Sub-Saharan Africa: A New Bright Spot on the Global Crypto Map

Sub-Saharan Africa is emerging as a crypto bright spot, where Bitcoin and stablecoins provide daily utility against inflation and FX restrictions, making the region a global leader in real-world adoption.

While many developed markets focus on complex financial products such as ETFs or DeFi, Sub-Saharan Africa is demonstrating the real-world strength of crypto by turning Bitcoin and stablecoins into vital tools for millions of people facing inflation and foreign exchange restrictions.

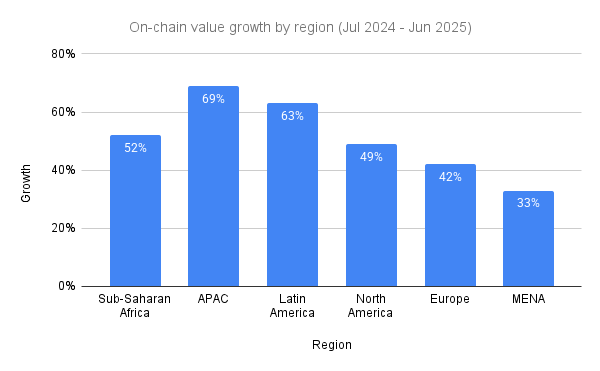

With on-chain value growth of 52% over the past year, the region has risen to third place globally, behind only APAC and Latin America. This is not just a story of capital flows but also living proof of crypto’s ability to reshape financial infrastructure from the ground up.

Retail-led growth, with Bitcoin at the core

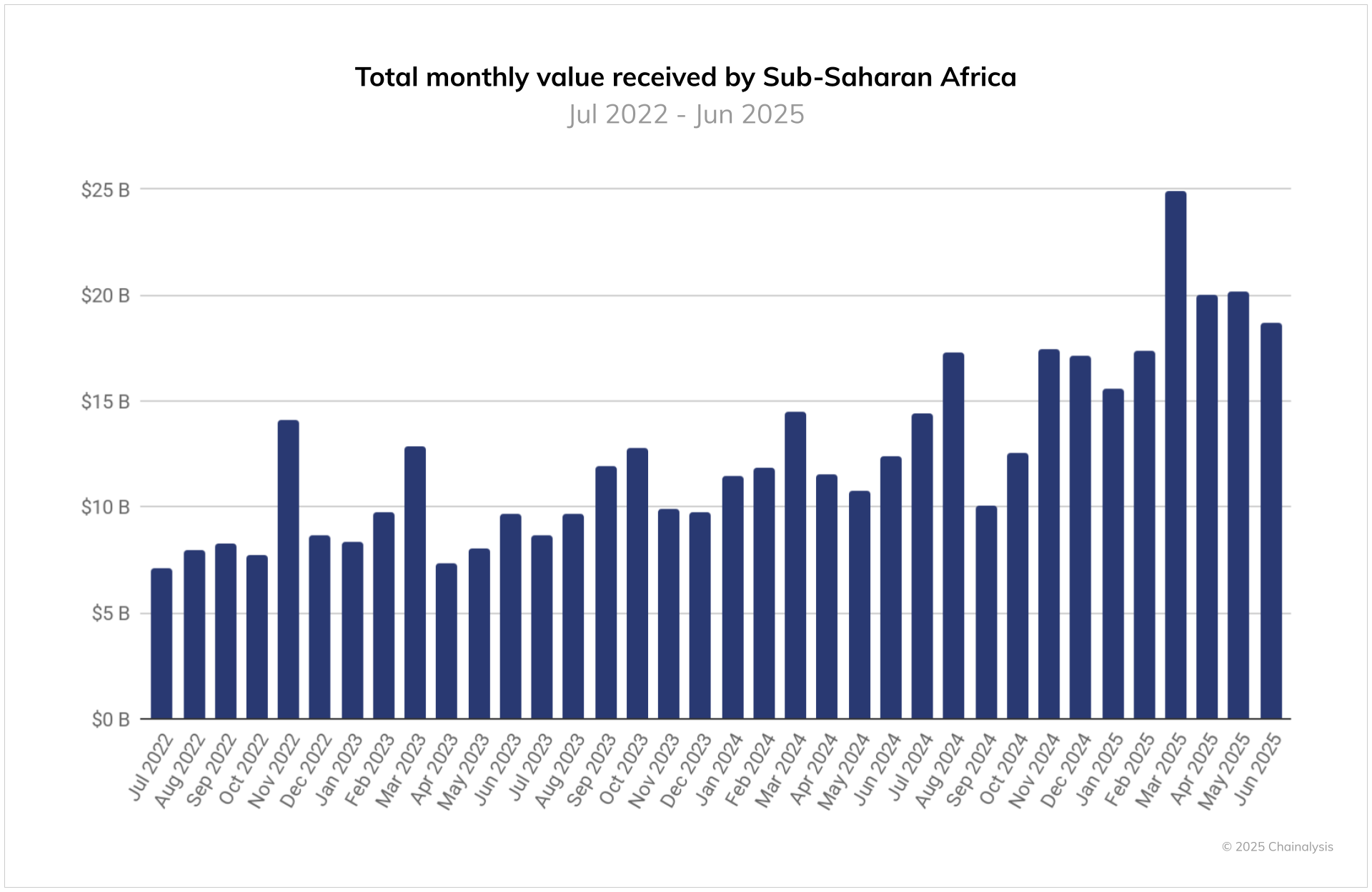

According to the latest report from Chainalysis, Sub-Saharan Africa (SSA) has emerged as the third-fastest-growing crypto market globally. On-chain transaction value surged by 52% between July 2024 and June 2025, reaching over $205 billion. The main driver is retail users—individuals leveraging crypto for daily transactions, value storage, and inflation hedging.

Monthly transaction value in Sub-Saharan Africa. Source:

Chainalysis

Monthly transaction value in Sub-Saharan Africa. Source:

Chainalysis

Nigeria and South Africa are the two powerhouses in the region. Nigeria recorded an on-chain transaction value of $92.1 billion, largely driven by citizens seeking alternatives amid high inflation and strict FX controls. In contrast, South Africa is moving in the opposite direction, focusing on institutional markets thanks to a clear regulatory framework and active participation from major banks like Absa, particularly in cross-border payments and new product development.

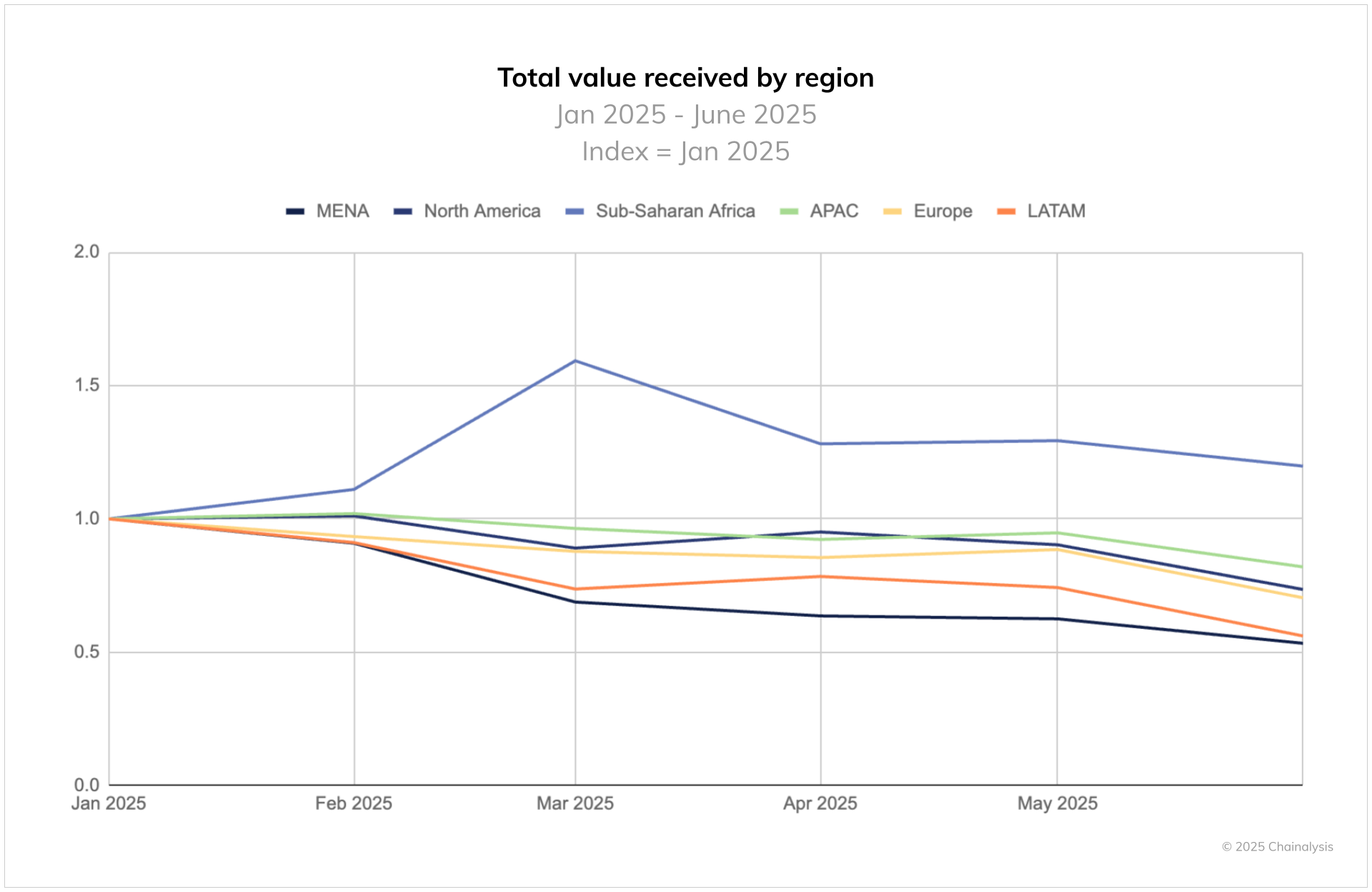

Total value by region. Source:

Chainalysis

Total value by region. Source:

Chainalysis

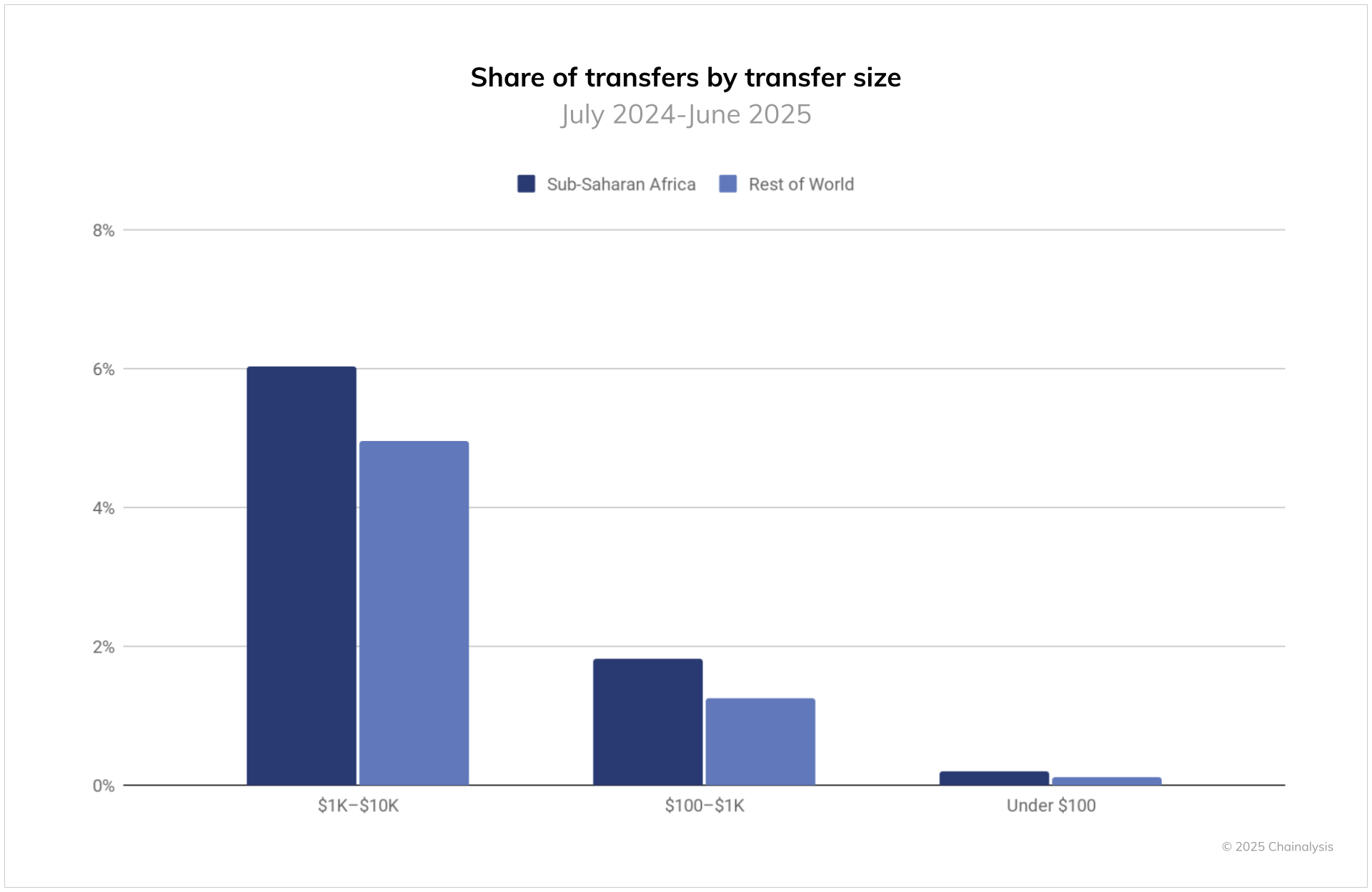

Unsurprisingly, Bitcoin (BTC) dominates in SSA as a form of “digital gold.” Bitcoin accounts for as much as 89% of retail transaction value in Nigeria, while in South Africa, the figure is 74%. Meanwhile, stablecoins, especially USDT, are favored for large-value transfers, serving as a practical substitute for the U.S. dollar.

Share of activity by transfer type in Nigeria & South Africa. Source:

Chainalysis

Share of activity by transfer type in Nigeria & South Africa. Source:

Chainalysis

Comparison with other regions: SSA stands out for real-world utility

Placing SSA in the global landscape reveals an interesting picture. According to aggregated data from Chainalysis, Asia-Pacific (APAC) is leading in growth with 69% YoY, fueled by the DeFi and Layer-2 boom, alongside massive institutional capital inflows into markets like Hong Kong, Singapore, and South Korea.

On-chain value growth by region. Source: BeInCrypto

On-chain value growth by region. Source: BeInCrypto

Latin America also shows robust growth of 63%, where crypto is widely used for remittances and P2P payments, particularly in Brazil and Mexico. Meanwhile, North America and Europe highlight the role of institutions. North America reached a scale of $1.2 trillion, driven by ETFs and custody services, while Europe achieved $1.1 trillion, focusing on DeFi and regulatory frameworks such as MiCA.

Compared with these regions, SSA is smaller in terms of total capital flow, but its unique strength lies in practical applications. While APAC and North America thrive on sophisticated financial products, SSA proves that crypto can address fundamental economic challenges, from preserving asset value against inflation to building cross-border payment infrastructure.

The SSA case clearly shows that crypto is not just a speculative tool or an advanced financial product but a practical solution for emerging economies. Looking ahead, if the region continues to improve its regulatory frameworks—striking a balance between fostering innovation and managing risks—SSA could well become the world’s leading hub for real-world crypto adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

100% rebate for KYB users: Earn fee rebates on EUR bank deposits!

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services