively above a long-standing resistance that forms the upper edge of a descending triangle. A confirmed breakout would likely flip $4.30 into support and could trigger a measured move toward $6, supported by volume and momentum indicators.

How is DOT trading right now and what are the key metrics?

DOT is trading just above $4, approaching the $4.30 resistance after a 3.88% daily jump and a 5.58% weekly gain. Volume is around $422 million, reflecting elevated market interest. Market cap spiked past $6.50 billion on September 7, then consolidated, indicating sustained demand.

Source: World Of Charts Via X

Source: World Of Charts Via X

Why does $4.30 matter for Polkadot?

$4.30 is the upper boundary of a descending triangle that constrained DOT since late 2024. Historically, sellers defended this level. If buyers push DOT above $4.30 with conviction, the level typically retests as new support — a technical confirmation that often precedes accelerated upside.

What technical signals support a breakout scenario?

Short-term momentum indicators are aligned for buyers. The MACD recently crossed bullishly, signaling growing trend strength. The RSI sits near 66, which shows healthy buying pressure without immediate overbought risk. Steady green candles and rising volume bolster the breakout thesis.

How could a breakout unfold and what are the scenarios?

- Confirmed breakout: Close above $4.30 on higher-than-average volume, followed by a retest of $4.30 as support, then a push toward $6.

- False breakout: A brief spike above $4.30 that fails to hold, returning into the triangle and signaling further consolidation or a pullback to $3.70 support.

- Neutral continuation: Prolonged consolidation near $4.30, allowing indicators to stabilize before a higher-probability move.

How should traders interpret market-cap and volume signals?

Market cap moving above $6.50B with concurrent volume spikes suggests capital inflows and renewed participation. Traders typically favor breakouts accompanied by higher volume as confirmation. The recent $422M volume day aligns with the bullish momentum narrative but requires follow-through.

Frequently Asked Questions

Can DOT sustain a move to $6 this quarter?

DOT can reach $6 if it secures $4.30 as new support, trading volume remains elevated, and broader crypto market conditions stay constructive. Timeline depends on momentum and macro liquidity conditions.

How should traders manage risk on a possible breakout?

Use position sizing, set a stop below the retest level (near $4.00–$4.20), and scale out partial positions on confirmed strength toward intermediate targets like $5 and $6.

Key Takeaways

- Immediate pivot: $4.30 is the decisive resistance that could flip to support on a confirmed breakout.

- Technical alignment: MACD bullish crossover, RSI ~66 and rising volume support upward momentum.

- Actionable steps: Wait for a daily close above $4.30, monitor volume, and manage risk with a retest-based stop.

Conclusion

Polkadot is at a technical crossroads: a sustained Polkadot breakout above $4.30 combined with rising volume and market-cap support would materially improve DOT’s odds of climbing toward $6. Traders should prioritize confirmation via a retest and manage exposures to limit downside risk. COINOTAG will continue tracking price action and updates.