Bitcoin Holds Steady as US CPI Lands In Line With Market Expectations

Bitcoin’s price showed a modest drop on Thursday following the release of fresh US inflation data, with markets parsing the figures for clues on the Federal Reserve’s policy path. Bitcoin, which often reacts to CPI data due to its implications for interest rates and the dollar, moved briefly lower to $113,823 following the report. Annual

Bitcoin’s price showed a modest drop on Thursday following the release of fresh US inflation data, with markets parsing the figures for clues on the Federal Reserve’s policy path.

Bitcoin, which often reacts to CPI data due to its implications for interest rates and the dollar, moved briefly lower to $113,823 following the report.

Annual Inflation Hits 2.9% in August, US CPI Data Shows

According to the US Labor Department, the Consumer Price Index (CPI) rose 2.9% year-over-year in August, in line with expectations of 2.9%. This follows a July CPI reading of 2.7%.

The Consumer Price Index measures retail inflation and is closely watched as a key economic indicator.

Meanwhile, the Producer Price Index (PPI), which tracks wholesale inflation, unexpectedly fell in August due to lower trade services margins and modest increases in goods costs. The figures came in weaker than expected at 2.6% year-over-year, well below the 3.3% forecast. The softer PPI print reinforced expectations for Fed rate cuts and boosted risk sentiment across equities and crypto markets.

“With labor market figures recently revised sharply downward and signs of economic slowdown emerging, this inflation report will be the final key data before the Federal Reserve’s September meeting, and will heavily influence the pace of future rate cuts,” Bitunix analysts told BeInCrypto ahead of the CPI release.

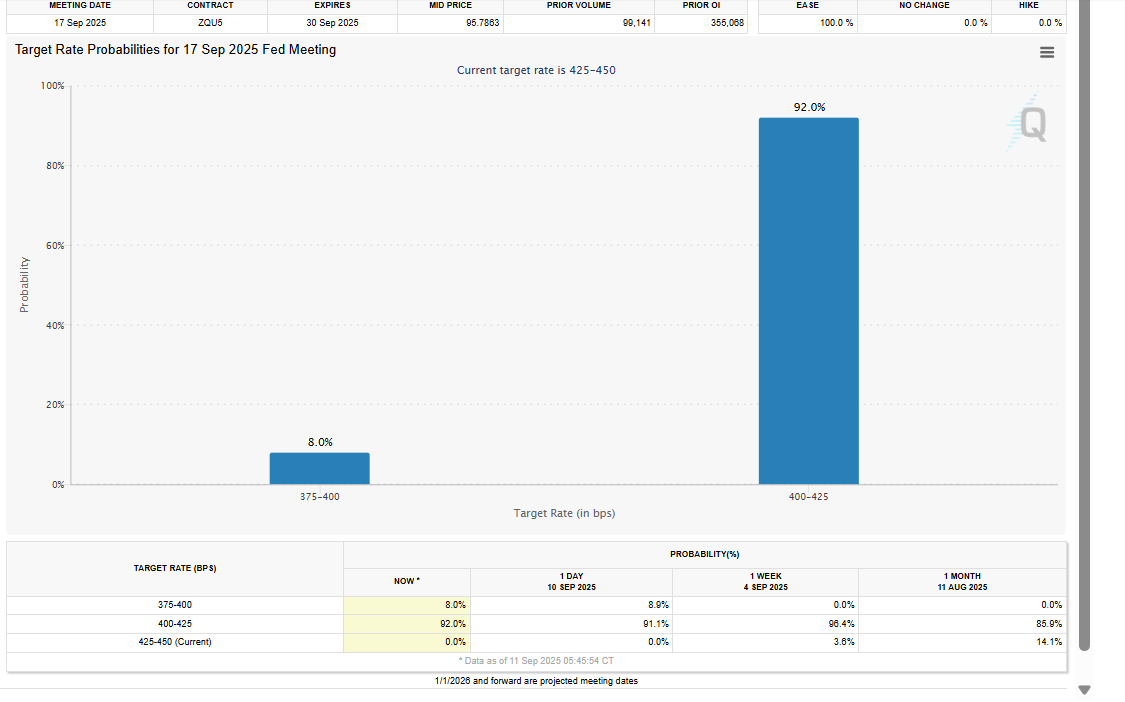

The Fed is widely expected to cut interest rates by 25 basis points at its meeting next Wednesday. Investors are also pricing in a small chance of a 50-basis-point reduction, according to the CME FedWatch tool.

Fed Interest Rate Cut Probabilities. Source:

CME FedWatchTool

Fed Interest Rate Cut Probabilities. Source:

CME FedWatchTool

On the crypto side, the Bitunix analysts noted that Bitcoin faces heavy liquidation pressure near $114,000, forming the main resistance zone.

“If CPI data is dovish and pushes BTC above this level, it could trigger a short squeeze and accelerate a move into the 115,000+ liquidity zone,” they said. “Conversely, if stronger-than-expected inflation drives the US Dollar Index (DXY) higher and delays rate-cut expectations, $111,000 will be the first key support, with a potential retest of the $108,500–$109,000 liquidity zone if it breaks.”

They recommended that traders scale back their positions before the CPI data is released. While the PPI dropped unexpectedly, the CPI could still drive prices higher. Traders should keep an eye on Bitcoin’s resistance at $114,000 and support at $111,000 to navigate possible market swings.

The inflation data adds another layer of complexity to Bitcoin’s short-term outlook. A hotter-than-expected CPI print typically pressures risk assets like BTC. This raises the likelihood of tighter monetary policy and strengthening the US dollar.

Conversely, softer inflation could support crypto markets by increasing the odds of rate cuts next week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!