The Fed's September rate cut is already a certainty—can the CPI overturn it?

The August CPI is about to be released, but Wall Street remains calm. This Thursday, the implied volatility in the stock market is lower than the average actual volatility on CPI release days over the past year and also lower than the expected volatility for the next non-farm payroll day.

Wall Street trading desks expect that the Consumer Price Index (CPI) to be released on Thursday will show rising inflation, but as the labor market situation dominates the market narrative, they are not preparing for significant stock market volatility.

Stuart Kaiser, head of U.S. equity trading strategy at Citi, stated that options traders are betting that the S&P 500 Index (SPX) will see only moderate volatility of about 0.7% after the CPI report is released. This expectation is lower than the average actual volatility of 0.9% on CPI release days over the past year, and also lower than the expected volatility ahead of the next jobs report on October 3. Moreover, Kaiser believes that the current implied volatility expectations are already on the high side.

All of this is related to traders’ predictions about the Federal Reserve’s rate path. As U.S. employment data shows signs of weakness “sufficient to threaten economic growth,” the market expects the Federal Reserve to cut the federal funds rate by 25 basis points at the conclusion of its September meeting, with further possible rate cuts at the October and December meetings.

Wall Street is closely watching the Federal Reserve’s thinking, and the market has priced in more than a 1 percentage point rate cut over the next year. However, rising inflation could disrupt this path.

Andrew Tyler, head of global market intelligence at JPMorgan, wrote in a client report on Monday: “We believe that the CPI data does not pose a real risk of ‘forcing the Fed to pause rate cuts in September’. But we do believe that if this CPI data is significantly hawkish, it will change the Fed’s approach to the October and December meetings.”

Several major banks have already raised their rate cut expectations, believing that the Federal Reserve will cut rates more times than previously forecast. For example, Barclays economists now expect three 25-basis-point rate cuts this year, with two more in 2026.

This CPI report will become “one of the additional clues for U.S. traders to interpret the Fed’s rate path,” enriching the current economic data puzzle.

Tyler wrote that if this report shows a sharp rise in consumer prices, “then we may see inflation continue to accelerate through the end of the year and even into 2026.” He stated that such an outcome could prompt the Fed to pause rate cuts at the October and December meetings, especially if economic growth indicators such as GDP continue to rise.

Economists predict that the core CPI, excluding food and energy costs, will rise 0.3% month-on-month in August, with the year-on-year increase remaining at 3.1%—a level far above the Fed’s 2% target and unchanged from the previous month.

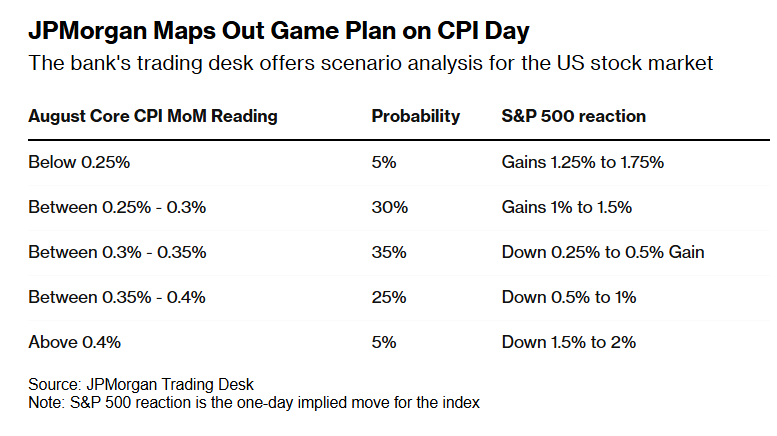

The “most likely scenario” proposed by Tyler’s team shows: core CPI rising 0.3% to 0.35% month-on-month, with the S&P 500 Index fluctuating between a 0.25% drop and a 0.5% gain.

Tyler wrote that if core CPI rises 0.25% to 0.3% month-on-month, JPMorgan’s trading desk expects the S&P 500 Index to rise 1% to 1.5%; if the month-on-month increase is below 0.25%, the S&P 500 Index could see a rebound of 1.25% to 1.75%; if the core CPI rises more than 0.4% month-on-month, the S&P 500 Index could fall by up to 2%—but he believes the probability of this scenario is only 5%.

JPMorgan’s trading strategies for CPI day

JPMorgan’s trading strategies for CPI day As economic growth remains resilient, traders believe the risks in the coming weeks are relatively low. The Atlanta Fed’s GDPNow model shows that the actual annualized GDP growth rate for the third quarter will reach 3%, slightly lower than the 3.3% in the second quarter but still at a relatively strong level.

This also explains why the Chicago Board Options Exchange Volatility Index (VIX) is well below the key threshold of 20, where “traders start to worry.” Meanwhile, Citi’s U.S. Economic Surprise Index—which measures whether economic indicators are coming in above or below expectations on a rolling basis—is near its highest level since January this year.

Citi’s U.S. Economic Surprise Index hovers near its highest level since January this year

Citi’s U.S. Economic Surprise Index hovers near its highest level since January this year Normally, a rising Economic Surprise Index is positive for the stock market. But in the current environment, if the economy delivers more positive surprises, it could complicate the Fed’s goal of “taming inflation,” forcing it to keep high interest rates for longer.

Citi’s Kaiser said: “Everything will depend on the labor market. If the Fed cuts rates in October, it likely means employment data remains under pressure and inflation has not risen unexpectedly.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Radpie - The upcoming "Convex" for RDNT

Since the Penpie $PNP IDO launch, its price once surged 5x. Riding on this momentum, Magpie announced it will continue to launch the "Convex" for Radiant $RDNT—Radpie—in the subDAO model. With multiple narratives supporting it, will Radpie be able to replicate or even surpass the returns of PNP?

Litecoin, HBAR ETFs by Canary Capital Triumph in Vital Nasdaq Listing Stage

Amidst a Favorable Regulatory Climate, Canary Capital Advances in the Crypto ETF Space with Litecoin and HBAR Filings

Explosive Interest in MegaETH Layer-2 ICO: $360M Pledged in Mere Minutes

Final Allocations to be Determined by Community Engagement Metrics, Following Rapid Oversubscription

Massive Buybacks Lead to 1.29B PUMP Withdrawal from Pump.fun Rally

Whale Sparks Market Activity by Withdrawing Over a Billion Tokens as Pump.fun's Buybacks Surpass $150 Million